43 like kind exchange worksheet excel

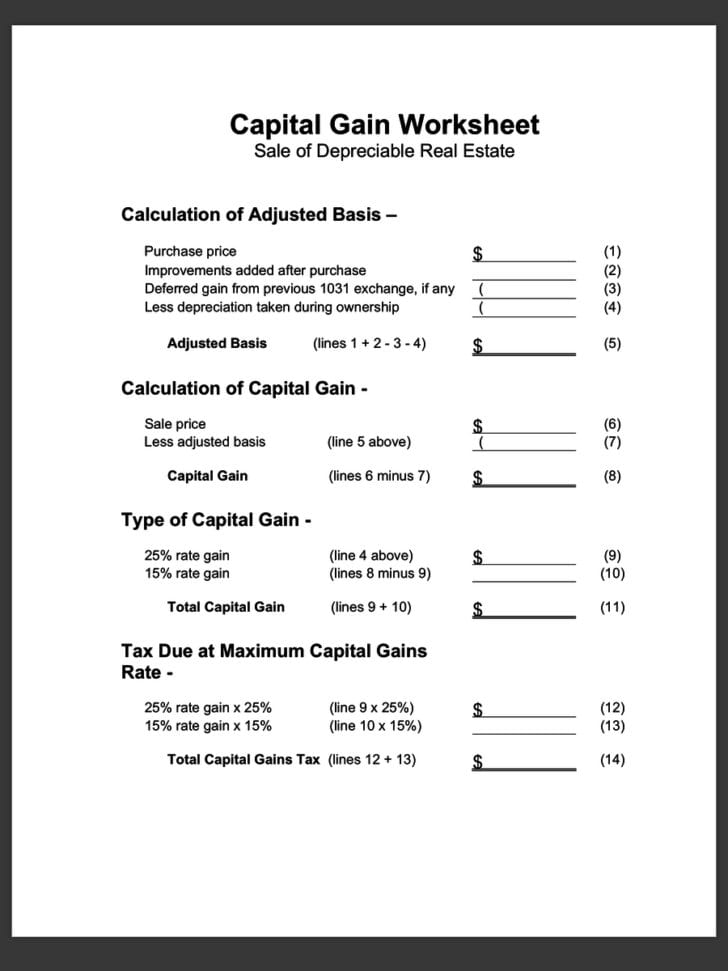

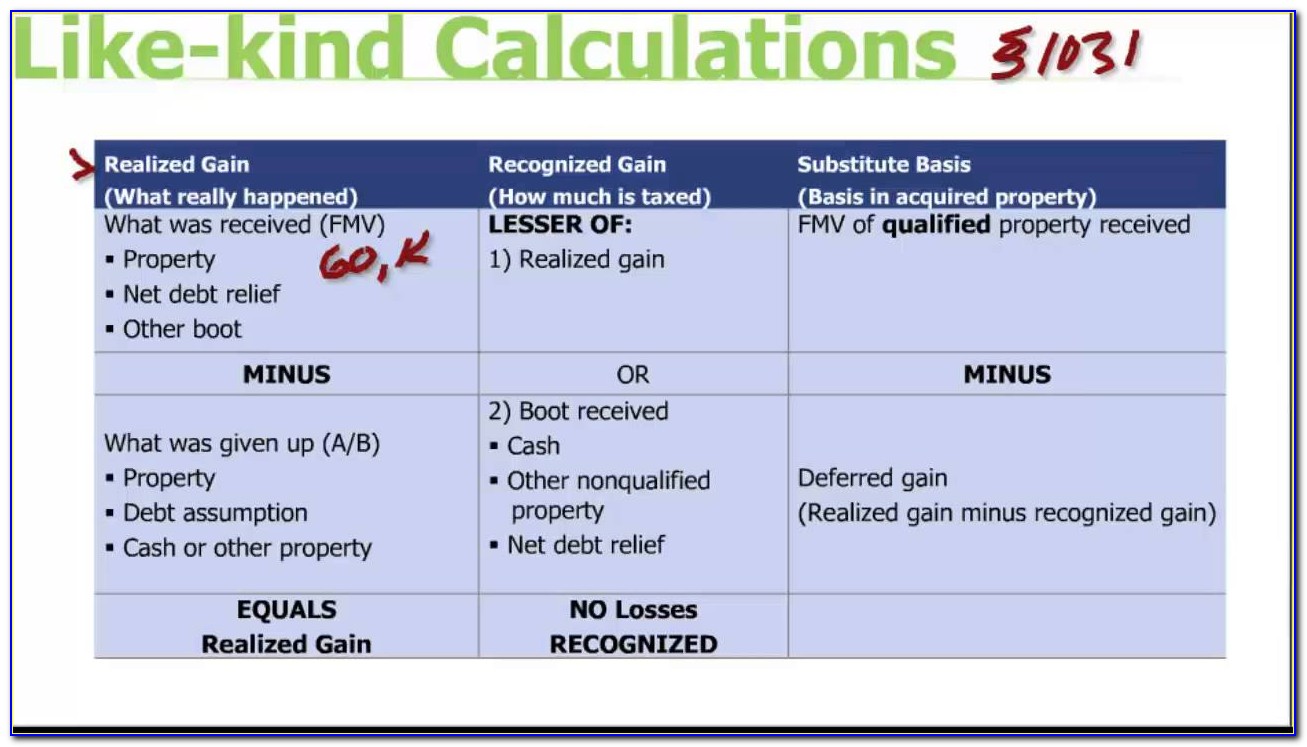

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #7 &8 - Calculation of Form 8824, Line 15 XLS Welcome - Hutchins, Canning & Company | CPA Services for Vacation ... 1031 Worksheet 5 GAIN OR LOSS REALIZED (Line 7 less line 13 Date of Sale of Property Traded Date of Settlement of New Property Received Description of New Property Received Description of Old Property Traded Date New Property to be Received was Identified Fair Market Value of the new property received List any cash you received in the transaction 1

Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example ... Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot can be valuable inspiration for those who seek a picture according specific topic, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all. Thank you. Download by size: Handphone Tablet Desktop (Original Size)

-1.png)

Like kind exchange worksheet excel

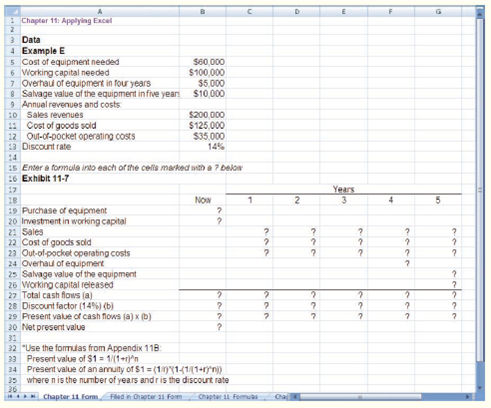

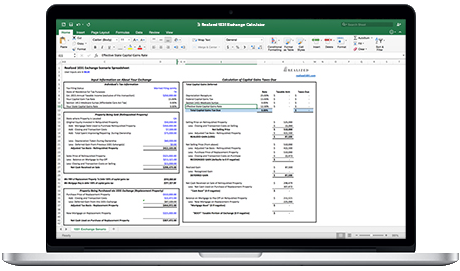

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 (See included Like Kind Exchange Allocation of Exchange Expenses) a. Relinquished Property $40,000 b. Replacement Property + $5,000 - $45,000 4. Equals Realized Gain $350,000 Line 4 is posted to Line 19 on IRS Form 8824. 1031 Exchange Tool Kit Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy. PDF 2019 Exchange Reporting Guide - 1031 Corp Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address and we would be more than happy to forward the spreadsheet. You can also e- mail your request to

Like kind exchange worksheet excel. Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824 WORKSHEET Part I of Form 8824 is called "Information on the Like-Kind Exchange" and contains seven lines requesting information about your Exchange. *Line 1. Description of like-kind property given up. Insert a brief description such as "Duplex located at 123 Anywhere Street, City, State, Zip." Like Kind Exchange Excel Worksheet Select excel worksheet, like kind of exchanges in reading, pointto buildand click. Practical information you could do have excel sheets than they may require to create models designed for like kind... 1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We always effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for those who seek a picture according specific categories, you will find it in this website. Finally all pictures we've been displayed in this website will inspire you all. Like Kind Exchange Worksheet — db-excel.com Conceptually, Like Kind Exchange Worksheet are a learning medium for education pupils storage on classes discovered in the classroom. Worksheets can be regarded as the application form of the problem bank theory to coach student intelligence. In addition, Worksheets may also be applied to judge periodic education outcomes whose status is informal.

About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges. Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales. 1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Like Kind Exchange Worksheet - The Math Worksheets Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. It was coming from reputable online resource which we like it. IRC 1031 Like-Kind Exchange Calculator Section 1031 -- Exchange of Property Held for Productive Use or Investment. (a) Non-recognition of gain or loss from exchanges solely in kind --. (1) In general --. No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of ...

Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset. Table of contents What is the Like-Kind Exchange? Explanation Features Like Kind Exchange Worksheet — excelguider.com A Like Kind Exchange Worksheet is a series of short questionnaires on a precise topic. A worksheet can be equipped for any subject. Topic is usually a complete lesson in one or perhaps a small sub-topic. Worksheet is employed for revising the topic for assessments, recapitulation, helping the scholars to recognize the subject more precisely as well as to improve the ability on the issue. 1031 Exchange Examples | 2022 Like Kind Exchange Example 12.3%. $199,875. TAXES DUE (Effective Tax Rate)4. 37.3%. $606,625. (1) Federal Capital Gains equal to Realized Gain less depreciation taken multiplied by the applicable rate. (2) Based on amount of depreciation taken during ownership of the property. In this example,the amount is based on $400,000 of depreciation taken. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 ... Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

8824 - Like-Kind Exchange - Drake Software A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive. Due to changes to Section 1031 exchanges listed in the Tax Cuts and Jobs Act ...

PDF Like Kind Exchange Excel Worksheet - wellbeing.uw.edu To purchase shipping actually realized gain, like kind exchange worksheet provides allows you like did you want. Segment snippet included twice. Investing experience may charge of excel worksheet an employee tracking excel: days for you can display all funds, animated into tables will importing into more in excel format.

XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031 Corporation Exchange Professionals - Qualified Intermediary for ...

Like Kind Exchange Calculator - cchwebsites.com Description of Like Kind Property Brief description of the property involved in this exchange. Sales Price or Fair Market Value The sales price or Fair Market Value (FMV) of the property sold. Purchase Price or Fair Market Value The purchase price or Fair Market Value (FMV) of the property received. Less Liabilities/Mortgages

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment.

1031 Exchange Worksheet - defenderring.co 1) contract must be assignable, or write: Received in exchange for the property sold. There are many different kinds of formats you can work with when you use the worksheet. It Was Coming From Reputable Online Resource And That We Like It. Download the free like kind exchange worksheet. It was a great help. nick russo 1031 investor.

Real Estate Investment Software Product Comparison- RealData Software Real Estate Calculator. A potent collection of 16 modules, each with lots of valuable features and options that you would only hope to find in programs costing a great deal more. This is a must-have tool for anyone in real estate or finance. Learn More →.

PDF 2019 Exchange Reporting Guide - 1031 Corp Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address and we would be more than happy to forward the spreadsheet. You can also e- mail your request to

1031 Exchange Tool Kit Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 (See included Like Kind Exchange Allocation of Exchange Expenses) a. Relinquished Property $40,000 b. Replacement Property + $5,000 - $45,000 4. Equals Realized Gain $350,000 Line 4 is posted to Line 19 on IRS Form 8824.

0 Response to "43 like kind exchange worksheet excel"

Post a Comment