39 credit report scenario worksheet answers

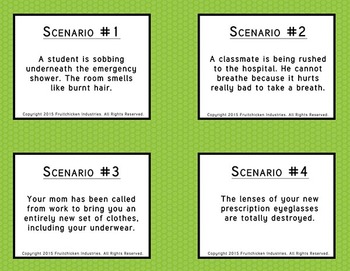

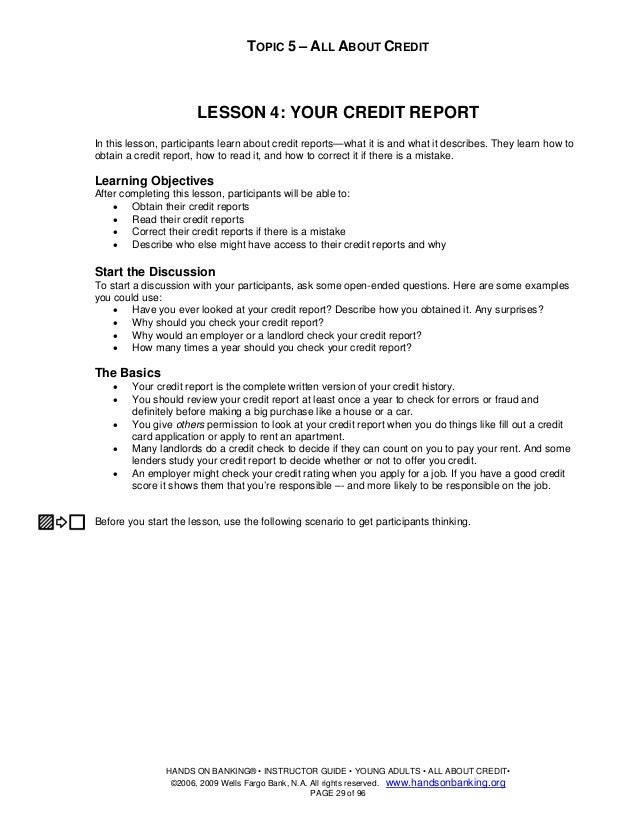

Analyze Caroline’s credit report and answer the following questions to determine if Caroline should receive the loan. 1. List four items on Caroline’s credit report that suggest she is a high risk borrower: (4 points) o o o o 2. When was the last time you checked your credit report? ... that follow each scenario to guide discussion and clarify answers. CREDIT CRUNCH SCENARIO CARDS.15 pages

21. If you are refused credit because of a credit report, upon request from you, the lender must give you the name and address of the credit bureau that issued the report. 22. Your credit report is available to anyone, regardless of the reason. 23. A debt collector has the right to contact you at any time of day or night. 24.

Credit report scenario worksheet answers

Name: Destiny Boothe Date: 10/1/18 School: SSHS Facilitator: Mrs. Clark-Rodgers 3.3 Credit Report Scenario Directions: Read Carolina Blue’s credit report on the following pages. Carolina is seeking a bank loan to purchase a new vehicle. Analyze Carolina’s credit report and answer the following questions to determine if Carolina should receive the loan. C AROLINA ’ S C REDIT R EPORT S ... Answers will vary but may include: Whenever a credit card account is closed, the credit card showed be cut into pieces and thrown away. Scenario 7: Ruben found his credit card statement in a stack of papers on his desk. Students should be prepared to justify their answers to the class. 10. Ask a volunteer from each group to share one scenario with the class and explain the ...

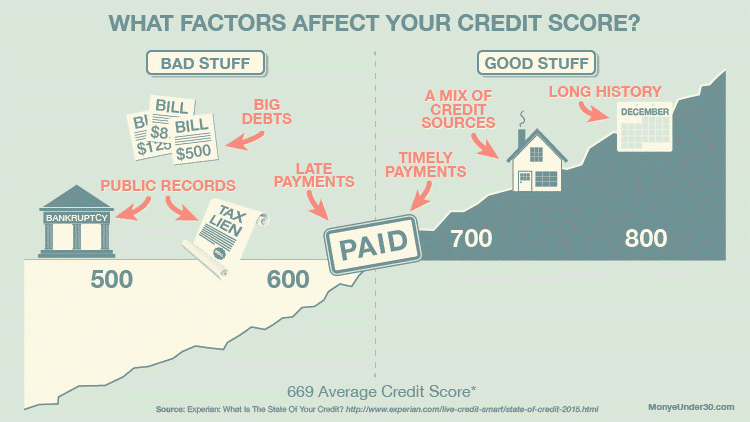

Credit report scenario worksheet answers. Credit Report Scenario Name_____ Date_____ Class_____ Directions: Read Carolina Blue’s credit report. Carolina is seeking a bank loan to purchase a new vehicle. Analyze Carolina’s credit report and answer the following questions to determine if Carolina should receive the loan. 1. A credit report is an important part of a teenager’s financial future. This record can affect everything from the rate paid ... • L1 — Credit reporting vocabulary worksheet answer key • L2 — Pre/post assessment answer key • L3 — Alphabet activity answer key (examples) simulate how credit scores weight key factors related to creditworthiness. ♢ Conduct a Web Quest by searching online for “how to increase your credit score ...14 pages ANSWER KEY: SPOT THE CREDIT CRISIS | 4 Spot the Credit Crisis LESSON 6: ANSWER KEY Scenario 1: Does your credit score go up or down? Your credit score goes down. Why does it go up or down? Falling behind on payments, or making late payments on your auto loan over time, will have a negative impact on your credit score.

Sample Credit Profile Scenario: Carolina Blue needs a consolidation loan from a bank to pay off her credit card and student loan debt. The loan officer at the ... Credit Report Scenario Name_____ Date_____ Class_____ Directions: Read Carolina Blue’s credit report. Carolina is seeking a bank loan to purchase a new vehicle. Analyze Carolina’s credit report and answer the following questions to determine if Carolina should receive the loan. 1. Have the group post the answer on the board under the correct heading and explain theirdecision.d. ... Hand out the Credit Report Scenario worksheet 1.4.2. Have the group post the answer on the board under the correct heading and explain their ... 14. Hand out the Credit Report Scenario worksheet 1.4.2.A2.13 pages

2 Cross-Selling Credit Union Services and Next Suggested Product be helpful for reminding employees to cross sell, and can point out which services must be discontinued when a member leaves the credit union. These tasks are documented in a Sales Tracker, an on-going record of contact credit union employees have with members. As the instructor goes over the answers, use the Narrative column to take notes on why each behavior ... Impact on Credit Score Worksheet Answer Key ... Credit Report Scenario – Carolina Blue Directions: Read Carolina Blue’s credit report. Carolina is seeking a bank loan to purchase a new vehicle. Analyze Carolina’s credit report and answer the following question s to determine fi Carolina should receive the loan. Review: Revolving = credit card (open ended) Installments = loans (closed ... Students should be prepared to justify their answers to the class. 10. Ask a volunteer from each group to share one scenario with the class and explain the ...

Answers will vary but may include: Whenever a credit card account is closed, the credit card showed be cut into pieces and thrown away. Scenario 7: Ruben found his credit card statement in a stack of papers on his desk.

Name: Destiny Boothe Date: 10/1/18 School: SSHS Facilitator: Mrs. Clark-Rodgers 3.3 Credit Report Scenario Directions: Read Carolina Blue’s credit report on the following pages. Carolina is seeking a bank loan to purchase a new vehicle. Analyze Carolina’s credit report and answer the following questions to determine if Carolina should receive the loan. C AROLINA ’ S C REDIT R EPORT S ...

0 Response to "39 credit report scenario worksheet answers"

Post a Comment