40 sale of rental property worksheet

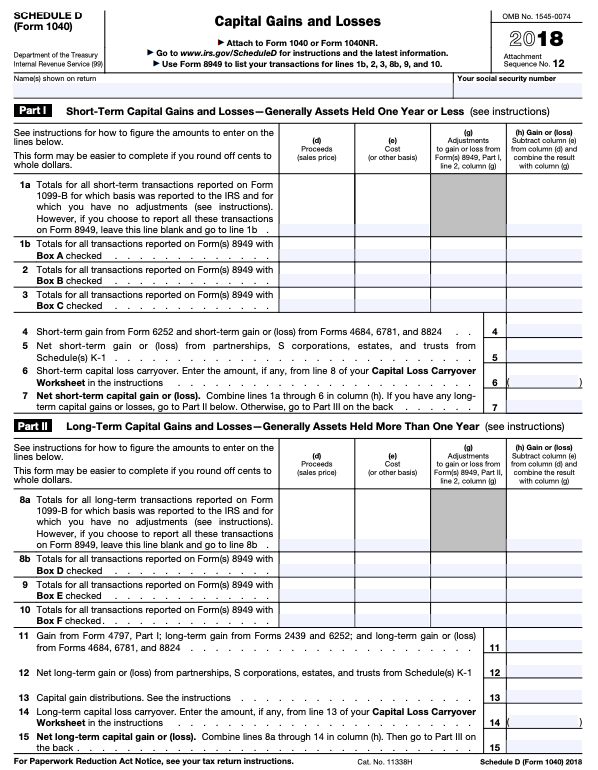

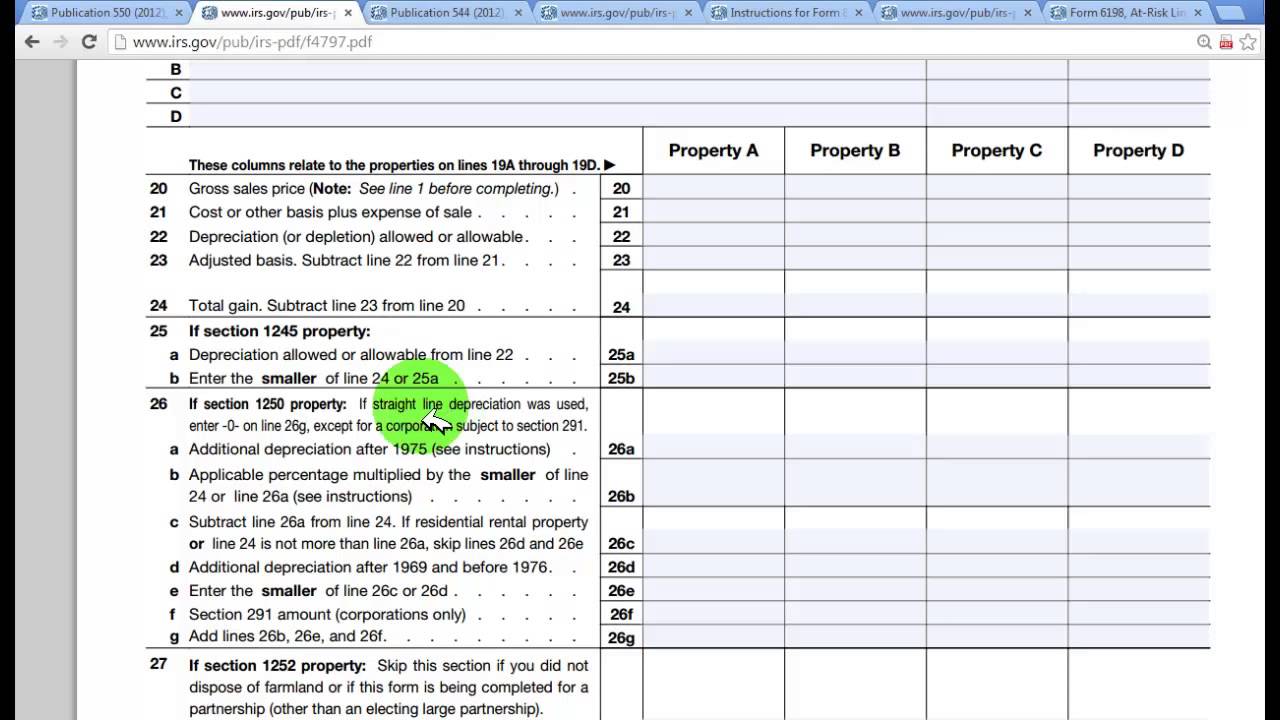

Tax Planning Tips for Depreciation Recapture - The Balance Residential Rental Property (IRS Publication 527) Sales and Other Dispositions of Assets (IRS Publication 544, especially the section in Section 3 dealing specifically with depreciation recapture) Instructions for Schedule D (Worksheet on page D-14 to calculate the depreciation recapture tax) › FormsandPublications › PANet Gains (Losses) from the Sale, Exchange, or Disposition of ... Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased ...

Entering a home sale exclusion in ProSeries - Intuit Open the individual tax return. Press the F6 to bring up Open Forms. Type sale to select the Home Sale Wks. Click the OK button to create a copy of the Home Sale Worksheet. Enter the address of the home sold during the tax year. Click the Select button to go to this copy of the Home Sale Worksheet.

Sale of rental property worksheet

Publication 17 (2021), Your Federal Income Tax - IRS tax forms Gross income means all income you received in the form of money, goods, property, and services that isn't exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). Don't include any social security benefits unless (a) you are married filing a separate return and you lived with … Publication 537 (2021), Installment Sales | Internal Revenue Service An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. All or part of any gain from the disposition of the property may be ordinary gain from depreciation recapture. For trade or business property held for more than 1 year, enter the amount from line 26 ... › ExcelTemplates › rental-cash-flowCash Flow Analysis Worksheet for Rental Property - Vertex42.com Aug 18, 2021 · Real Estate Tax and Rental Property at turbotax.intuit.com - A good summary of tax issues related to rental property. How to Figure Cap Rate at wikihow.com - This article provides a pretty good explanation of how the capitalization rate (cap rate) is calculated and how it can be used. Capitalization Rate at wikipedia.org - For a general definition.

Sale of rental property worksheet. Rental Property Deductions: 21 Tax Deductions for Landlords in 2022 The short version is that landlords can deduct 20% of their rental business income from their taxable business income amount. For example, if you own a rental property that netted you $10,000 last year, the pass-through deduction reduces your taxable rental business income from $10,000 to $8,000. 1040 (2021) | Internal Revenue Service - IRS tax forms See the instructions for line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount. Standard deduction amount increased. For 2021, the standard deduction amount has been increased for all filers. The amounts are: Single or Married filing separately—$12,550. Married filing jointly or Qualifying widow(er)—$25,100. Head of household—$18,800. Virtual … How to Calculate Capital Gains Tax on Real Estate Investment Property $10,000 in closing costs upon purchase of the rental property, $10,000 for a roof replacement, $25,000 for new plumbing, and; $50,000 in commissions and fees upon sale of the rental property. In this scenario, Elaine's cost basis would be $295,000 ($250,000+$10,000+$10,000+$25,000). Her net proceeds would be $500,000 ($550,000 - $50,000). › publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... For more information about using any part of your home for business or as a rental property, see Pub. 587, Business Use of Your Home, and Pub. 527, Residential Rental Property. Gain from the sale or exchange of your main home isn’t excludable from income if it is allocable to periods of non-qualified use.

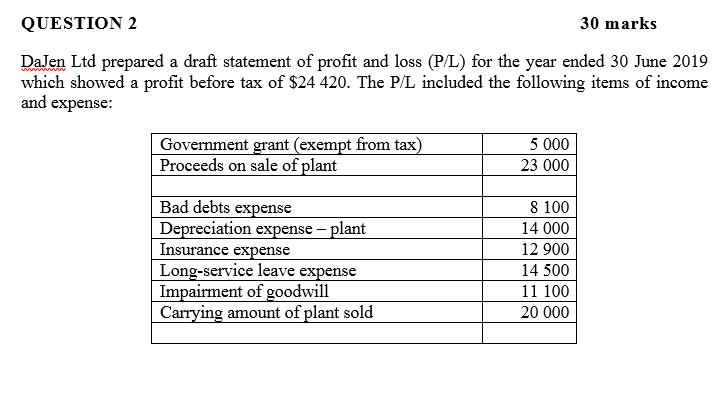

Tax On Sale Of Rental Property - TaxProAdvice.com Sale of a Rental Property Tax Consequences & Depreciation Recapture The IRS allows $250,000 of tax-free profit on a primary residence. What this means, in a simplified sense, is if you bought your primary residence for $300,000 in 2010, lived in it for 8 years, and then sold it in 2018 for $550,000, you wouldnt have to pay any capital gains tax. Calculator for Adjusted Basis in Real Estate -Simple & Easy Sale value $1,000,000 Cost basis $230,000 Step up price = $600,000 Taxable capital gains = $400,000 ( $1,000,000 -$600,000) Had there been no step-up price, the taxable gain would have been $770000 Read IRS publication Publication 4895, Tax Treatment of Property Acquired From a Decedent Dying. Rental Property Excel Spreadsheet: A Guide | Mashvisor A rental property Excel spreadsheet is a tool that lets you compare a large number of rental properties in a market to determine the ones with the best value. It is done by categorizing properties based on different types of data, using the Excel spreadsheet for rental property management, and sorting properties based on their return on investment. Depreciation Recapture & Other Tax Implications of Real Estate Rental ... Here's how to calculate the depreciation recapture on the sale of a rental property: Determine property cost basis (generally the amount paid less the land value) Calculate annual depreciation expense (cost basis / 27.5 or 39 based on property type) Multiply annual depreciation expense by number of years the property was held

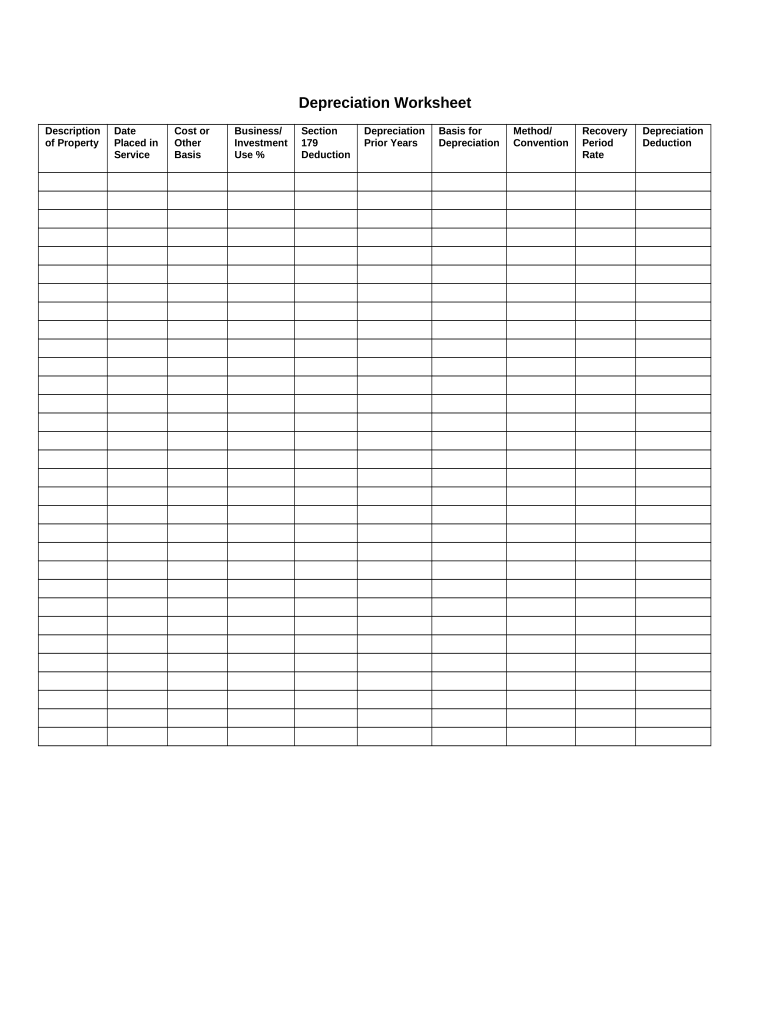

Publication 587 (2021), Business Use of Your Home If you used your home for business and you are filing Schedule C (Form 1040), you will use either Form 8829 or the Simplified Method Worksheet in your Instructions for Schedule C. The rules in this publication apply to individuals. If you need information on deductions for renting out your property, see Pub. 527, Residential Rental Property. Rental Real Estate and Taxes - TurboTax Tax Tips & Videos To figure out the depreciation on your rental property: Determine your cost or other tax basis for the property. Allocate that cost to the different types of property included in your rental (such as land, buildings, so on). Calculate depreciation for each property type based on the methods, rates and useful lives specified by the IRS. 1. How to report sale of rental property in TurboTax - Pinestcars Report the gain or loss on the sale of rental property on Form 4797, Sales of Business Property or on Form 8949, Sales and Other Dispositions of Capital Assetsdepending on the purpose of the rental activity.Individuals typically use Schedule D (Form 1040), Capital Gains and Lossestogether with Form 4797 or Form 8949. For further information ... Publication 527 (2020), Residential Rental Property Sale of main home used as rental property. For information on how to figure and report any gain or loss from the sale or other disposition of your main home that you also used as rental property, see Pub. 523. Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange …

How to Calculate Rental Property Depreciation - Investopedia The most recent real estate tax assessment values the property at $90,000, of which $81,000 is for the house and $9,000 is for the land. Therefore, you can allocate 90% ($81,000 ÷ $90,000) of the...

Publication 535 (2021), Business Expenses | Internal Revenue … Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

selling-guide.fanniemae.com › Selling-GuideB3-6-06, Qualifying Impact of Other Real Estate Owned (06/30 ... Oct 05, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

How to dispose of a rental property with assets in ProSeries - Intuit Complete the Schedule E Worksheet with any final-year rental income and expenses. In the Check All that Apply section, select Box H, Complete taxable disposition - See Help. Go to Asset Entry Worksheet. Go to the Dispositions section and enter any applicable information. Do the same for any other asset.

Capital Gains Tax On The Sale Of Investment Property There are three ways to sell a rental property (if you do not have to pay taxes). Under Section 1031 of the Internal Revenue Code, a real estate investor can postpone paying capital gains tax. Tax on rental property profits is usually paid by the seller under the Capital Gains Tax (CGT) rule.

Sale of rental property and correct tax forms : r/tax - reddit Sale of rental property and correct tax forms This year we sold a property we used as primary residence then switched to rental. We have verified we qualify for capital gains exemption with own/use test.

Instructions for Form 4562 (2021) | Internal Revenue Service The term of the lease is less than 50% of the property's class life and, for the first 12 months after the property is transferred to the lessee, the deductions related to the property allowed to you as trade or business expenses (except rents and reimbursed amounts) are more than 15% of the rental income from the property. Election.

How To Calculate Cost Basis For Real Estate | Rocket Mortgage Let's take a look at an example when it comes to calculating the cost basis in real estate. S ay Tim purchased a home for $300,000 and sold it 20 years later for $500,000.. During the time that he was the homeowner, Tim put $30,000 worth of improvements into the property, including a new backyard fence and numerous kitchen and bathroom renovations, which increased his cost basis to $330,000.

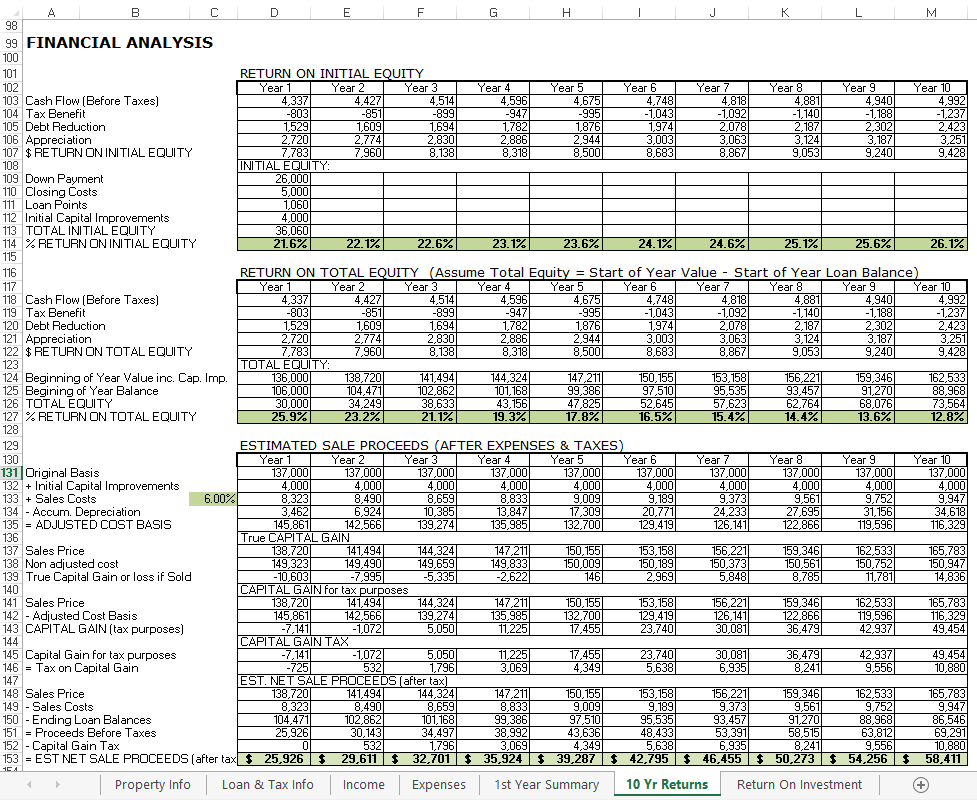

How much tax you pay when selling a rental property in 2022 - Roofstock When you sell a rental property, you need to pay tax on the profit (or gain) that you realize. The IRS taxes the profit you made selling your rental property 2 different ways: Capital gains tax rate of 0%, 15%, or 20% depending on filing status and taxable income Depreciation recapture tax rate of 25%

JPMorgan Chase says it has fully eliminated screen scraping 06/10/2022 · JPMorgan Chase has reached a milestone five years in the making — the bank says it is now routing all inquiries from third-party apps and services to access customer data through its secure application programming interface instead of allowing these services to collect data through screen scraping.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property. Line 8l. Olympic and Paralympic medals and USOC prize money. Line 8m. Section 951(a) inclusion. Line 8n. Section 951A(a) inclusion. Line 8o. 461(l) excess business loss adjustment. Line 8p

How to Report Cancellation of Debt on Rental Property If you are insolvent, you can use the insolvency worksheet in Form 4681 to calculate the amount of money you owe. The insolvency worksheet will also show whether the amount of canceled debt is taxable COD. The rest of the money you owe is non-taxable. However, if you were forced to sell your property, you may be subject to capital gains tax.

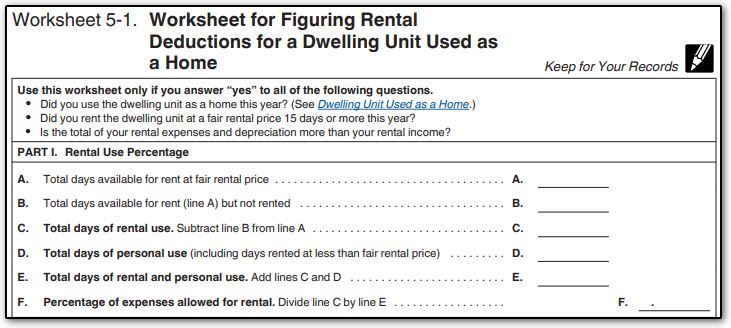

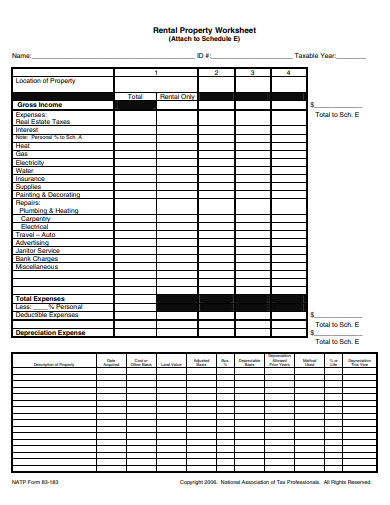

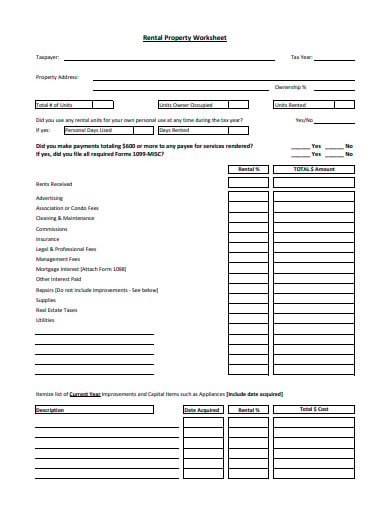

Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment ...

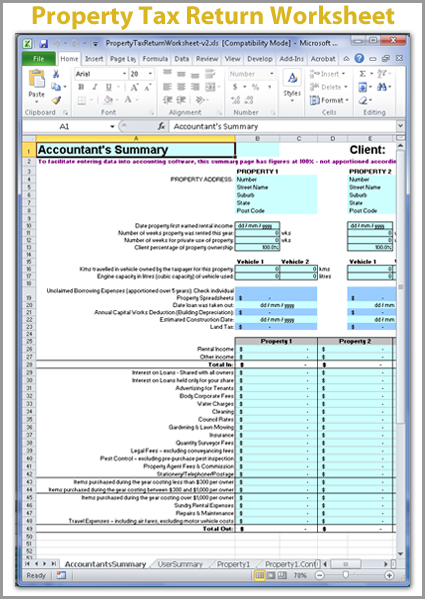

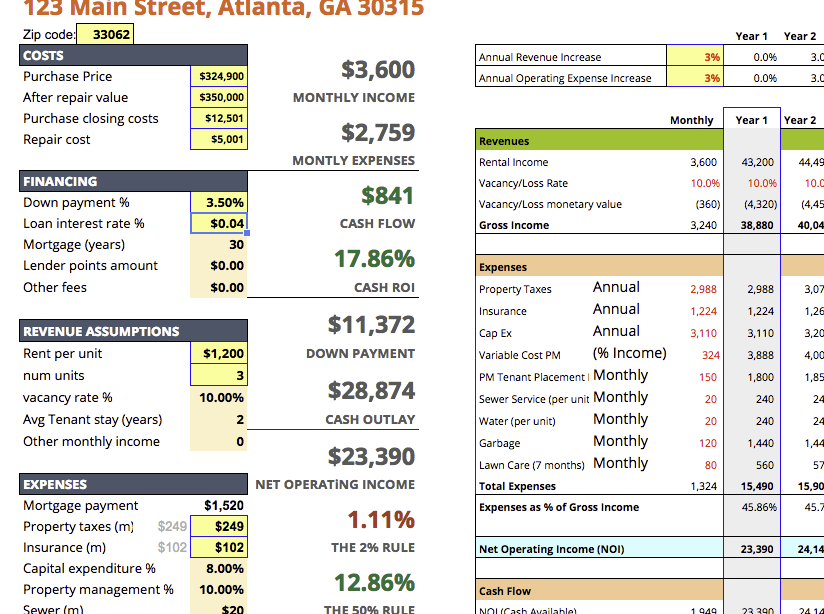

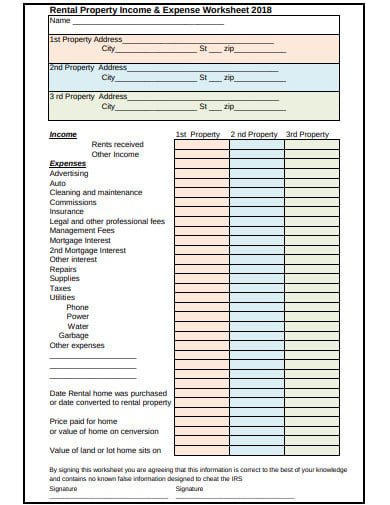

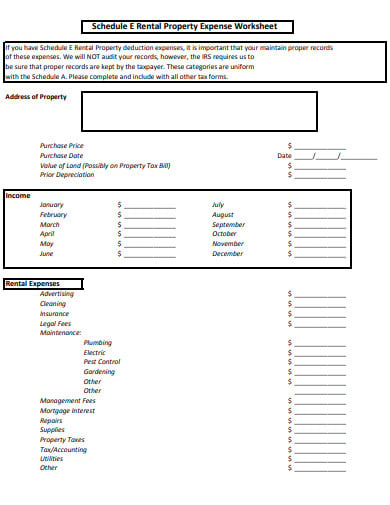

Vacation Rental Income And Expense Worksheet - VacationTalk.net A rental property spreadsheet is a document that keeps all of your property expenses and income data in one safe, verifiable place. It helps property owners keep track of monthly rent costs and property taxes, and it calculates the totals of any property-related expenses owed.

Canada Mortgage and Housing Corporation | CMHC Default, claims and properties for sale; Underwriting centre; emili; NHA approved lenders; Calculating GDS / TDS; Mortgage fraud; Contact mortgage loan insurance; Insured Mortgage Purchase Program (IMPP) COVID-19: CECRA for small businesses has ended; Securitization. NHA Mortgage Backed Securities; Canada Mortgage Bonds; Canadian registered covered …

› rental-manager › resourcesRental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

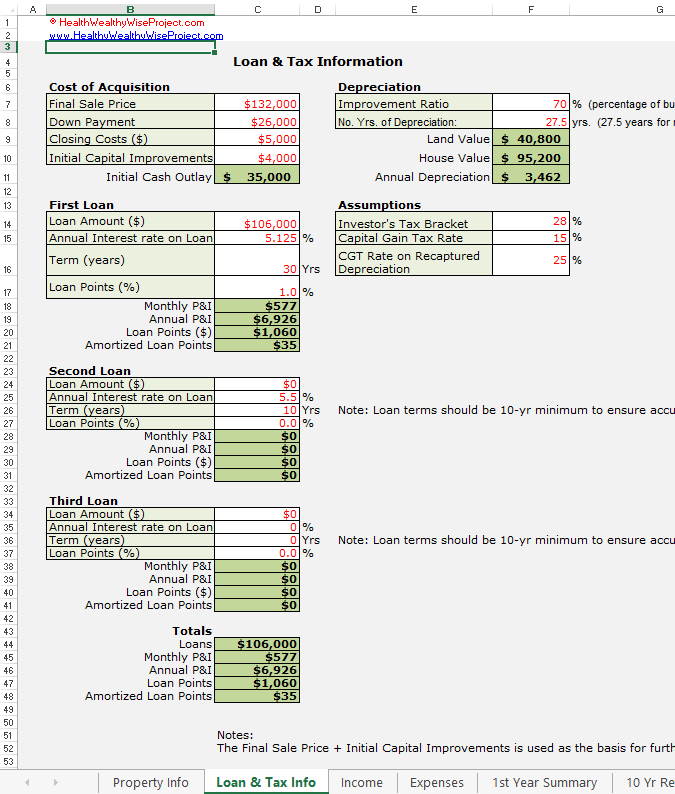

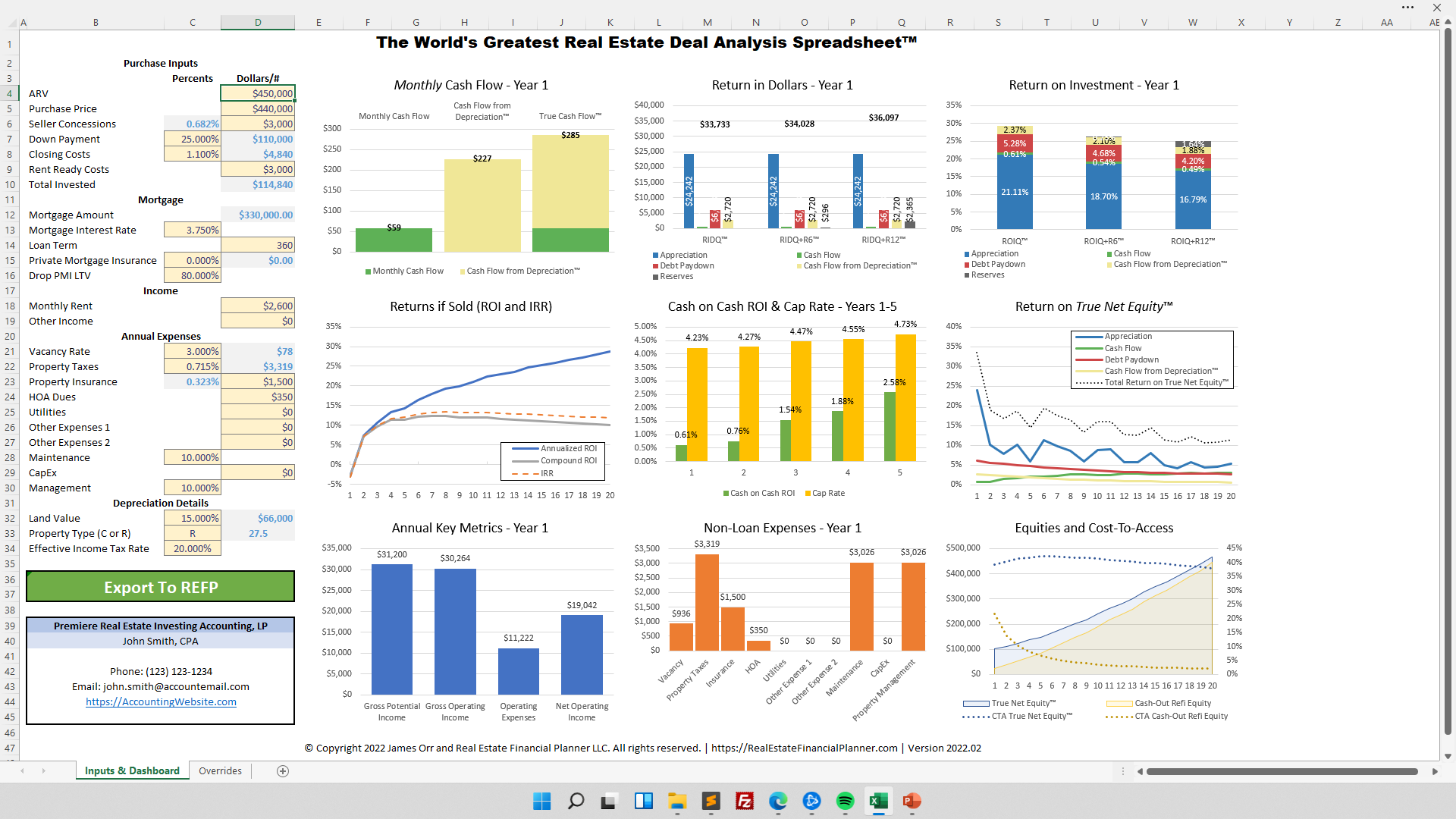

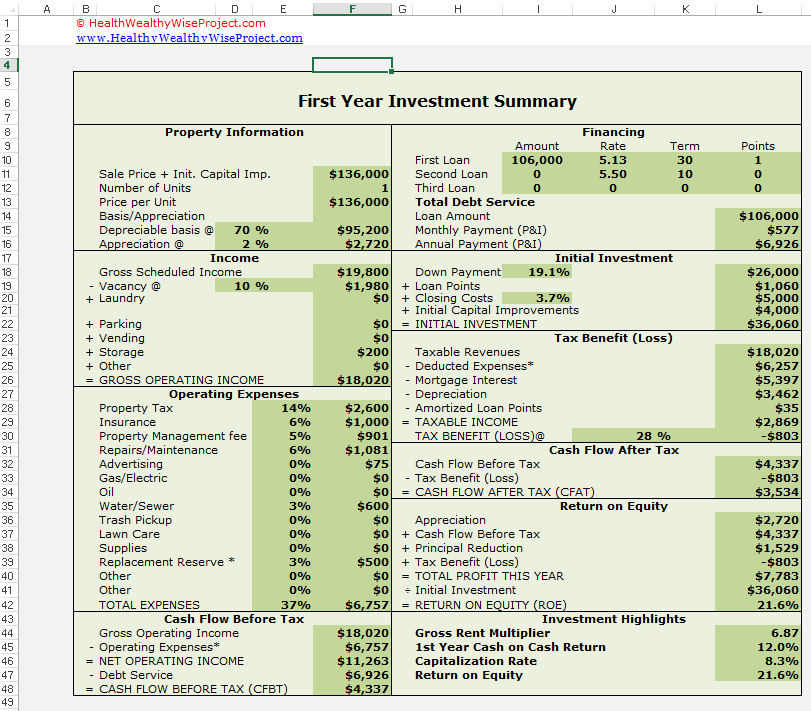

Download a Free Real Estate Investment Spreadsheet In the Excel sheet, you will notice cells C42 to C50 lists many of a building's typical expenses, and that includes: taxes, insurance, electricity, hydro, gardener, water, management, maintenance, heat, and snow clearing. Once done, the system will calculate the building's profit, and, then automatically calculate the building's CAP rate.

Best Rental Property Spreadsheet Template For Download - monday.com Blog A rental property spreadsheet is a document that keeps all of your property expenses and income data in one safe, verifiable place. It helps property owners keep track of monthly rent costs and property taxes, and it calculates the totals of any property-related expenses owed. A template for this document provides you with a specific format to ...

Rental Income and Expense Worksheet - Rentals Resource Center 01/01/2021 · This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a rental property. Appropriate sections are broken down by month and by property. Each section automatically calculates the totals to provide your gross income, net income and total expenses for the year.

Sale of rental property - ttlc.intuit.com I entered the data for the sale of a rental property and was surprised by the TT results. Specifically, the Cost or Other basis number /plus selling expense number that appears in form 4797 is substantially different than what I expected. I can't tie to that calculated number based on the info I p...

How To Calculate Capital Gains or Losses With a Worksheet - The Balance Worksheet 1: Simple Capital Gains Worksheet Let's say you bought 100 shares of Company XYZ stock on Jan. 3, 2021. You bought the 100 shares at $12 per share, for a total cost of $1,200. Your broker charged you a commission of $25. Over a year later, on March 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of $1,400.

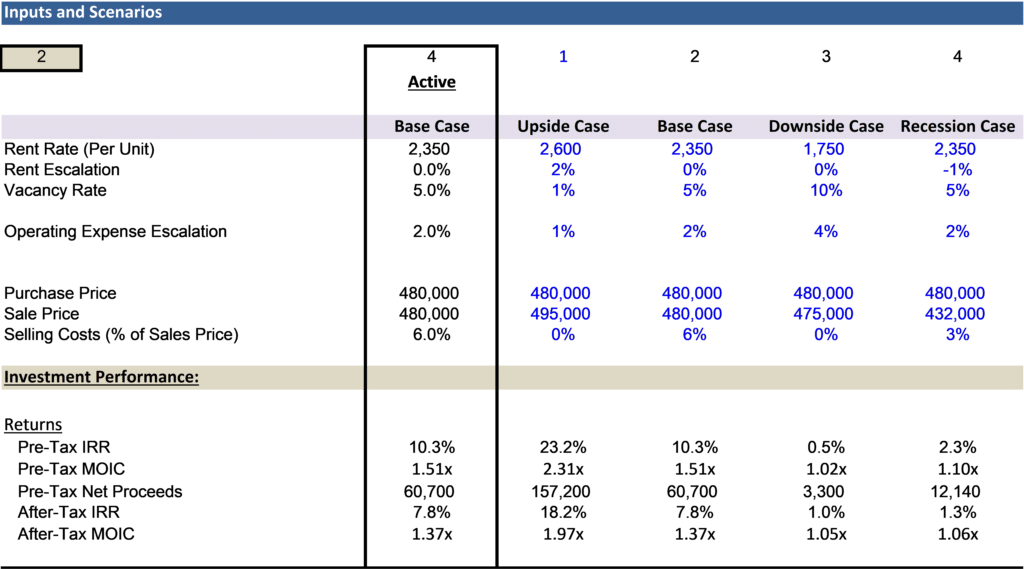

How to Calculate ROI on a Rental Property - Investopedia You earned $12,000 in total rental income for the year at $1,000 per month. Your annual return was $5,016.84 ($418.07 x 12 months). To calculate the property's ROI: Divide the annual return by...

How To Calculate Tax On Sale Of Rental Property? (Perfect answer) To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price - $74,910 adjusted basis = $59,490 gains subject to tax. = Selling Price of Rental Property - Adjusted Cost Basis = (Capital Gains x Tax Rate) + (Depreciation x ...

Capital Gains On Rental Property: What You Need To Know When you sell a property that you've been living in as your primary residence, you can exclude up to $250,000 of the capital gains from your taxes if you're single and up to $500,000 if you're married and filing jointly. This means that once everything has been factored into the equation, you may not owe anything on the sale of your property.

Military Extensions & Tax on Selling a Rental Property - Military OneSource When you sell a rental property, you may have to pay capital gains taxes and recaptured depreciation taxes, technically called unrecaptured section 1250 gain. Capital gains taxes are based on any profit made on the sale of your rental property, as determined by subtracting the purchase price and any improvements from the sales price.

Easiest capital gains tax calculator 2022 & 2023 The capital gains tax calculator is a quick way to compute the gains on the transfer or sale of a capital asset for the tax year 2022 (filing in 2023) and tax year 2021. This capital gains tax calculator will compute gains on every kind of asset that you have sold or transferred during the tax year 2022 or tax year 2021.

› enCanada Mortgage and Housing Corporation | CMHC Finding or advertising a rental property; Visiting the rental property; Lease and rental agreements; Signing the lease; Credit checks and bad credit; Rental payments and deposits; Roommates and pets; I am renting. Moving day; Landlord/Tenant responsibilities; Inspections; Maintenance and repairs; Complaints and evictions; Rent increases; When ...

Publication 523 (2021), Selling Your Home | Internal Revenue Service For more information about using any part of your home for business or as a rental property, see Pub. 587, Business Use of Your Home, and Pub. 527, Residential Rental Property. Gain from the sale or exchange of your main home isn’t excludable from income if it is allocable to periods of non-qualified use. Non-qualified use means any period after 2008 where neither you nor your …

› ExcelTemplates › rental-cash-flowCash Flow Analysis Worksheet for Rental Property - Vertex42.com Aug 18, 2021 · Real Estate Tax and Rental Property at turbotax.intuit.com - A good summary of tax issues related to rental property. How to Figure Cap Rate at wikihow.com - This article provides a pretty good explanation of how the capitalization rate (cap rate) is calculated and how it can be used. Capitalization Rate at wikipedia.org - For a general definition.

Publication 537 (2021), Installment Sales | Internal Revenue Service An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. All or part of any gain from the disposition of the property may be ordinary gain from depreciation recapture. For trade or business property held for more than 1 year, enter the amount from line 26 ...

Publication 17 (2021), Your Federal Income Tax - IRS tax forms Gross income means all income you received in the form of money, goods, property, and services that isn't exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). Don't include any social security benefits unless (a) you are married filing a separate return and you lived with …

0 Response to "40 sale of rental property worksheet"

Post a Comment