44 pastor's housing allowance worksheet

Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1. Clergy - Exempt Wages and Housing Allowance Clergy housing allowance. Generally, the housing allowance is reported in Box 14 of the W-2 and is not included in Boxes 1, 3, or 5. ... the TaxAct program requires that the housing allowance be entered on the Self-Employment Tax Adjustment Worksheet for calculation of the SE tax. The allowance is then transferred to Schedule SE Self-Employment ...

Everything Ministers/ Clergy Should Know About Their Housing Allowance Download: Housing Allowance Worksheet Package for Clergy and Churches If tax preparation is challenging for the general public, it can be even more so for members of the clergy, especially given recent changes to the tax code. That's why tax preparers who specialize in this area can be an invaluable partner when tax time rolls around.

Pastor's housing allowance worksheet

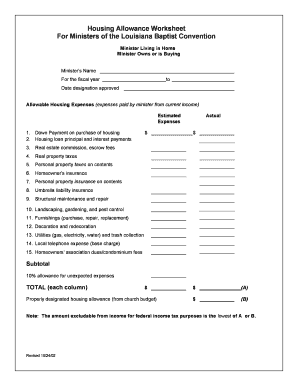

PDF 2020 Minister Housing Allowance Worksheet - The Pastor's Wallet 2020 Minister Housing Allowance Worksheet Mortgage Payment *Real Estate Taxes *Homeowners Insurance Mortgage Down Payment & Closing Costs Rent Renter's Insurance HOA Dues/Condo Fees Home Maintenance & Repairs Utilities Furniture & Appliances Household Items Home Supplies Yard Service Yard Care Tools & Supplies Miscellaneous Other: Other: Other: Sample Housing Allowance for Pastors - Payroll Partners Ready-to-use resolution language for church board to set a clergy housing allowance in 2019 by Richard R. Hammar. Editor's Note: A resolution can only be applied prospectively, never retroactively. For a church to have a resolution in place for a specific calendar year, it needs to adopt the resolution by December 31 of the previous year. How Much Housing Allowance Can A Pastor Claim? How To Calculate Your Housing Allowance Limit Therefore, to figure out what size of housing allowance you're eligible for, simply calculate each of the above amounts and go with the lowest. If your mortgage payment is $2,000 a month but you could only rent the home for $1,500, then your housing allowance is limited to $1,500 a month.

Pastor's housing allowance worksheet. Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet ... Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet - The Pastor's Wallet Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet by Amy Monday, September 23, 2019 As we enter the final stretch of 2019, it's time to review the year's housing expenses and how they align with your designated housing allowance. Allocating a Housing Allowance | Church Law & Tax Pastor Dave owns his own home. In December of 2012 his church board approved a compensation package for 2013 in the amount of $45,000. Of this amount, $30,000 was allocated to salary and $15,000 was designated as a housing allowance. The housing allowance was based on Pastor Dave's estimated housing expenses for 2013. Housing Allowance Calculator - The Pastor's Wallet Housing Allowance Calculator - The Pastor's Wallet Clergy Housing Allowance Calculator It is important to remember that you are only allowed to claim a housing allowance of the lesser of: the amount actually used to provide or rent a home; the fair market rental value of the home (including furnishings, utilities, garage, etc.); Ministers' Compensation & Housing Allowance - IRS tax forms Ministers' Compensation & Housing Allowance | Internal Revenue Service Help News English Charities & Nonprofits Tax Pros File Pay Refunds Credits & Deductions Forms & Instructions Search Home Help Frequently Asked Questions Ministers' Compensation & Housing Allowance Ministers' Compensation & Housing Allowance

PASTORAL BUDGET GUIDELINES the pastor’s total compensation. Where there is no parsonage, the housing allowance designation should include the cost of maintaining a home, including mortgage payments, furnishing, utilities, etc. Benefits The Comprehensive Plan provides retirement benefits and protects the minister and his or her How Do You Report Your Clergy Housing Allowance To The IRS? 13.9.2021 · This is an excerpt from my book, The Pastor’s Wallet Complete Guide to the Clergy Housing Allowance: The church is not required to report the housing allowance to the IRS. Unless a church includes it in an informational section on Form W-2, the IRS and the Social Security Administration (SSA) are only made aware of the housing allowance when a minister … PDF MINISTER'S HOUSING EXPENSES WORKSHEET - AGFinancial TOTAL HOUSING EXPENSES $ MINISTER'S HOUSING ALLOWANCE In order to claim Minister's Housing Allowance exemptions for federal income tax purposes on your retirement distributions, you must: • Have been credentialed during the time the contribution was made • Have earned the income for the contribution from ministry • Be retired Four Important Things to Know about Pastor’s Housing Allowance The housing allowance is for pastors/ministers only. Not every staff member at the church can take this allowance. Section 107 of the Internal Revenue Code clearly allows only for "ministers of the gospel" to exclude some or all of their ministerial income as a housing allowance from income for federal income tax purposes. Who, then, is a minister?

Microsoft takes the gloves off as it battles Sony for its Activision ... 12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. 2022 Housing Allowance Form - Clergy Financial Resources If you are seeking legal advice, you are encouraged to consult an attorney. For more information or if you need additional assistance, please use the contact information below. Clergy Financial Resources 11214 86th Avenue N. Maple Grove, MN 55369 Tel: (763) 425-8778 Fax: (888) 876-5101 Email: clientservices@clergyfinancial.com Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14.10.2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc Minister's Housing Allowance — Servant Solutions Housing Allowance Article Review your current year housing expenses and then complete this worksheet from ECFA. Once your worksheet is completed, review "The Minister's Housing Allowance" page on this site. You will then be ready to submit your request to your church Finance Board or Board of Elders.

Church Financial Benefits - Kentucky Baptist Convention How to structure financial support for church employees in 4 steps. SBC Compensation Study. Ministers' Financial Support Worksheet. HOUSING: Basics of housing for ministers. HOUSING: Housing Allowance Estimate Form. HOUSING: Sample Housing Allowance Notification Form. RETIREMENT: Retirement contributions for church employees. INSURANCE ...

Unbanked American households hit record low numbers in 2021 25.10.2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

PDF 2021 Minister's Housing Allowance Worksheet - MinistryCPA between taxable and tax-free (i.e., excluded) ministerial income. (Sources: IRS Publication 1828; Clergy Housing Allowance Clarification Act of 2002; IRS Regulation Section 1.107-1). MinistryCPA Corey A. Pfaffe, CPA, LLC 302 N. 3rd Street, Suite 107, Watertown, WI 53094 ... Minister's Housing Allowance Worksheet. Yes. No. D . D .

Ultimate Guide to the Housing Allowance for Pastors According to Christianity Today, 81% of full-time senior pastors take advantage of the housing allowance. In addition, this is saving pastors a total of about $800 million a year. For example, suppose a minister has an annual salary of $50,000, but their total housing allowance is $25,000.

Clergy Housing Allowance | Wespath Benefits & Investments Clearing the Clouds: Clergy Housing Allowance. Wespath Benefits and Investments (Wespath) recognizes the unique and often complex nature of clergy taxes. The following information is designed to help clear some of the gray when thinking about a housing allowance. It pertains to active clergy living in an owned or rented home, active clergy ...

Get Clergy Housing Allowance Worksheet 2010-2022 - US Legal Forms pastor housing allowance worksheet minister housing allowance worksheet clergy worksheet form worksheet clergy clergy housing allowance worksheet 2020 housing allowance for pastors 2022 parsonage allowance worksheet housing allowance for pastors form housing worksheet pastoral housing allowance worksheet housing worksheet pdf

Minister's Housing Expenses Worksheet | AGFinancial Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet Download the free resource now. Did you know we have a wide array of products and services to help you on your financial journey?

Housing Allowance for Pastors - Clergy Housing Allowance | MMBB How It Works. Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000.

Minister's Housing Allowance Determination - Executive Pastor Online Estimate - The minister is asked to estimate housing expenses for the coming year in December. Their estimates are due to the executive pastor by or before the 2nd Friday in December. A "worksheet" is provided for the minister's use upon request. (Here's a link to the form: Minister's Housing Allowance Worksheet.)

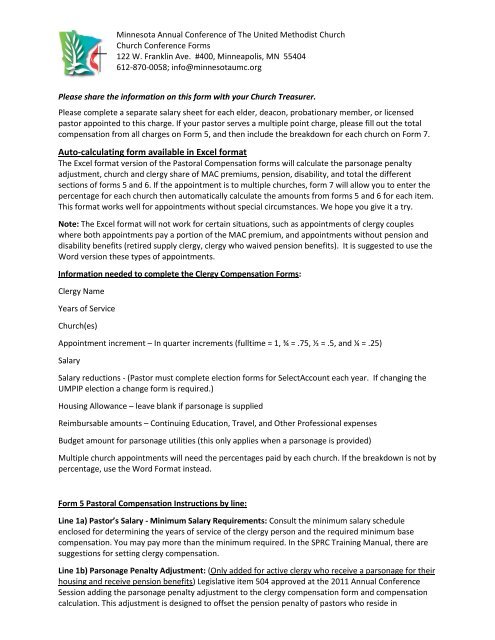

Box 1 of Clergy W-2 Form = Line 2 + Line 8b - Lines 10b, 11a, 11b, 11c, 12; Box 14 on W-2 should = Line 13 with notation "Housing" 2023 PASTOR'S SUPPORT WORKSHEET 8b. Cash Housing Allowance (if answered YES above, leave blank) One time Moving Expense (not included in appointment or benefits calculations) 10b. Contribution to UMPIP (Tax Deferred)

Clergy Housing Allowance Worksheet - cchwebsites.com Clergy Housing Allowance Worksheet. Use this calculator to help determine the amount that a member of the clergy can claim as a housing allowance. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. ...

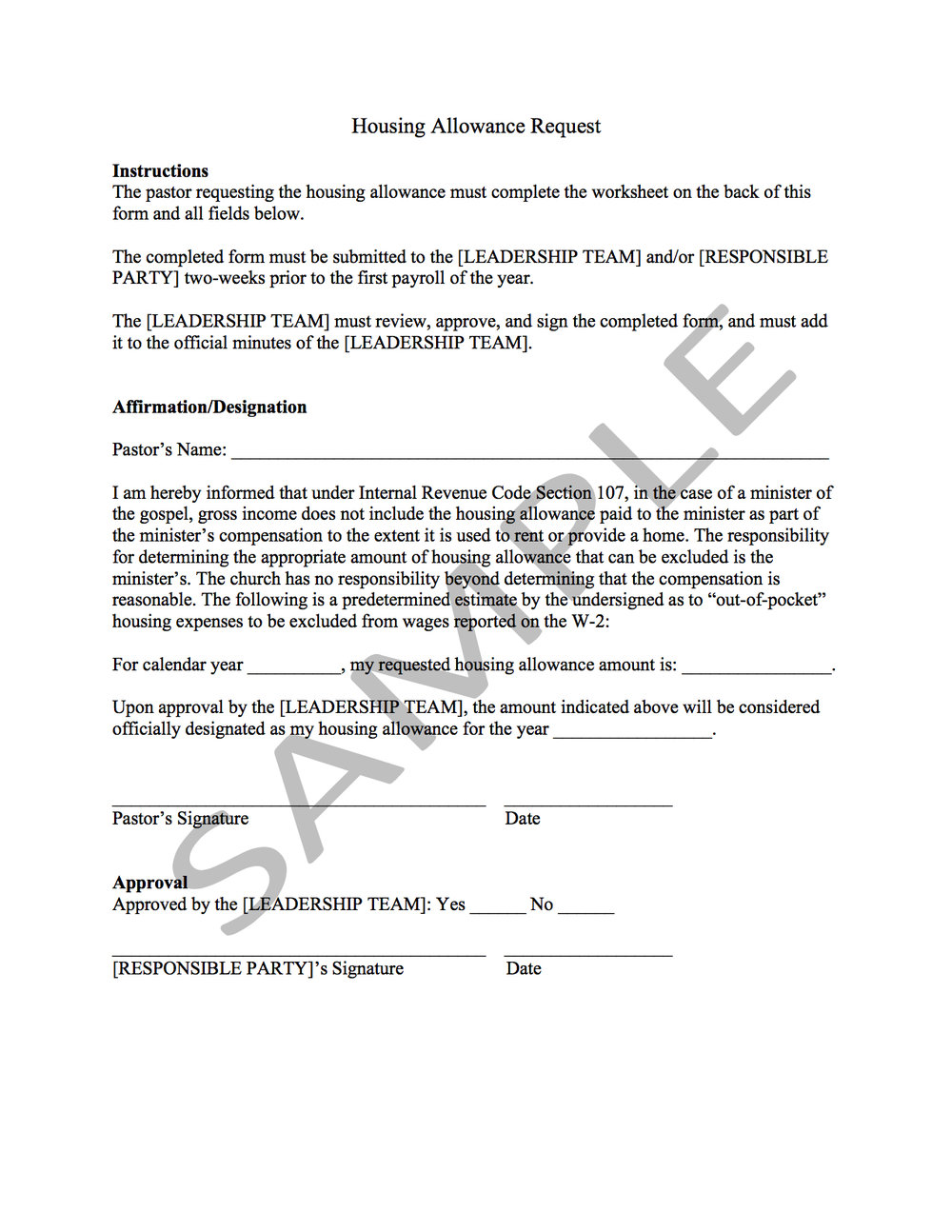

HOUSING ALLOWANCE Q&As (FOR UNITED METHODIST … housing allowance for the pastor(s). 9. How is the housing allowance set up? A pastor may not claim a housing allowance exclusion for federal income tax purposes unless his local church (or other salary paying unit) has first established or designated a housing allowance for him. The preferred way to do this is for the church council or charge

2020 Housing Allowance For Pastors: What You Need To Know 2020 Housing Allowance for Pastors Worksheet (.pdf) Download 2020 Housing Allowance for Pastors Excel Worksheet Download I hope you find these tools useful and if you have any questions as you go, don't hesitate to email me at amy@pastorswallet.com! 8 Comments 1 Previous post Health Insurance For Pastors: What Are Your Options? Next post

Microsoft is building an Xbox mobile gaming store to take on … 19.10.2022 · Microsoft is quietly building an Xbox mobile platform and store. The $68.7 billion Activision Blizzard acquisition is key to Microsoft’s mobile gaming plans.

Center Street United Methodist Church In addition to the annual cash salary of the pastor, _____ United Methodist Church will also provide a housing allowance of $ _____ ($ _____per month) for a home at _____, in _____, Texas . Whereas Section 107 of the Internal Revenue Code of 1986 provided that a minister of the gospel may exclude from gross income the rental value of a home and any allowance to …

housing allowance worksheet 2021 Clergy Housing Allowance Worksheet 2010-2022 - Fill And Sign Printable . worksheet clergy allowance housing 2021 form forms template sign printable signnow legal. Housing Vacated Ang Request Housing Allowance Letter : Housing Crisis helgadiorio.blogspot.com.

Housing Allowance Tools - News + Resources Sample wording for use in documenting pastor's housing allowance in council minutes. Download. Housing Allowance Worksheet—Own . Worksheet to calculate housing allowance when pastor owns a home. Download. Housing Allowance Worksheet—Parsonage.

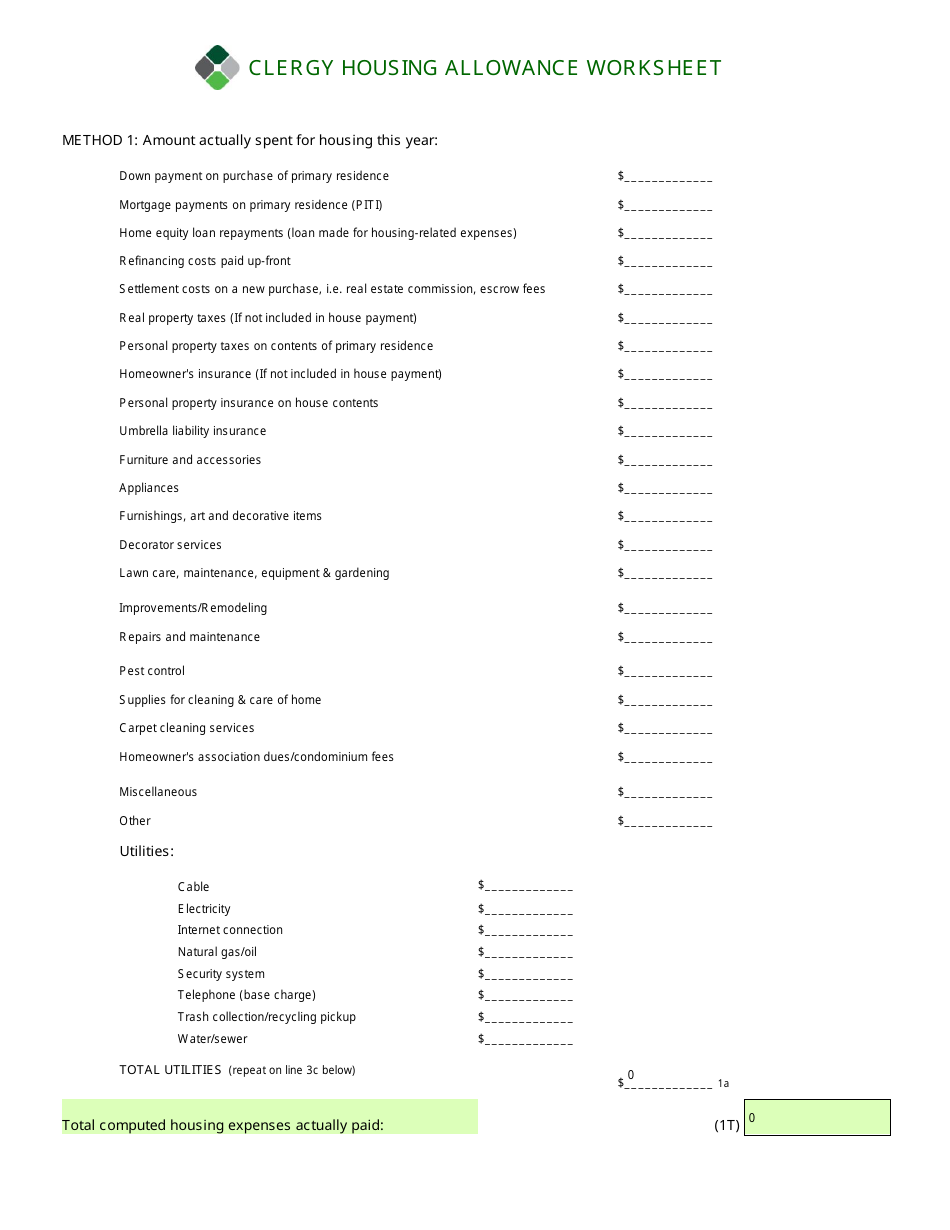

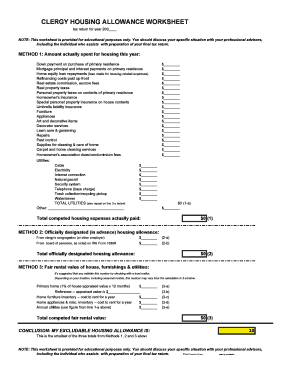

PDF Clergy Housing Allowance Worksheet EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

Pastoral Housing Allowance for 2021 - Geneva Benefits Group Determining the amount of your housing allowance can be challenging. For this reason, RBI has three online housing allowance worksheets available for you: one for a pastor who lives in a manse, one for a pastor who rents, and one for a pastor who owns a house.

How Much Housing Allowance Can A Pastor Claim? How To Calculate Your Housing Allowance Limit Therefore, to figure out what size of housing allowance you're eligible for, simply calculate each of the above amounts and go with the lowest. If your mortgage payment is $2,000 a month but you could only rent the home for $1,500, then your housing allowance is limited to $1,500 a month.

Sample Housing Allowance for Pastors - Payroll Partners Ready-to-use resolution language for church board to set a clergy housing allowance in 2019 by Richard R. Hammar. Editor's Note: A resolution can only be applied prospectively, never retroactively. For a church to have a resolution in place for a specific calendar year, it needs to adopt the resolution by December 31 of the previous year.

PDF 2020 Minister Housing Allowance Worksheet - The Pastor's Wallet 2020 Minister Housing Allowance Worksheet Mortgage Payment *Real Estate Taxes *Homeowners Insurance Mortgage Down Payment & Closing Costs Rent Renter's Insurance HOA Dues/Condo Fees Home Maintenance & Repairs Utilities Furniture & Appliances Household Items Home Supplies Yard Service Yard Care Tools & Supplies Miscellaneous Other: Other: Other:

0 Response to "44 pastor's housing allowance worksheet"

Post a Comment