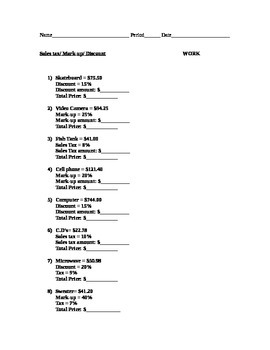

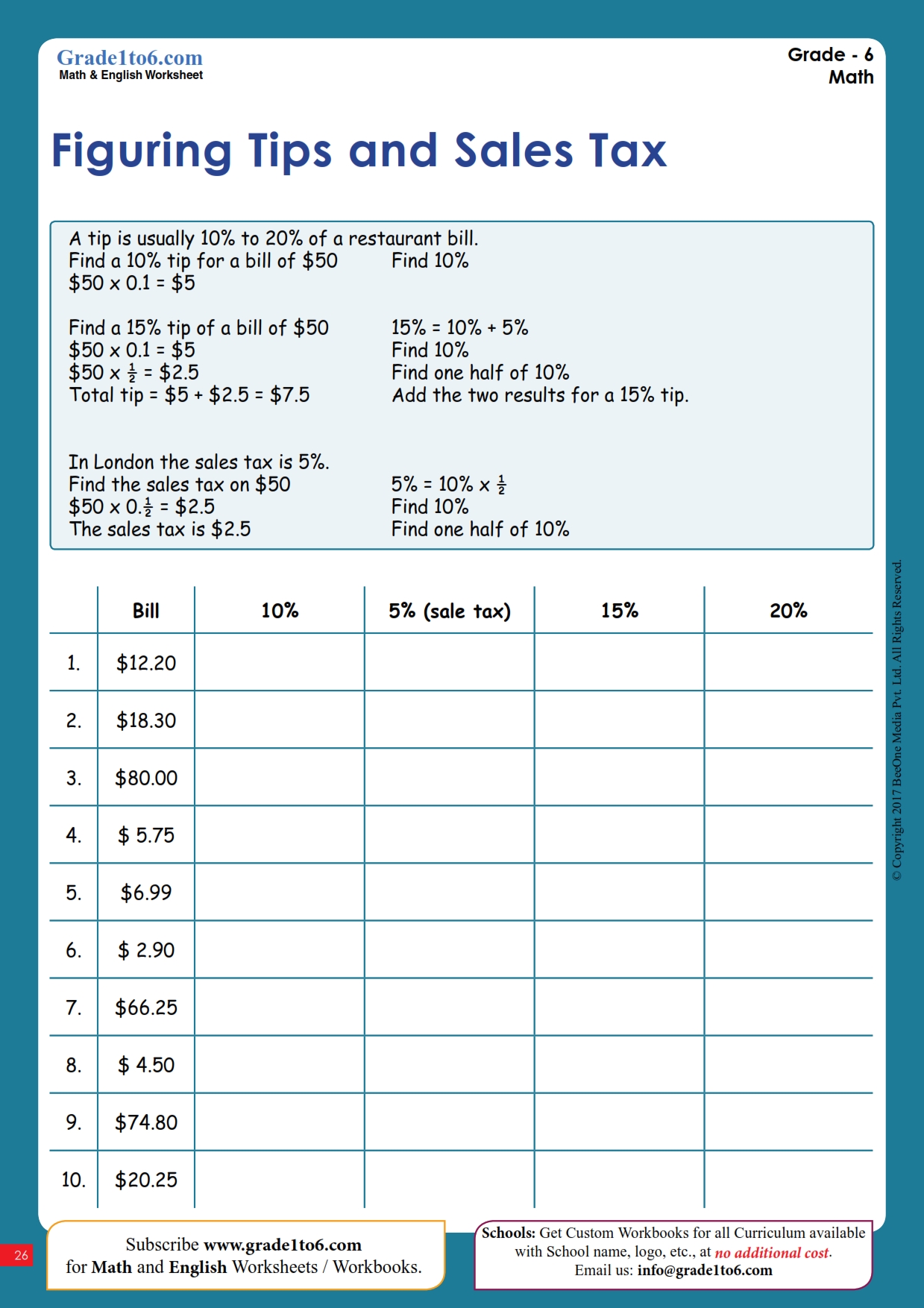

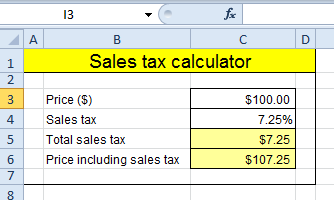

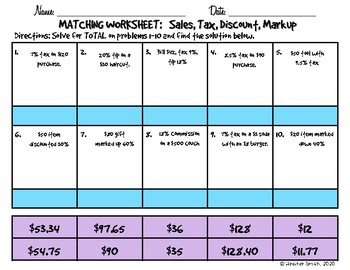

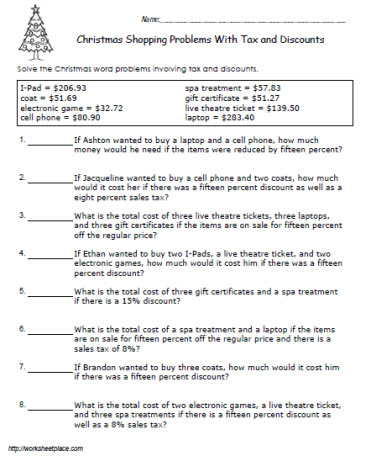

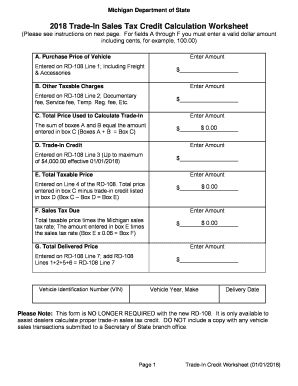

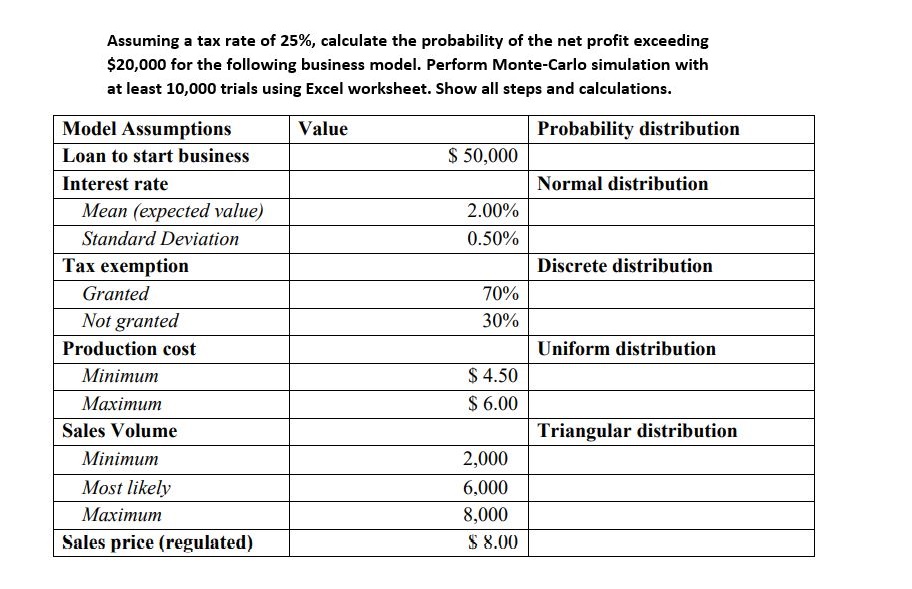

40 calculating sales tax worksheet

dor.mo.gov › formsForms and Manuals - Missouri Worksheet for Calculating Business Facility Credit, Enterprise Zone Modifications and Enterprise Zone Credit: 12/5/2014: 4357: Other Tobacco Products Tax Exemption Certificate: 5/30/2014: 4374: Application for Registration as a Fleet Vehicle Owner: 2/13/2014: 4379: Request For Information or Audit of Local Sales and Use Tax Records: 4/9/2021: 4379A www2.gov.bc.ca › gov › contentProvincial sales tax forms - Province of British Columbia FIN 407 - Provincial Sales Tax (PST) Schedule - Boats and Aircraft (PDF) Appraisal You must have this form completed by a motor vehicle dealer or qualified appraiser if you believe the actual value of a motor vehicle is less than the average wholesale value obtained from the Canadian Black Book valuation guide.

study.com › academy › practiceQuiz & Worksheet - Calculating Payroll Costs | Study.com This worksheet and quiz will let you practice the following skills: Interpreting information - verify you can read information regarding how to calculate taxes and interpret it correctly

Calculating sales tax worksheet

turbotax.intuit.com › tax-tips › familyChild Tax Credit - TurboTax Tax Tips & Videos Dec 01, 2022 · Determining the Child Tax Credit amount. Calculating the amount of the Child Tax Credit requires a few key numbers. Take the number of children that qualify for the tax credit and multiply this by $2,000 to calculate the total potential credit. › en › revenue-agencyBritish Columbia Information Guide - Canada.ca This credit is a non-taxable amount paid to help individuals and families with the carbon taxes they pay. This amount is combined with the quarterly payment of the federal Goods and services tax / harmonized sales tax credit. You do not need to apply for the GST/HST credit or the BC climate action tax credit. › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

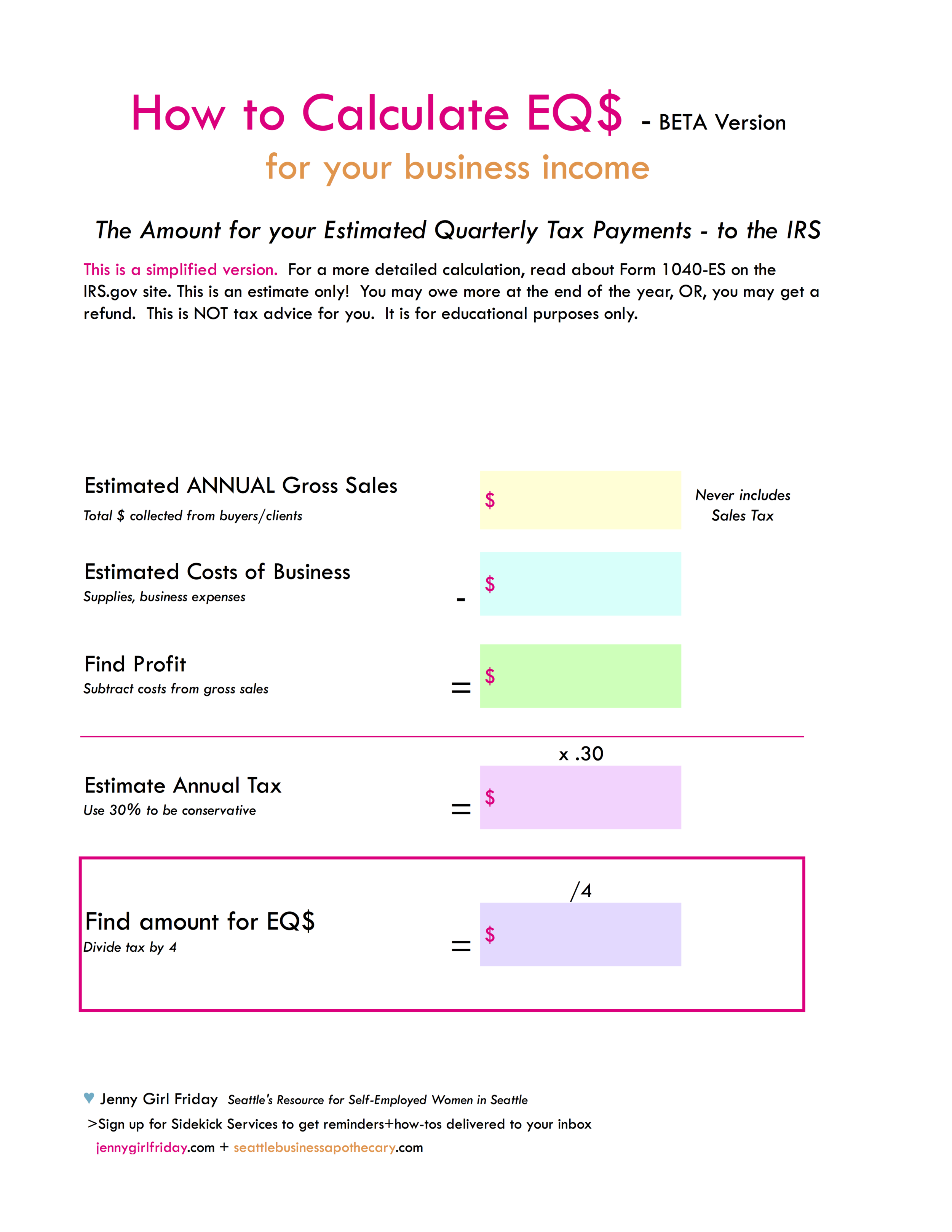

Calculating sales tax worksheet. › self-employed-individuals-tax-centerSelf-Employed Individuals Tax Center | Internal Revenue Service Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior year’s annual tax return in order to fill out Form 1040-ES. Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... › en › revenue-agencyBritish Columbia Information Guide - Canada.ca This credit is a non-taxable amount paid to help individuals and families with the carbon taxes they pay. This amount is combined with the quarterly payment of the federal Goods and services tax / harmonized sales tax credit. You do not need to apply for the GST/HST credit or the BC climate action tax credit. turbotax.intuit.com › tax-tips › familyChild Tax Credit - TurboTax Tax Tips & Videos Dec 01, 2022 · Determining the Child Tax Credit amount. Calculating the amount of the Child Tax Credit requires a few key numbers. Take the number of children that qualify for the tax credit and multiply this by $2,000 to calculate the total potential credit.

0 Response to "40 calculating sales tax worksheet"

Post a Comment