45 1040 qualified dividends worksheet

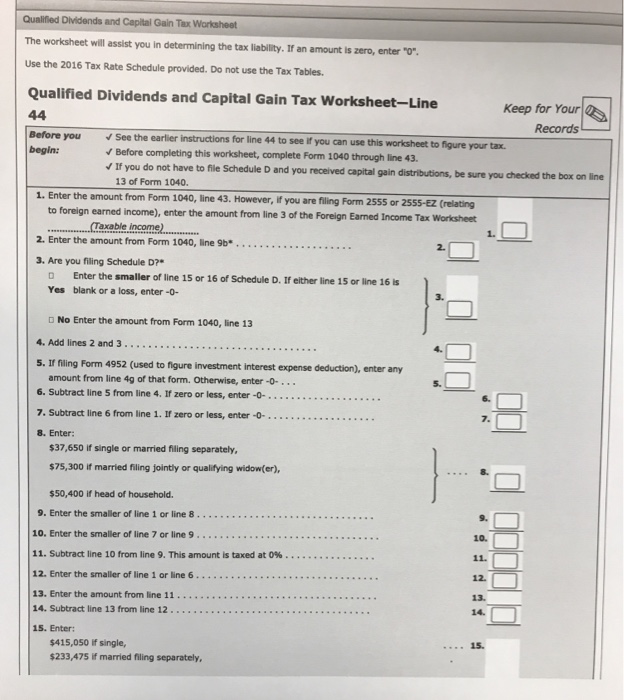

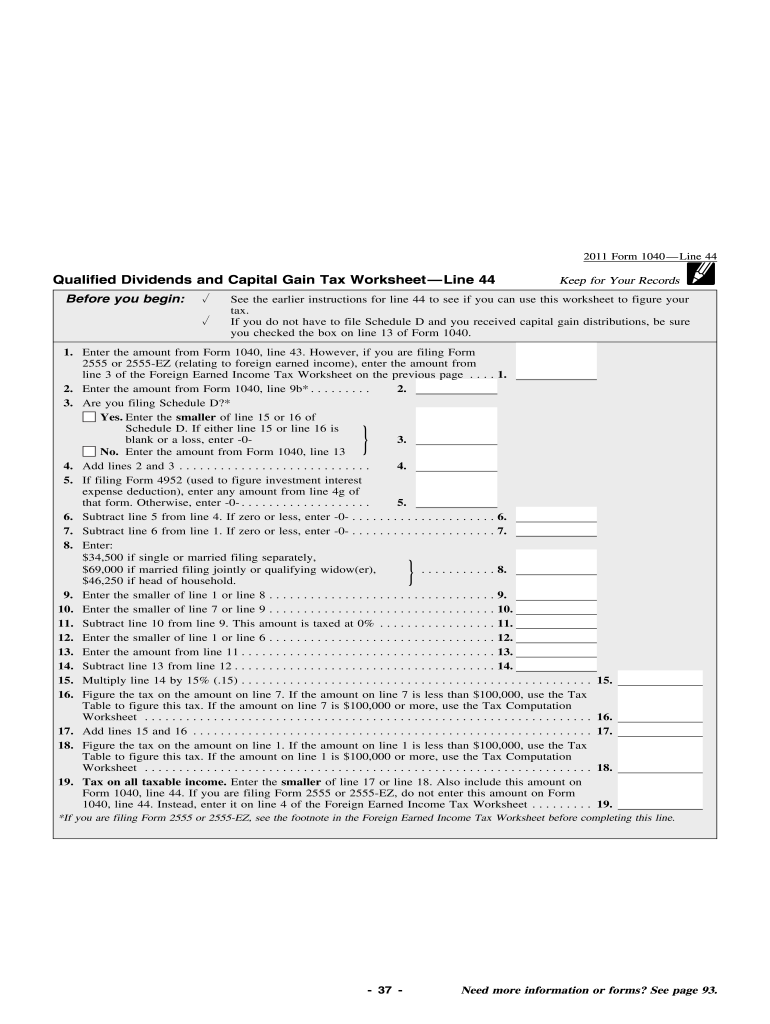

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube Qualified Dividend and Capital Gains Tax Worksheet? 4,129 views Feb 16, 2022 The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and... What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

1040 qualified dividends worksheet

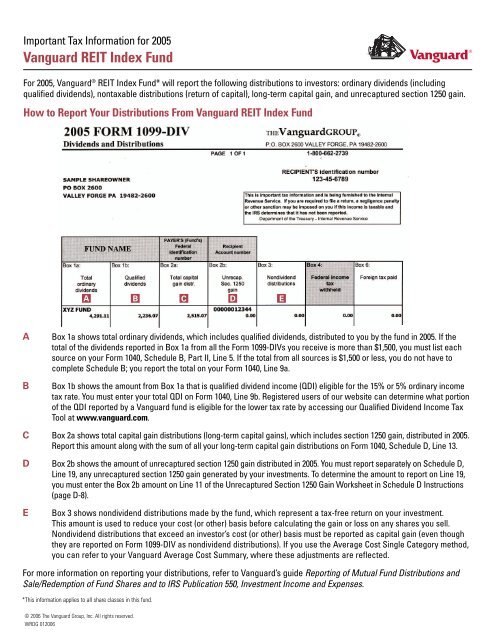

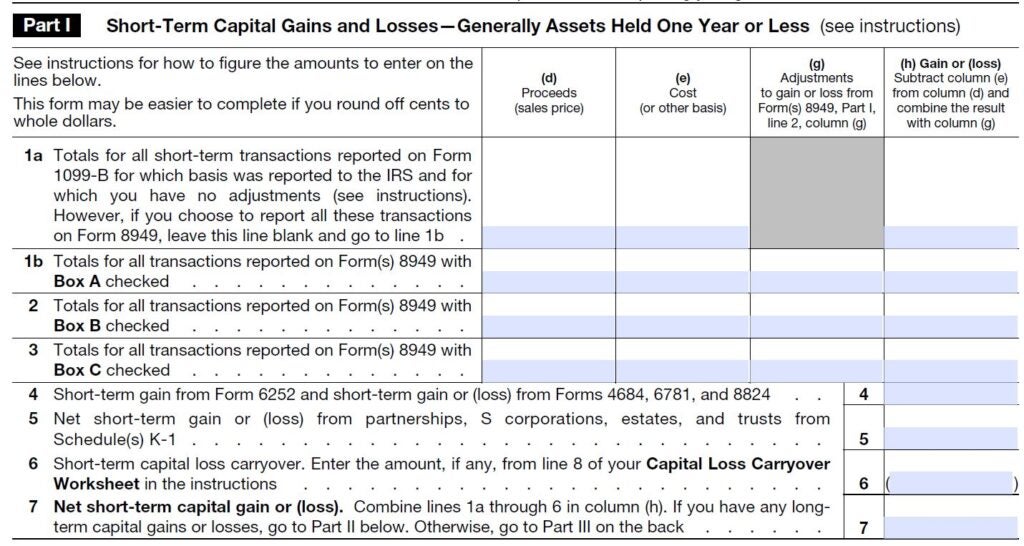

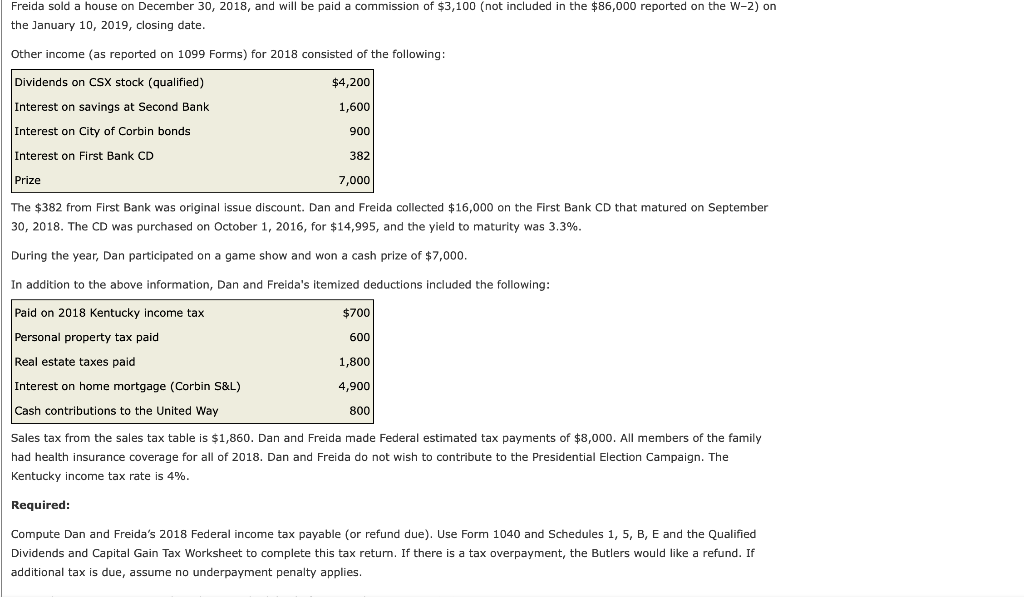

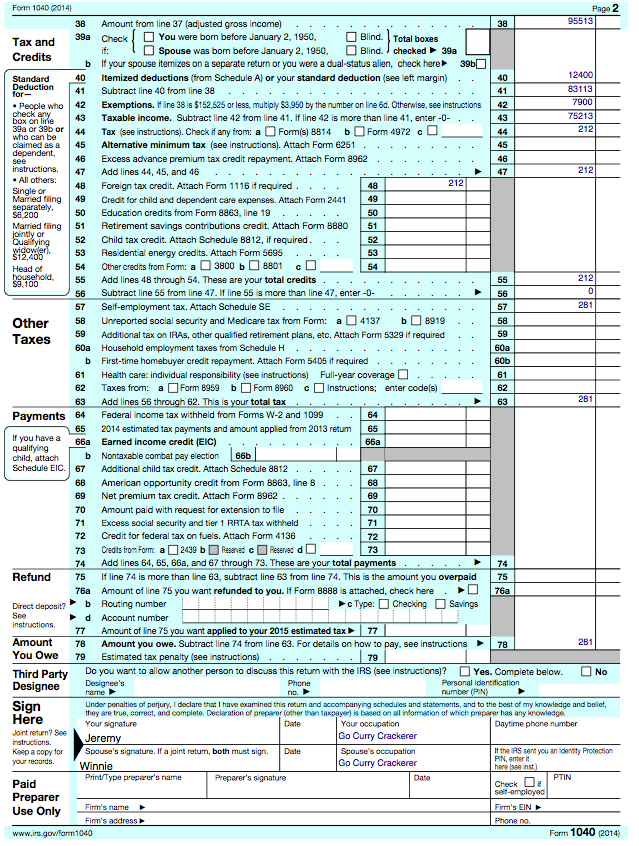

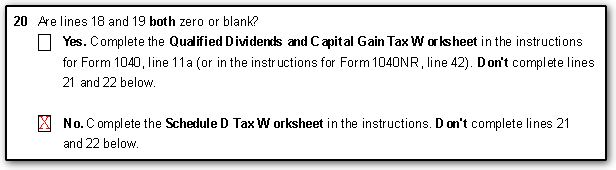

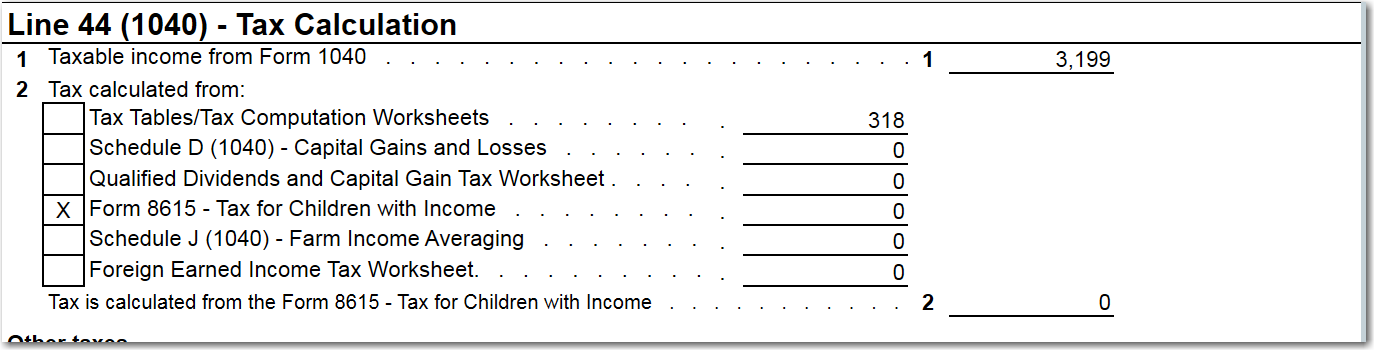

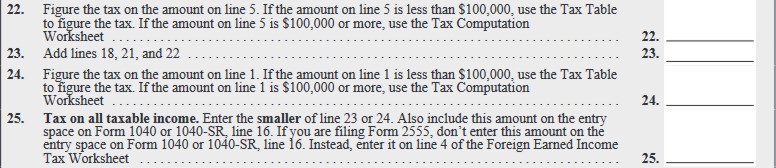

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Qualified Dividends and Capital Gain Tax Worksheet - Course Hero Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D. Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet.

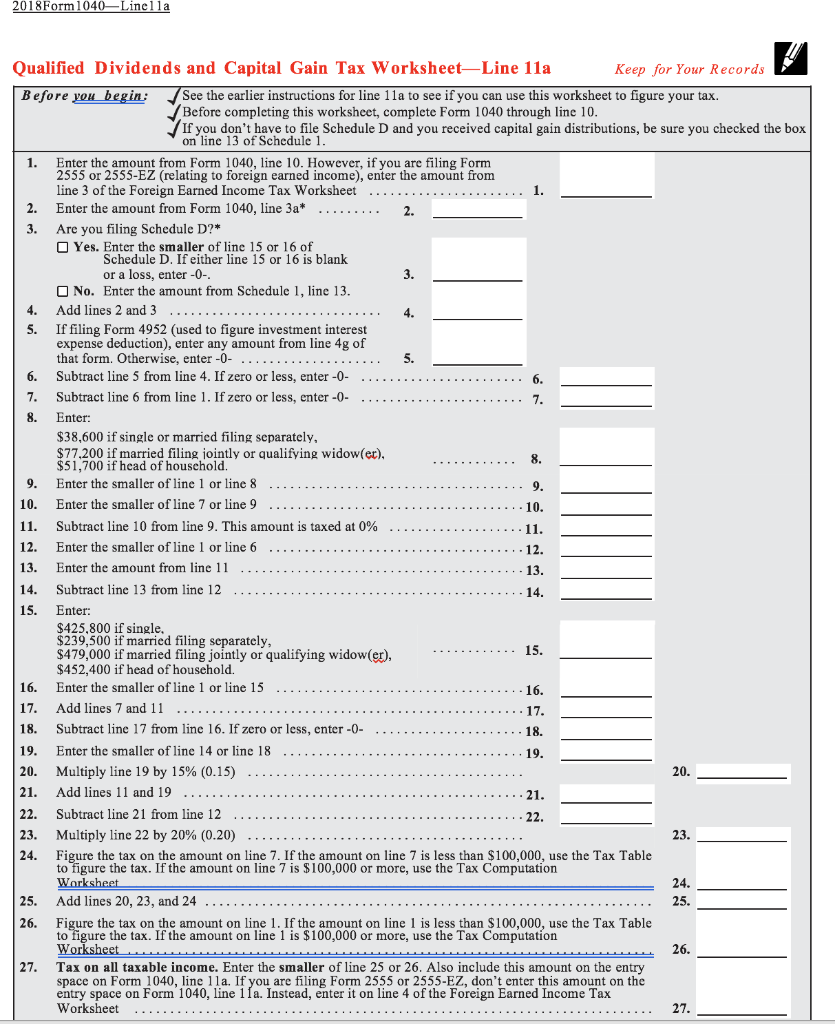

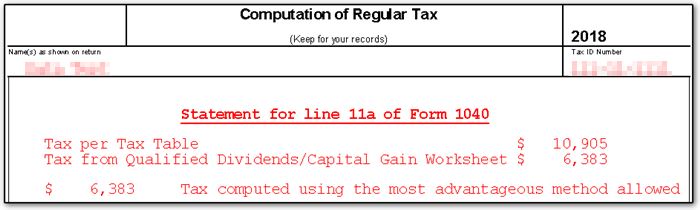

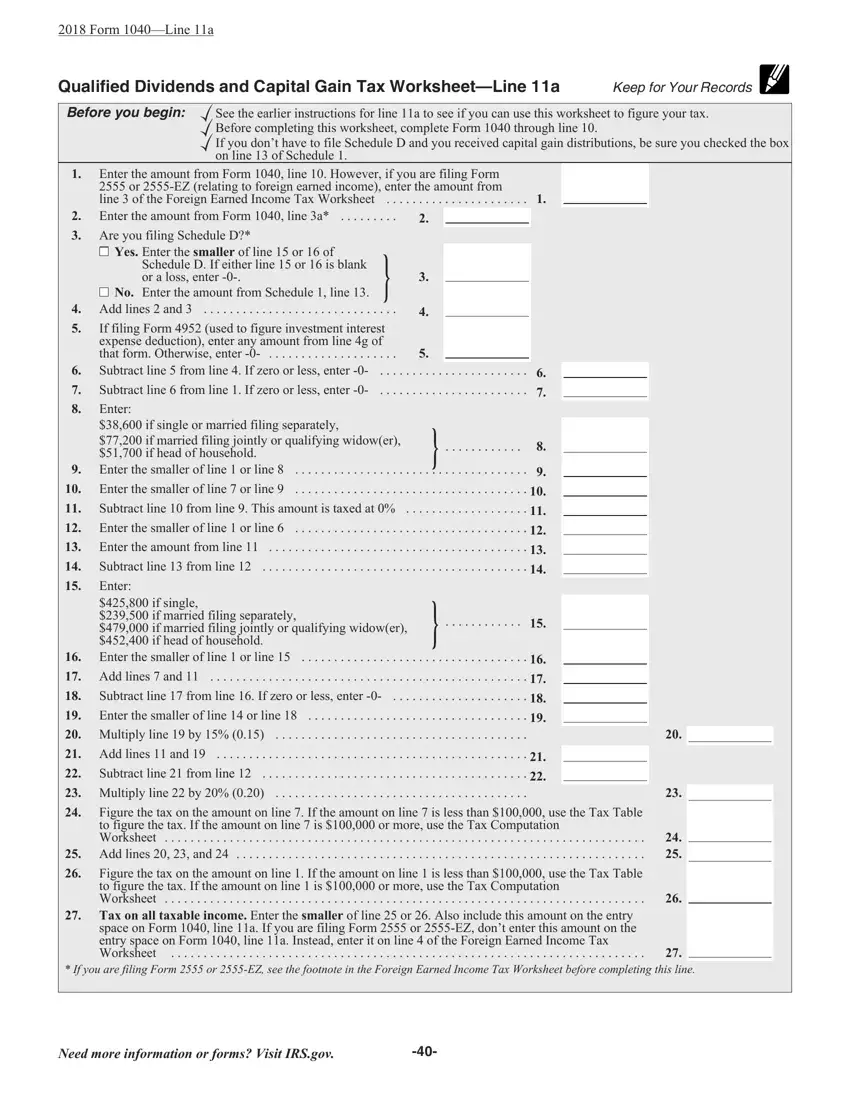

1040 qualified dividends worksheet. About Schedule B (Form 1040), Interest and Ordinary Dividends About Schedule B (Form 1040), Interest and Ordinary Dividends Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 85 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ... 6-2 Final Project Two-Qualified Dividends and Capital Gain Tax Worksheet 2018 Form 1040—Line 11a. Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital ...

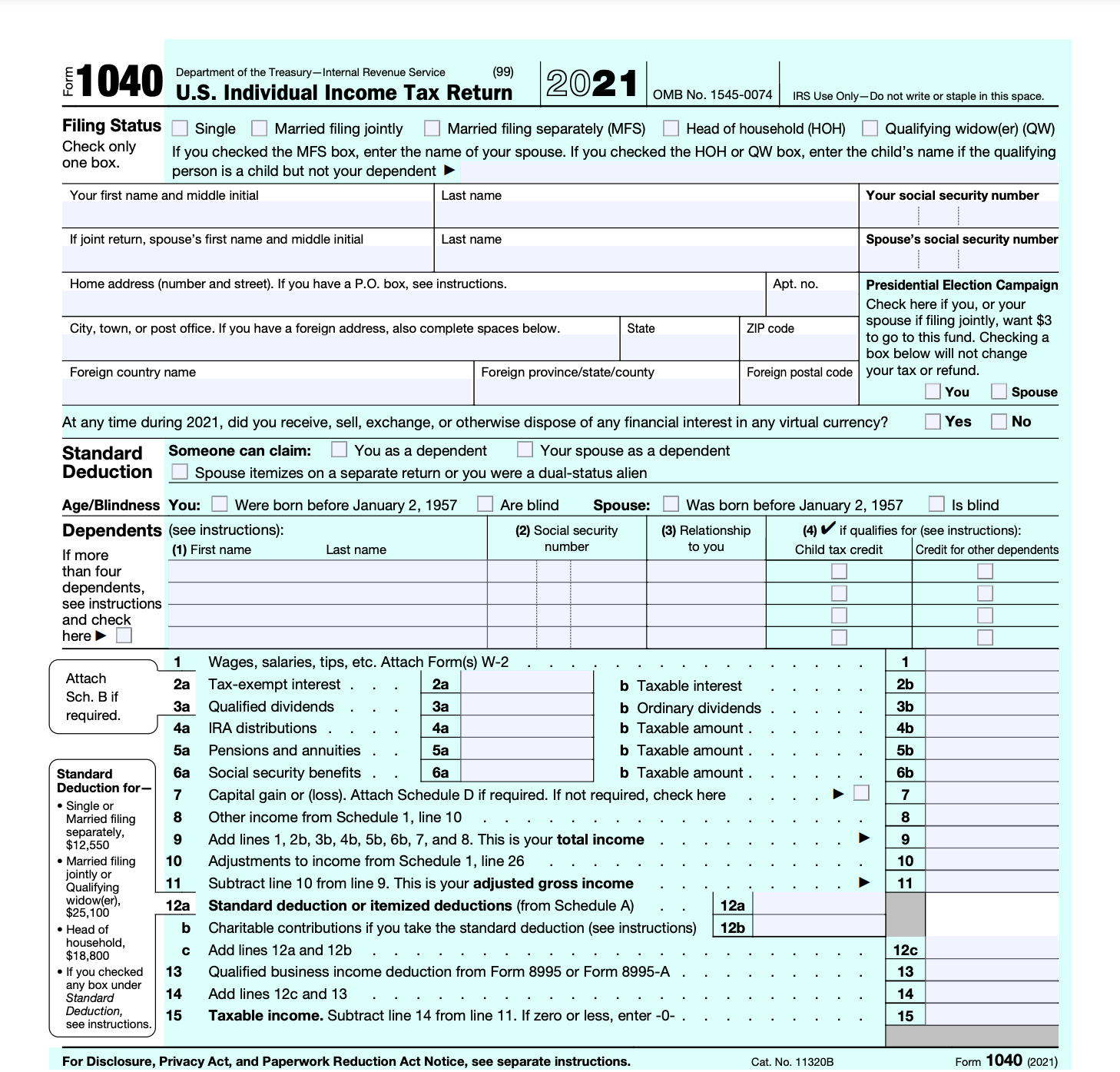

1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. How to Figure the Qualified Dividends on a Tax Return Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the... PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Qualified Dividends And Capital Gain Worksheet - Martin Lindelof 2017 Qualified Dividends And Capital Gain Tax Worksheet — from db-excel.com. This document is locked as it has been sent for signing. Web form 1040 qualified dividends and capital gain tax worksheet 2018. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

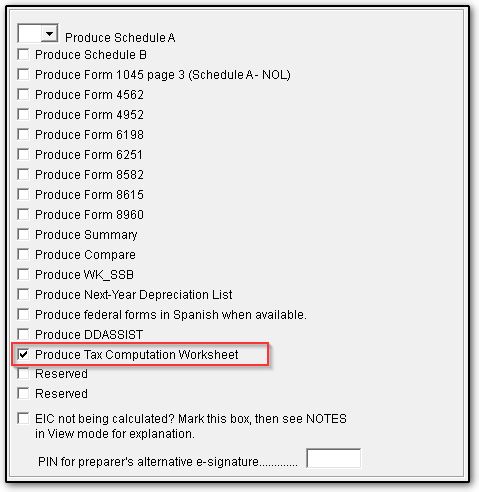

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Qualified Dividends and Capital Gain Tax Worksheet 2015-2022: get and sign the form in seconds Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021 How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). Qualified dividends, on 1040 Schedule D, worksheet, does not… This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet.

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

qualified dividend qualified dividend momidwest Returning Member posted Wednesday last updated December 07, 2022 11:50 AM qualified dividend on qualified dividend & capital gain tax worksheet last year line one = $ 1586.00 line two = $2945.00. married filing jointly. line 24 was $159.00 line 25 was zero. IRS just wrote me said I need to pay $159.00.

Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet.

Qualified Dividends and Capital Gain Tax Worksheet - Course Hero Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D.

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

0 Response to "45 1040 qualified dividends worksheet"

Post a Comment