39 ira deduction worksheet 2014

Publication 559 (2021), Survivors, Executors, and Administrators Net operating loss (NOL) carryback. Generally, an NOL arising in a tax year beginning in 2021 or later may not be carried back and instead must be carried forward indefinitely. However, farming losses arising in tax years beginning in 2021 or later may be carried back 2 years and carried forward indefinitely.For special rules for NOLs arising in 2018, 2019 or 2020, see Pub. 536, Net Operating ... 2022-2023 Federal Income Tax Brackets & Tax Rates - NerdWallet There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status.

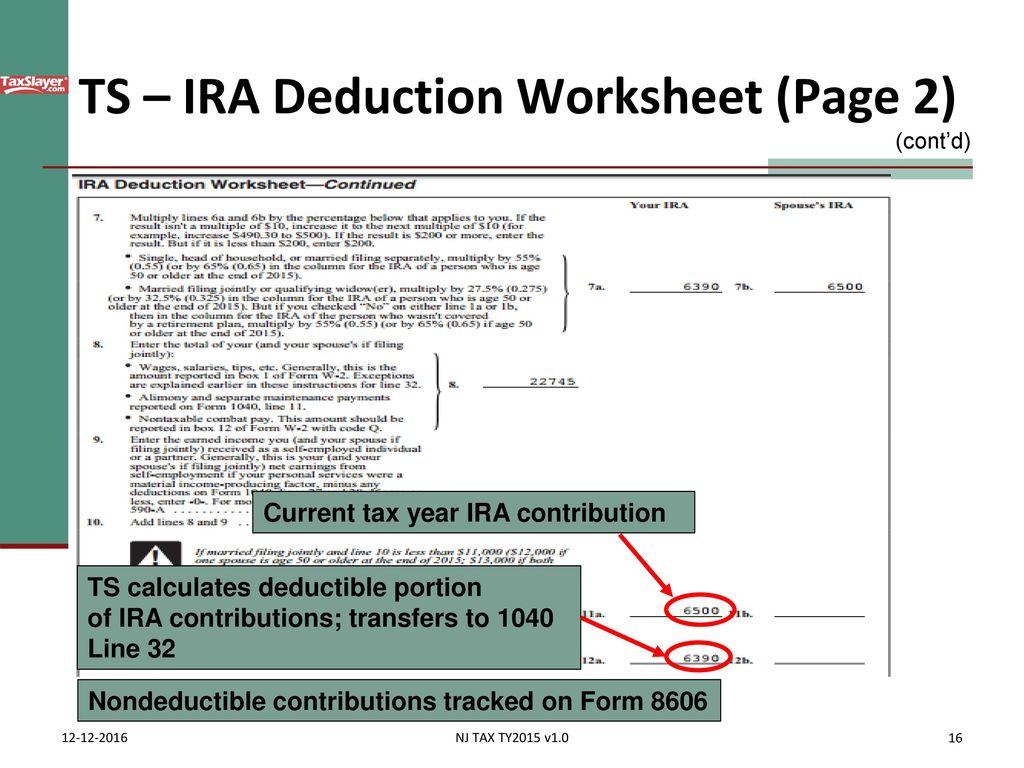

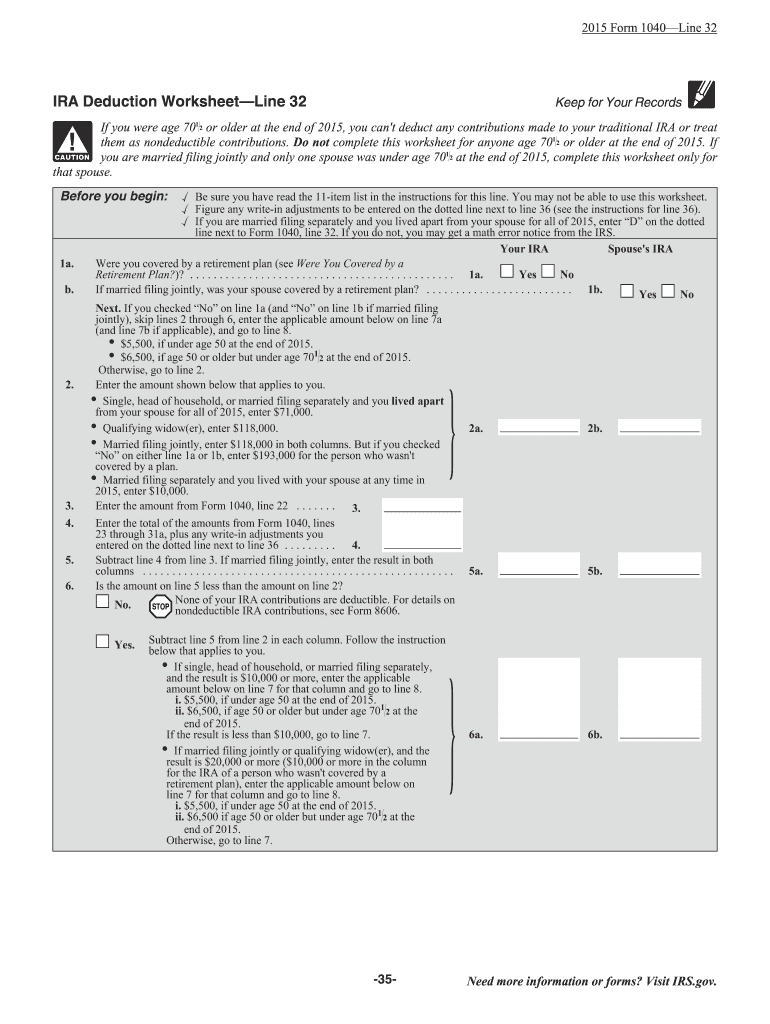

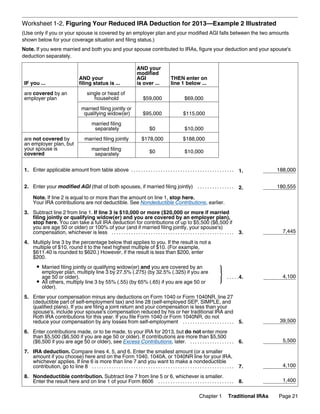

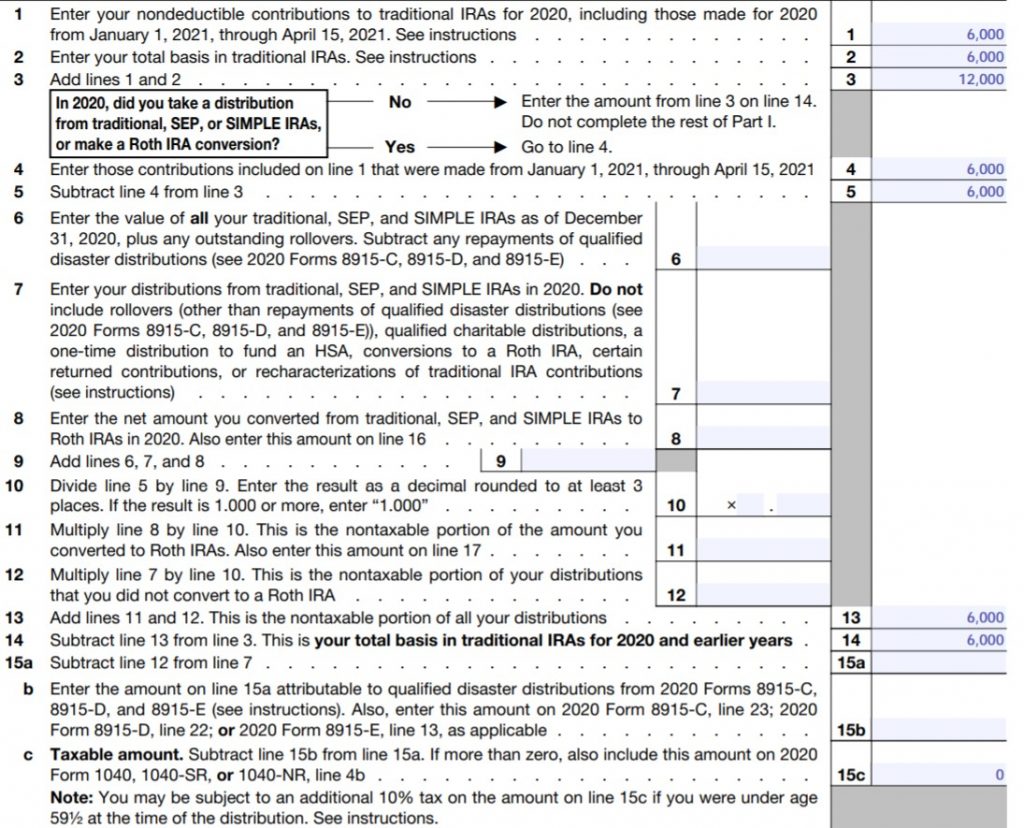

Publication 590-B (2021), Distributions from Individual ... Use Worksheet 1-2 in chapter 1 of Pub. 590-A, or the IRA Deduction Worksheet in the Form 1040 or 1040-SR, or 1040-NR instructions to figure your deductible contributions to traditional IRAs to report on Schedule 1 (Form 1040), line 20.

Ira deduction worksheet 2014

2019 Instructions for Schedule CA (540) | FTB.ca.gov - California Student Loan Interest Deduction Worksheet. Enter the total amount from Schedule CA (540), line 20, column A. If the amount on line 1 is zero, STOP. You are not allowed a deduction for California. Enter the total interest you paid in 2019 on qualified student loans but not more than $2,500 here. Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions. Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Ira deduction worksheet 2014. Publication 526 (2021), Charitable Contributions | Internal ... If you don’t itemize your deductions on Schedule A (Form 1040), you may qualify to take a deduction for contributions of up to $600. See Cash contributions for individuals who do not itemize deductions, later. Deduction over $5,000. Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions. 2019 Instructions for Schedule CA (540) | FTB.ca.gov - California Student Loan Interest Deduction Worksheet. Enter the total amount from Schedule CA (540), line 20, column A. If the amount on line 1 is zero, STOP. You are not allowed a deduction for California. Enter the total interest you paid in 2019 on qualified student loans but not more than $2,500 here.

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Late-Backdoor-Roth-IRA-Contributions-2020.png)

0 Response to "39 ira deduction worksheet 2014"

Post a Comment