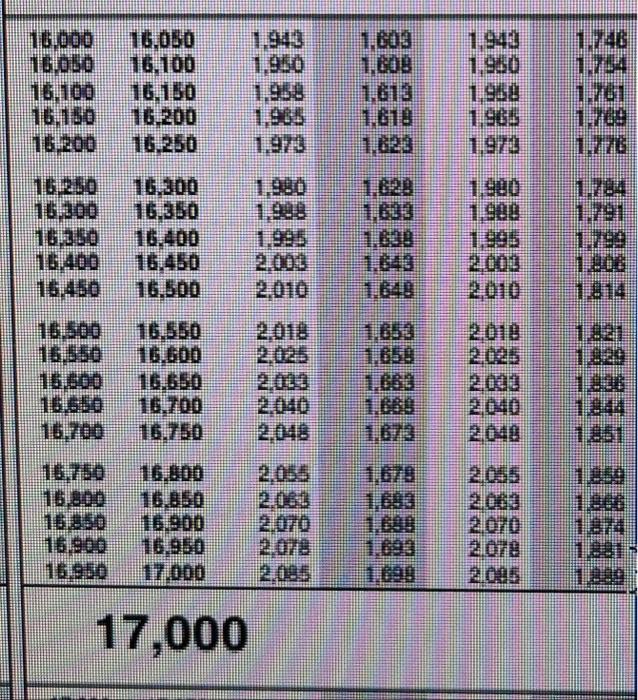

45 2015 tax computation worksheet

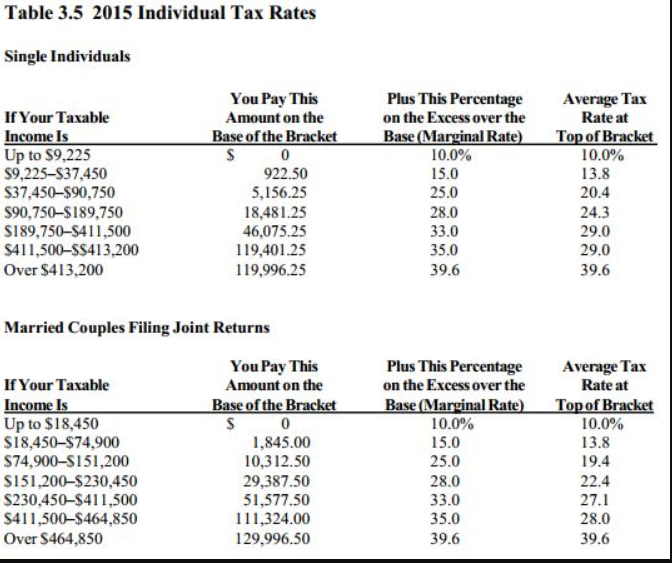

Federal Income Tax Computation Worksheet 2015 Individual Income Tax Instructions Kansas Department. Tax Worksheet in the Instructions for Form 1040 line 44 or in the Instructions for. Small. Bt; ... Fill Free fillable Form 1040 Tax Computation Worksheet. Compute federal income taxes using a tax table and tax schedules Tax Tables Worksheets and Schedules 7-1 The hardest thing in the ... PDF WORKSHEETS A, B and C These are worksheets only. 2015 NET PROFITS TAX ... WORKSHEET C: Computation of Estimated Tax Base If the amount on Line 3 is $100 or less, estimated payments are not required. If the amount on Line 3 is greater than $100, enter 25% of the amount on ... WORKSHEET NR-3 2015 NET PROFITS TAX RETURN Computation of apportionment factors to be applied to apportionable net income of certain ...

Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ...

2015 tax computation worksheet

Partner's Instructions for Schedule K-1 (Form 1065-B) (2017) Code C5. General partner's alternative minimum tax adjustment from other rental activities. An AMT adjustment must be reported on Form 6251, line 16. However, if the AMT adjustment is from a passive activity, it must be taken into account on line 19 with adjustments and preferences from other passive activities instead of being reported on line 16. 2015 tax computation worksheet 30 2015 Tax Computation Worksheet - Notutahituq Worksheet Information. 14 Pictures about 30 2015 Tax Computation Worksheet - Notutahituq Worksheet Information : 30 2015 Tax Computation Worksheet - Notutahituq Worksheet Information, Annualized Estimated Tax Worksheet and also worksheet. Publication 590-A (2021), Contributions to Individual Retirement ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

2015 tax computation worksheet. 2015 Individual Income Tax Forms - Marylandtaxes.gov 2015 Individual Income Tax Forms 2015 Individual Income Tax Forms For additional information, visit Income Tax for Individual Taxpayers > Filing Information. Instruction Booklets Note: The instruction booklets listed here do not include forms. Forms are available for downloading in the Resident Individuals Income Tax Forms section below. PDF RI-1041 TAX COMPUTATION WORKSHEET 2015 - TaxFormFinder a year beginning in 2015. RI-1041 TAX COMPUTATION WORKSHEET 2015 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c) Enter here and on RI-1041, line 8 TAX $605.50 ... PDF Marylandtaxes.gov | Welcome to the Office of the Comptroller Tax Rate Schedule Il For taxpayers filing Joint, Widowers. If taxable net income is: At least: but not over: Head of Household, or for Qualifying Widows/ Maryland Tax is: $20 $50 $90 ,072. 322. ,947. ,072. .00 .00 .00 50 50 50 50 plus plus plus plus plus plus plus If taxable net income is: At least: but not over: $20. $50. › lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

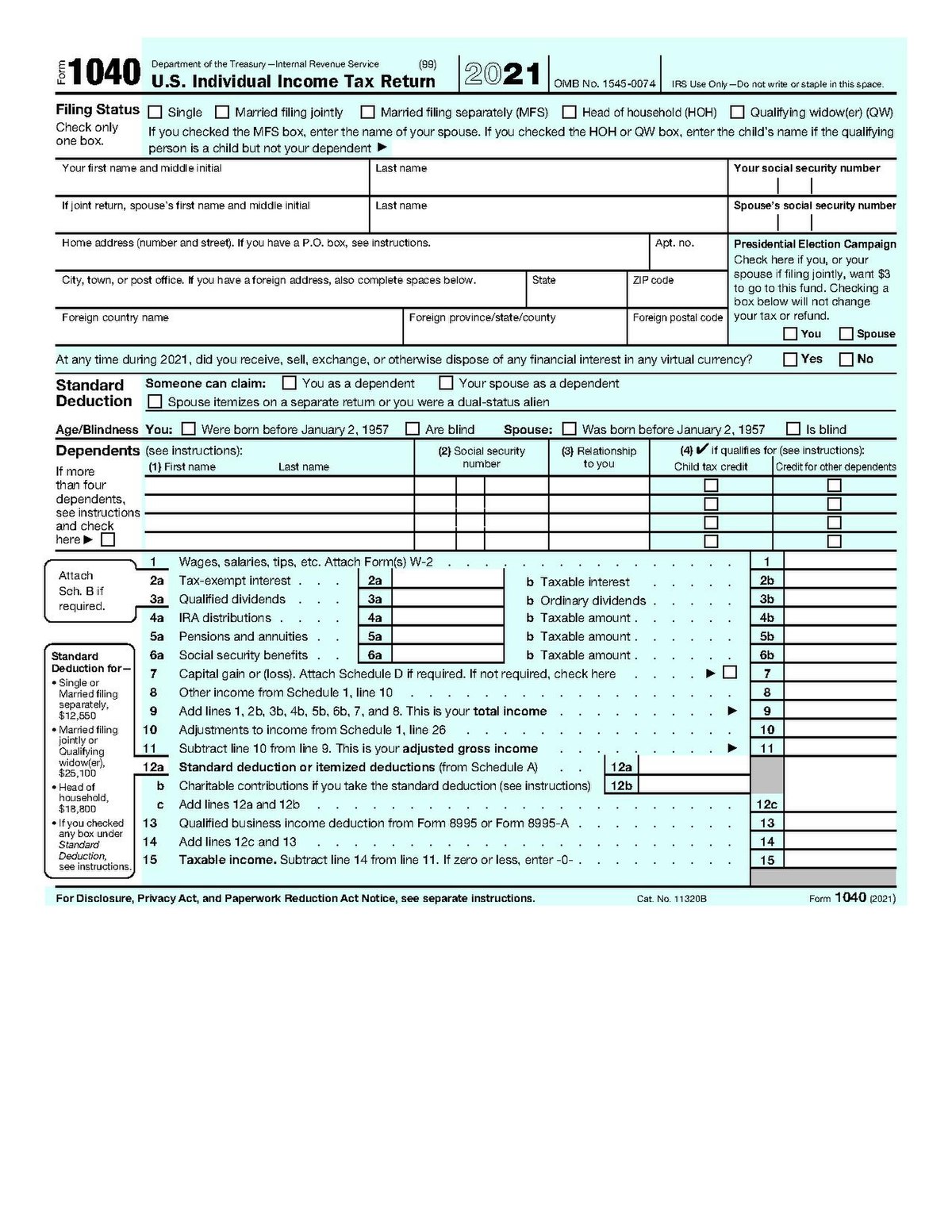

Income Limits | HUD USER Although HUD uses the most recent data available concerning local area incomes, there is still a lag between when the data are collected and when the data are available for use. For example, FY 2022 Income Limits are calculated using 2015-2019 5-year American Community Survey (ACS) data, and one-year 2019 data where possible. › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing 1040 (2021) | Internal Revenue Service - IRS tax forms Form 1040 and 1040-SR Helpful Hints. Form 1040 and 1040-SR Helpful Hints. For 2021, you will use Form 1040 or, if you were born before January 2, 1957, you have the option to use Form 1040-SR.

Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2015 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) ... 2021 Instructions for Schedule 8812 (2021) - IRS tax forms If your employer withheld or you paid Additional Medicare Tax or Tier 1 RRTA taxes, use this worksheet to figure the amount to enter on line 21 of Schedule 8812 and line 7 of Credit Limit Worksheet B. Social security tax, Medicare tax, and Additional Medicare Tax on Wages. 1. Enter the social security tax withheld (Form(s) W-2, box 4) 1. _____ 2. PDF 2019 Tax Computation Worksheet—Line 12a - cchcpelink.com appropriate line of the form or worksheet that you are completing. Section A—Taxable income.Use if your filing status is Single. Complete the row below that applies to you. If line 11b is— (a) Enter the amount from line 11b (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount Tax. Subtract (d) from (c). Enter › division › individualIncome Tax - Alabama Department of Revenue Income Tax is responsible for the administration of individual income tax, business privilege tax, corporate income tax, partnerships, S-Corporation, fiduciary and estate tax, financial institution excise tax, and withholding taxes. For a complete listing of forms, visit the forms page.

CCH AnswerConnect | Wolters Kluwer A comprehensive Federal, State & International tax resource that you can trust to provide you with answers to your most important tax questions.

› 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

› portal › datasetsIncome Limits | HUD USER Although HUD uses the most recent data available concerning local area incomes, there is still a lag between when the data are collected and when the data are available for use. For example, FY 2022 Income Limits are calculated using 2015-2019 5-year American Community Survey (ACS) data, and one-year 2019 data where possible.

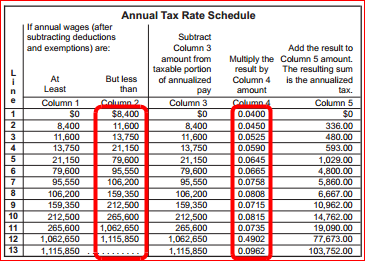

Tax Computation Worksheet 2022 - 2023 - TaxUni Tax Computation Worksheet Charles Young Tax Computation Worksheet for the 2022 taxes you're paying in 2023 can be used to figure out taxes owed. The tax computation worksheet is for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax.

PDF QPE Table of Contents - Thomson Reuters 2015 Tax Computation Worksheet 2015 EIC Table Tab 2 2015 States Quick Reference State Individual Income Tax Quick Reference Chart (2015) General Alabama Alaska Arizona Arkansas ... Child Tax Credit Worksheet (2015) Donations—Noncash Donated Goods Valuation Guide Donations Substantiation Guide Earned Income Credit (EIC) Worksheet (2015)

Microsoft takes the gloves off as it battles Sony for its Activision ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Get and Sign Computation Worksheet 2015-2022 Form Use a computation worksheet 2015 template to make your document workflow more streamlined. Get form. ... 2019 tax computation worksheet fillable. 2021 tax computation worksheet. tax computation worksheet 2019 excel. 2019 tax computation worksheet calculator. Create this form in 5 minutes!

› publications › p587Publication 587 (2021), Business Use of Your Home If you deducted actual expenses for business use of your home on your 2020 tax return, enter on line 29 the amount from line 42 of your 2020 worksheet. If you used the simplified method in 2020, enter on line 29 the amount from line 6b of your 2020 Simplified Method Worksheet.

Publication 587 (2021), Business Use of Your Home If you deducted actual expenses for business use of your home on your 2020 tax return, enter on line 29 the amount from line 42 of your 2020 worksheet. If you used the simplified method in 2020, enter on line 29 the amount from line 6b of your 2020 Simplified Method Worksheet.

PDF IRS tax forms IRS tax forms

PDF Calculate your Louisiana tax by using the Tax Computation Worksheet ... Tax CompuTaTion WorksheeT (keep this worksheet for your records.) a Taxable income: Enter the amount from Form IT-540B-NRA, Line 11. a .00 B First Bracket: If Line A is greater than $12,500 ($25,000 if filing status is 2 or 5), enter $12,500 ($25,000 if filing status is 2 or 5). If Line A is less than $12,500

Income Tax - Alabama Department of Revenue Income Tax is responsible for the administration of individual income tax, business privilege tax, corporate income tax, partnerships, S-Corporation, fiduciary and estate tax, financial institution excise tax, and withholding taxes. For a complete listing of forms, visit the forms page.

PDF RI-1041 TAX COMPUTATION WORKSHEET 2015 - Rhode Island Bankruptcy Estate tax computation worksheet above. 6. Attach Form RI-1040 or Form RI-1040NR to RI-1041. 7. ... RI-1041 TAX COMPUTATION WORKSHEET 2015 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b)

Publication 3 (2021), Armed Forces' Tax Guide Credit for Excess Social Security Tax Withheld Worksheet. Do I figure my credit differently if I am a railroad employee? ... Include a before and after tax forgiveness computation. Computation when the decedent filed joint returns. ... Philippines (from January 9, 2002, through September 30, 2015). Djibouti (as of July 1, 2002). Yemen (as of ...

PDF RI-1041 TAX COMPUTATION WORKSHEET 2016 - Rhode Island Compute the tax on Form RI-1040 or Form RI-1040NR using the Bankruptcy Estate tax computation worksheet above. 6. Attach Form RI-1040 or Form RI-1040NR to RI-1041. 7. Complete only the identification area at the top of Form RI-1041. 8. Enter the name of the individual in the following format: "John Q. Public Bankruptcy Estate." 9.

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

Publication 3920 (09/2014), Tax Relief for Victims of Terrorist … 2011 tax year – April 15, 2015. 2012 tax year – April 18, 2016. ... Tax Table or Tax Computation Worksheet, use the "Married filing separately" column in the Tax Table or Section C of the Tax Computation Worksheet. When figuring the total tax, allocate credits and other taxes, if any, in the same manner as they would have been allocated if ...

PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only.

PDF AND PART-YEAR RESIDENT You must enter your SSN below in the same YOUR LOUISIANA INCOME TAX - See the Tax Computation Worksheet to calculate the amount of your Louisiana income tax. NONREFUNDABLE TAX CREDITS 13A FEDERAL CHILD CARE CREDIT - Enter the amount from your Federal Form 1040A, Line 31, or Federal Form 1040, Line 49. This amount will be used to compute your 2015 Louisiana Nonrefundable Child Care ...

Publication 590-A (2021), Contributions to Individual Retirement ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

2015 tax computation worksheet 30 2015 Tax Computation Worksheet - Notutahituq Worksheet Information. 14 Pictures about 30 2015 Tax Computation Worksheet - Notutahituq Worksheet Information : 30 2015 Tax Computation Worksheet - Notutahituq Worksheet Information, Annualized Estimated Tax Worksheet and also worksheet.

Partner's Instructions for Schedule K-1 (Form 1065-B) (2017) Code C5. General partner's alternative minimum tax adjustment from other rental activities. An AMT adjustment must be reported on Form 6251, line 16. However, if the AMT adjustment is from a passive activity, it must be taken into account on line 19 with adjustments and preferences from other passive activities instead of being reported on line 16.

0 Response to "45 2015 tax computation worksheet"

Post a Comment