42 truck driver expenses worksheet

Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs , continue to visit CDLjobs.com for up-to-date information and job ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) - Possible Deductions From Checks- Licenses & Permits Bobtail Fees Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions-

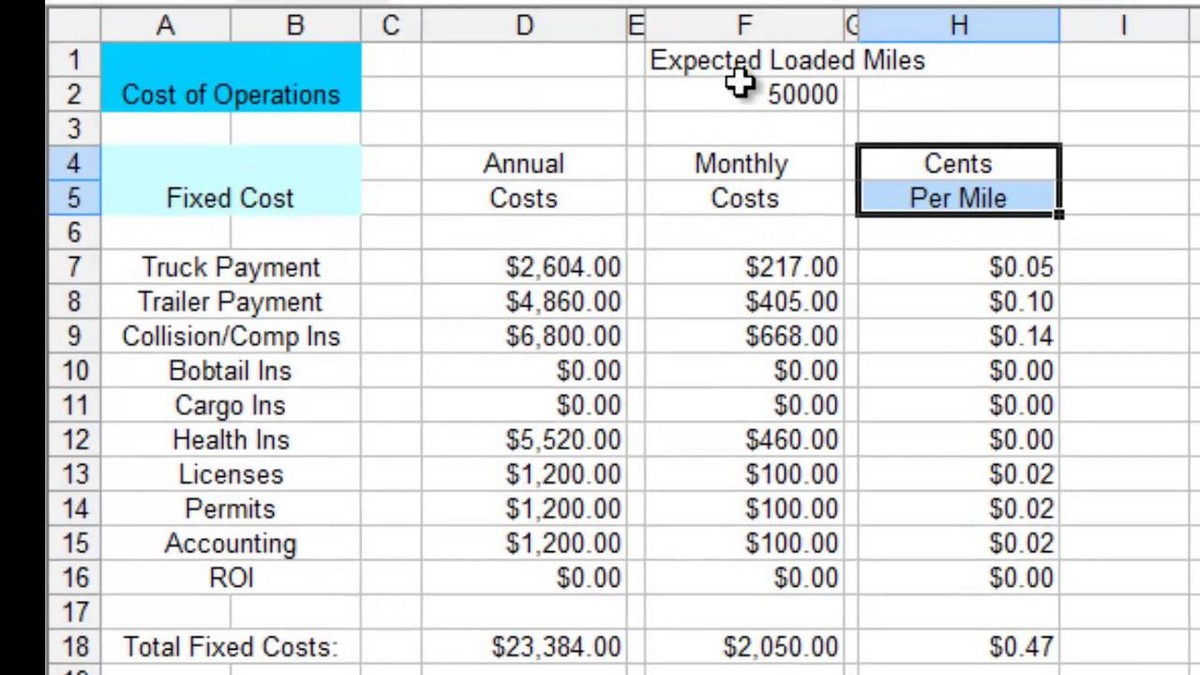

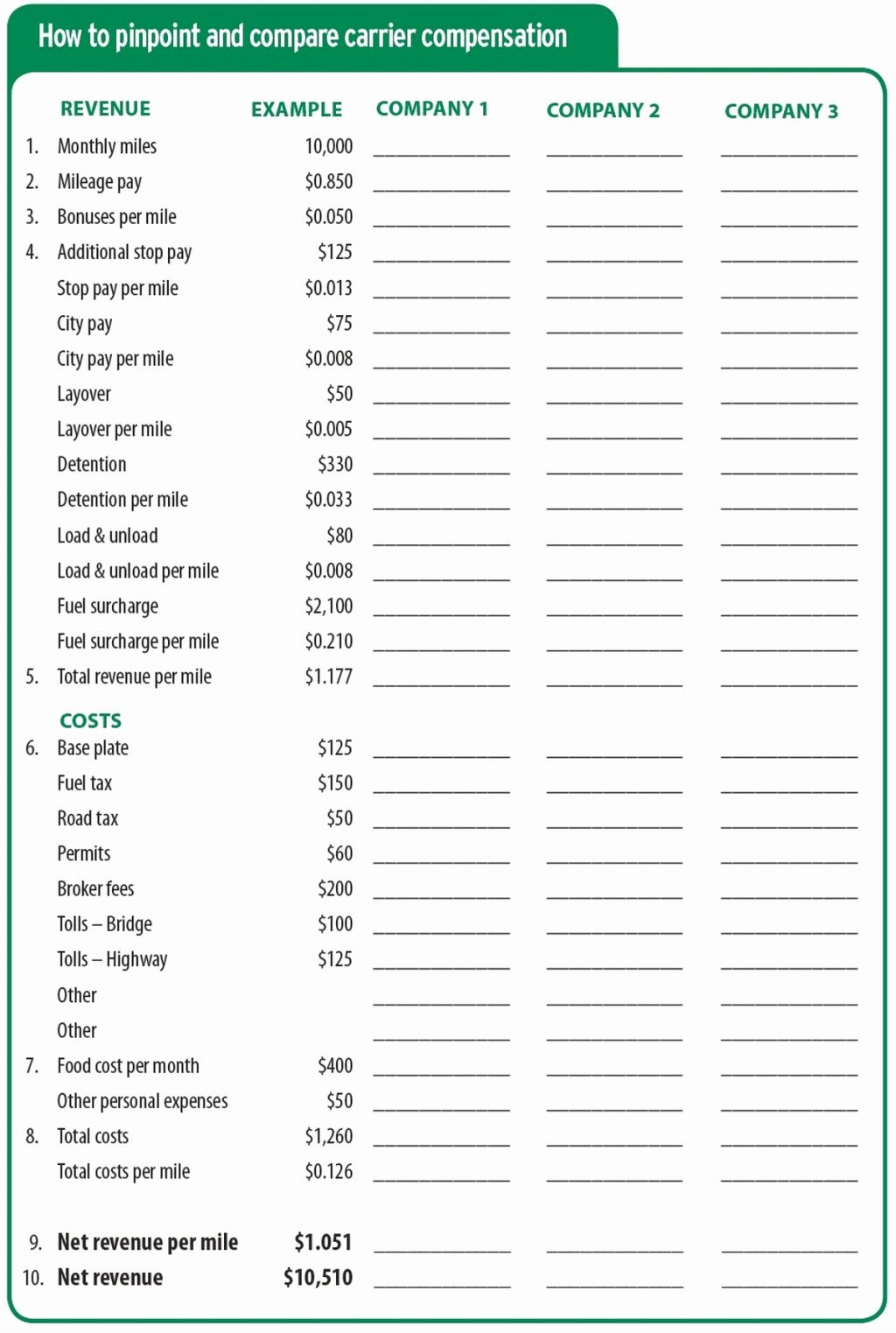

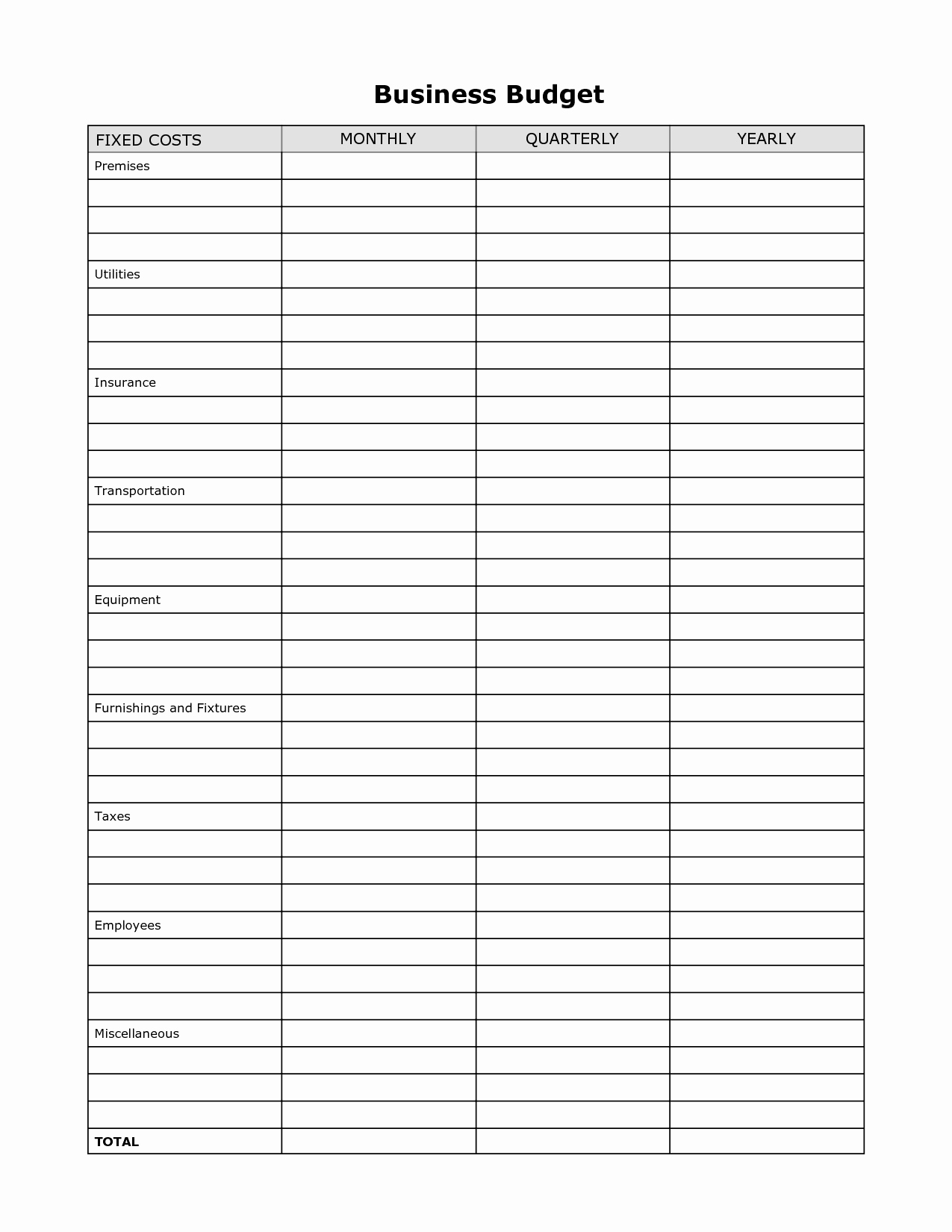

The more you can plan for your operating expenses, the smoother things will go and you and your trucking business will thrive as a result. You'll need to itemize all of the costs you are going to incur on the road and at home. These don't just include truck and driving expenditures, but also registrations, office costs and fees.

Truck driver expenses worksheet

Truck expenses are the second-biggest expense behind fuel. This is true even if your truck is completely paid off and your main truck-related expense is maintenance and tires. Maintenance costs are generally estimated to be around 10% of total costs and typically run $0.10-$0.15 per mile. Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ Commissions & fees paid to others $_____ Contract labor $_____ Did you pay $600 or more in total during the year to any individual? ... Company B owns the truck the worker drives and pays for all operating expenses. It requires the truck driver to work a regular five-day work schedule and pays the driver hourly. The driver has to stay in frequent contact with XYZ Logging's dispatcher and may be asked to use specific routes. The payer resolves any complaints it receives from ...

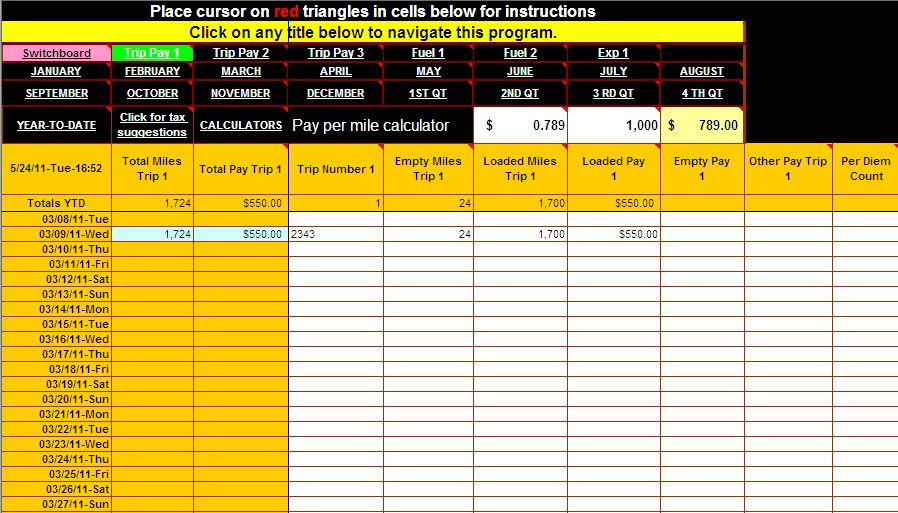

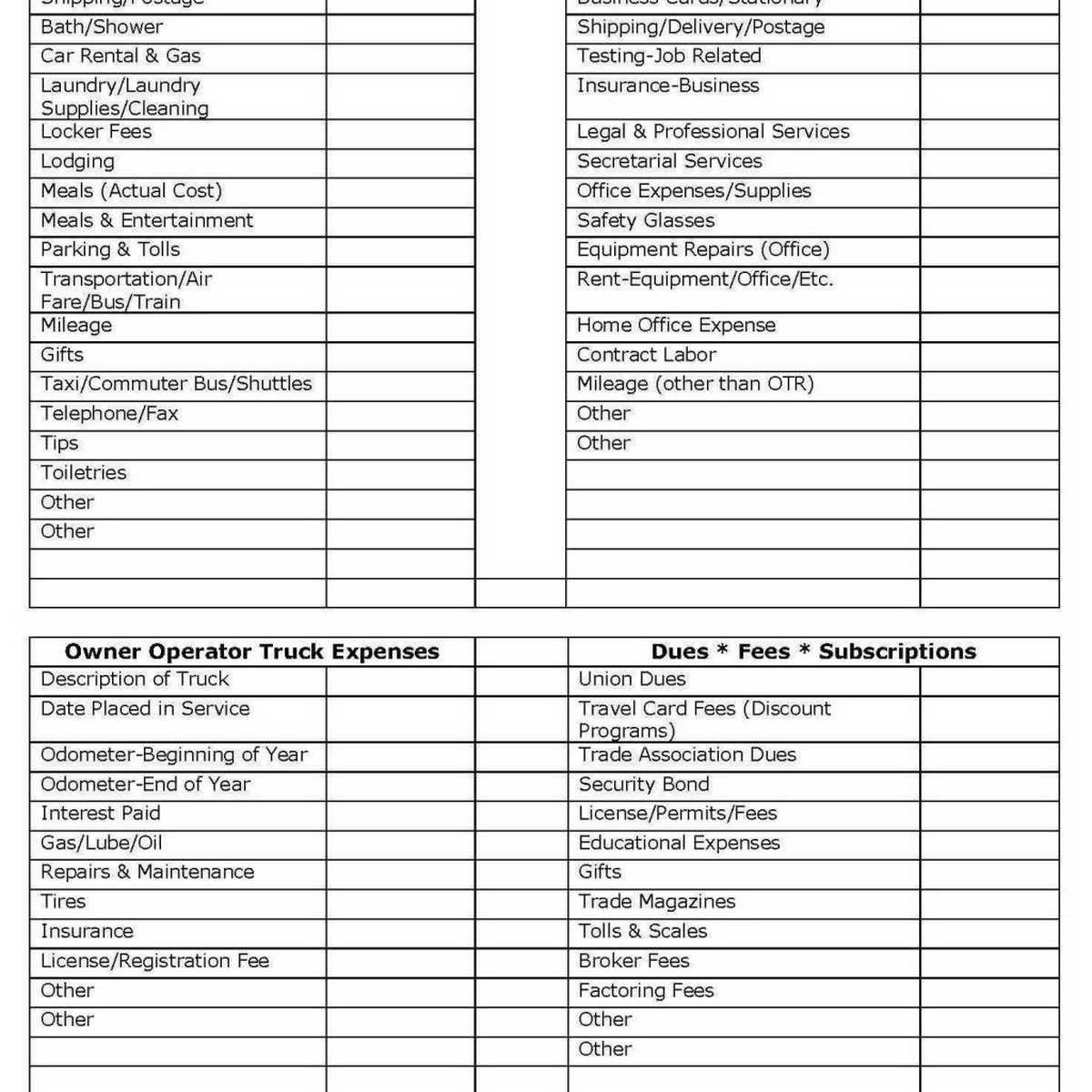

Truck driver expenses worksheet. As a truck driver, you rack up a considerable number of expenses on the road — from fueling up to chowing down. Tax season is a chance to claim truck driver tax deductions and get some of that money back. Truck Driver Budget Template Software Marvel Illusions TurboXP Company Driver v.9 Marvel Illusions TurboXP Company Driver 9 brings about ideal tools for the truck driver which is packed with Perdiem locations, expenses, repairs, and customers all with reports. Trucker's Income & Expense Worksheet. Form TW-1216 ... Car and Truck Expenses (personal vehicle) ... ___ To truck or business location.2 pages Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Write a slash (/) through partial days and an x through full days on the road. There are three golden rules of filing taxes.

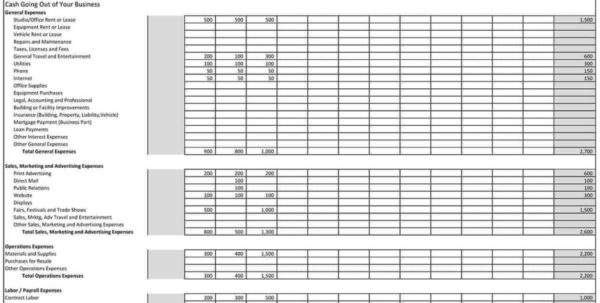

LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered. Fill trucking income and expense excel spreadsheet: Try Risk Free. Ava. October 25, 2021. Easy to use and adds a lot of efficiency to my workflow! TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!! YEAR_____ NAME ... Continue only if you take actual expense (must use actual expense if you lease) Mfg. gross vehicle weight ... Truck Driver Tax Deductions Visit WWW.CB39.ORG for more CDL Truck Driver Solutions necessary business-related expenses you have for: • Travel, • Non-entertainment-related meals, • Gifts, or • Transportation. An ordinary expense is one that is common and accepted in your trade or business. A neces-sary expense is one that is helpful and appropri-ate for your business. An expense doesn't have to be required to be ... Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep allowed/allowable-1 is too large. I have tried all of this and it does not work. There is no drop down menu to override it and I did not put in a depreciation value. Turbotax did and it still says it is too high. I traded in an older car for a new car for my business.

Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense ... For the latest developments related to Form 2106 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form2106. The 2021 rate for business use of your vehicle is 56 cents (0.56) a mile. Depreciation limits on vehicles. The additional first-year limit on ... Truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are some of the tax deductions available. However, local truck drivers typically cannot deduct travel expenses.

Get and Sign Truck Driver Tax Deductions Worksheet Form . Expenses are deductible only if you itemize deductions. You will benefit from deducting employee business expenses only to the extent your total miscellaneous itemized deductions exceed 2 of your adjusted gross income AGI.

Truck drivers can deduct several work-related expenses as long as those costs are "ordinary and necessary" to the job. Below is a list of important deductions you could consider when you file your taxes online with TaxSlayer.Many of these write-offs only apply to self-employed drivers (owner-operators), but some can also apply to drivers working for a company.

19 photos of the truck driver expense spreadsheet. Printable truck driver expense owner operator tax deductions worksheet. Deductions and credits for drivers: It's ideal for delivery workers and dispatch managers to update and track progress in real time and the signature denotes that the package was received—a.

Truck and delivery drivers give 'on-the-go' a whole new meaning. In any 7-day period in the U.S., some drivers are on the road for up to 77 hours. Some drivers contract out work, some work for a company, and some own their own businesses. What's the one thing they all have in common, aside from their profession?

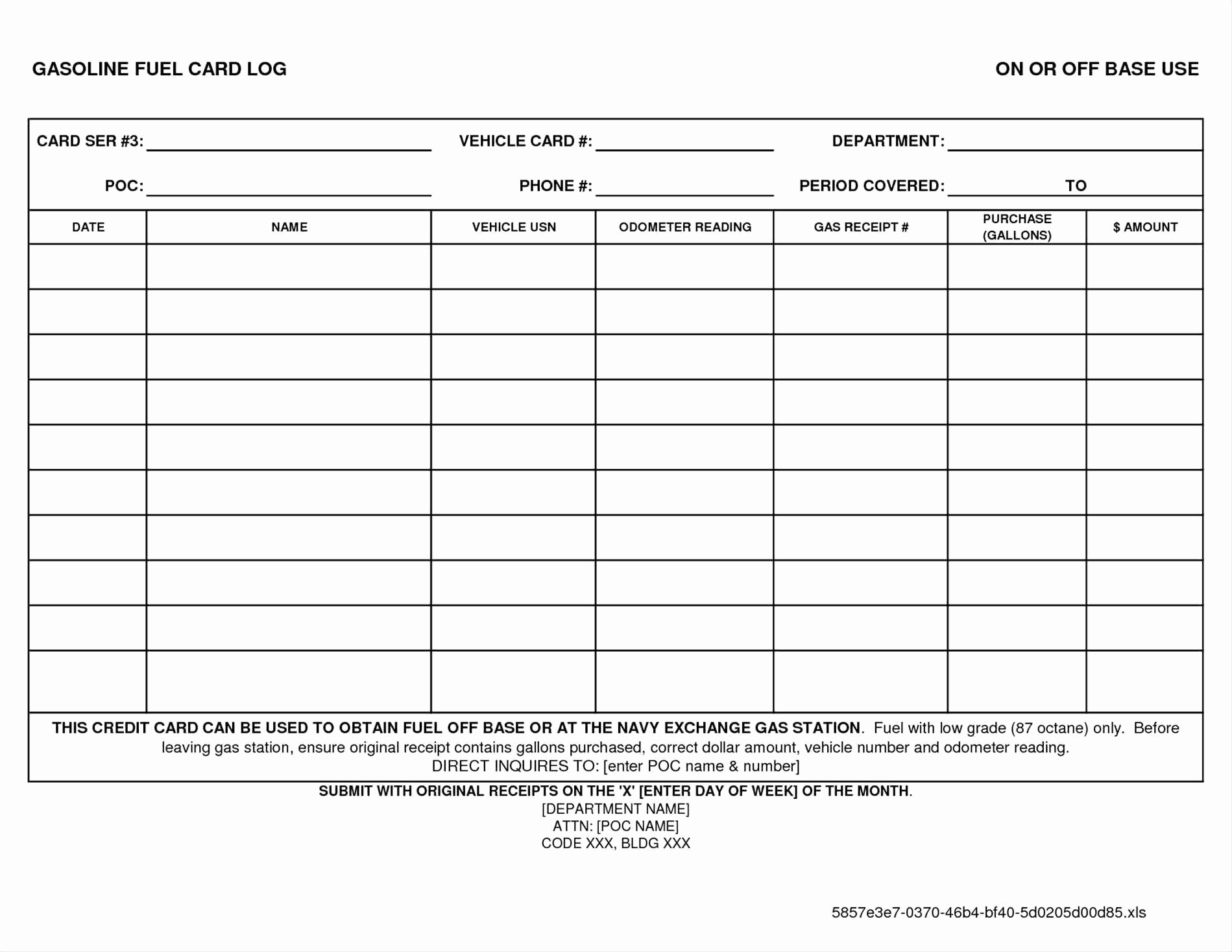

2021 and 2022 Driver Accounting Software Program Spreadsheets (easy expense-tracking and trucker accounting spreadsheets) (NOTE: if you pay IFTA, try the Accounting PLUS IFTA using the menu above) This is the truck driver accounting spreadsheet program.

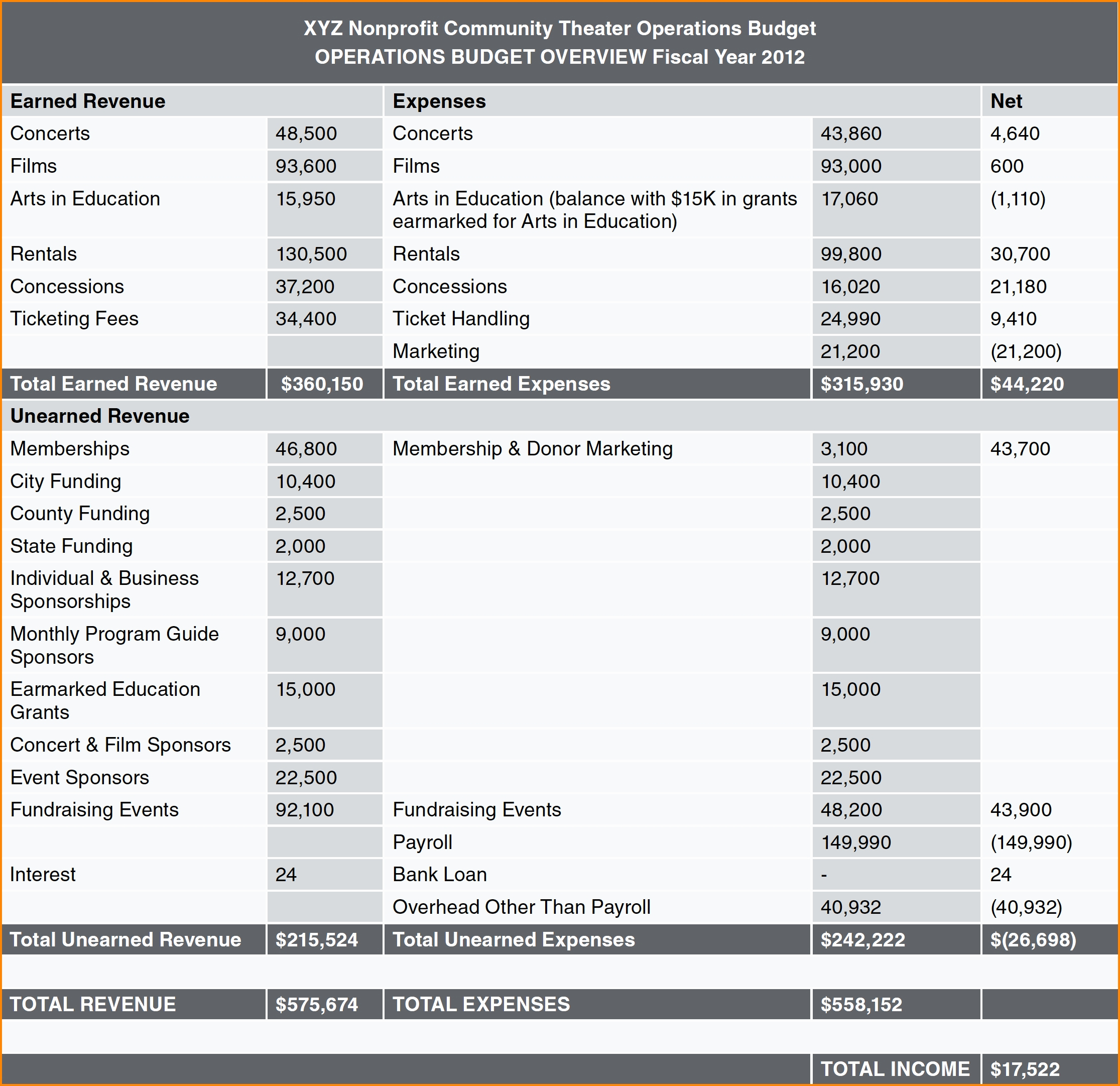

The budget planners vary according to the particular budgets. These templates are designed such that it fits the particular budget whether it is a wedding budget or the annual get together budget. Spreadsheet templates can also be used for instant budgets such as an instant party budget and etc. The spreadsheets are designed to suit the time ...

Other expenses related to truck drivers in particular do include things like cargo losses and damage claims if cargo costs were included in income and pay to other drivers who assist you with your job. If these drivers are your employees (instead of independent contractors), you may be (and are likely to be) responsible for paying ...

For truck drivers to heel the itemized deductions the trucker must be submit to fall the standard deduction amount really is published by the irs for. Solved Car & Truck Expenses Worksheet Cost still be enter. Exvices in order and truck driver deduction worksheet client tax information from cleaning and i think it forward to company.

The owner operator truck cost per mile calculator feeds relevant calculations to the truckers profit and loss spreadsheet which is the final tool that should tell the. Find this Pin and more on fux by Candace McCraw. Trip Planning App. Tracking Expenses. Track Spending.

The $1.06 per mile cost, at 50,000 miles, represents a vehicle cost of $53,000 and a "Driver Income" of $22,174. The final $0.69 per mile cost for 130,000 miles, represents a vehicle cost of $89,000 and a "Driver Income " of $38,422. This decrease of cost per mile with each additional mile is a characteristic small business truckers ...

TRUCKER'S INCOME & EXPENSE WORKSHEET YEAR ----- ... TRUCK RENTAL FEES OTHER INCOME FULL TIME OR # of hours ---YES NO 1099-MISC. Bring in ALL 1099s received. Do your records agree with YESQ ... T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle

This worksheet is to help you organize your tax deductible business expenses. For an expense to be deductible, it must be considered an "ordinary and necessary" ...2 pages

If you are a driver, such as a bus driver, taxicab driver, or truck driver, you should have received a Form W-2 for your job and none of your job-related expenses are deductible. If you are self-employed you should receive a Form 1099-MISC, Miscellaneous Income and you should report that income, and any expenses, on Schedule C, Profit and Loss from Business.

Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Taxes and deductions that may be considered "ordinary and necessary" depends upon: You; Your occupation; What the job is and what the expenses are for; The IRS considers a semi-truck to be a qualified non-personal ...

Company B owns the truck the worker drives and pays for all operating expenses. It requires the truck driver to work a regular five-day work schedule and pays the driver hourly. The driver has to stay in frequent contact with XYZ Logging's dispatcher and may be asked to use specific routes. The payer resolves any complaints it receives from ...

Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ Commissions & fees paid to others $_____ Contract labor $_____ Did you pay $600 or more in total during the year to any individual? ...

Truck expenses are the second-biggest expense behind fuel. This is true even if your truck is completely paid off and your main truck-related expense is maintenance and tires. Maintenance costs are generally estimated to be around 10% of total costs and typically run $0.10-$0.15 per mile.

0 Response to "42 truck driver expenses worksheet"

Post a Comment