38 sales tax and discount worksheet answer key

SAP - Wikipedia SAP SE (/ ˌ ɛ s. eɪ ˈ p iː /; German pronunciation: [ɛsʔaːˈpeː] ()) is a German multinational software company based in Walldorf, Baden-Württemberg.It develops enterprise software to manage business operations and customer relations. The company is the world's leading enterprise resource planning (ERP) software vendor. SAP is the largest non-American software company by revenue, the ... Discount Rate - Definition, Types and Examples, Issues Discount Rate Example (Simple) Below is a screenshot of a hypothetical investment that pays seven annual cash flows, with each payment equal to $100. In order to calculate the net present value of the investment, an analyst uses a 5% hurdle rate and calculates a value of $578.64. This compares to a non-discounted total cash flow of $700.

Excel Discount Rate Formula: Calculation and Examples - Investopedia Discount Rate First, let's examine each step of NPV in order. The formula is: NPV = ∑ {After-Tax Cash Flow / (1+r)^t} - Initial Investment Broken down, each period's after-tax cash flow at time t...

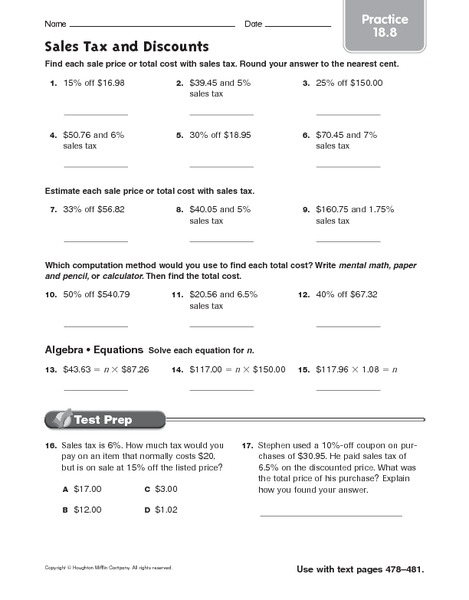

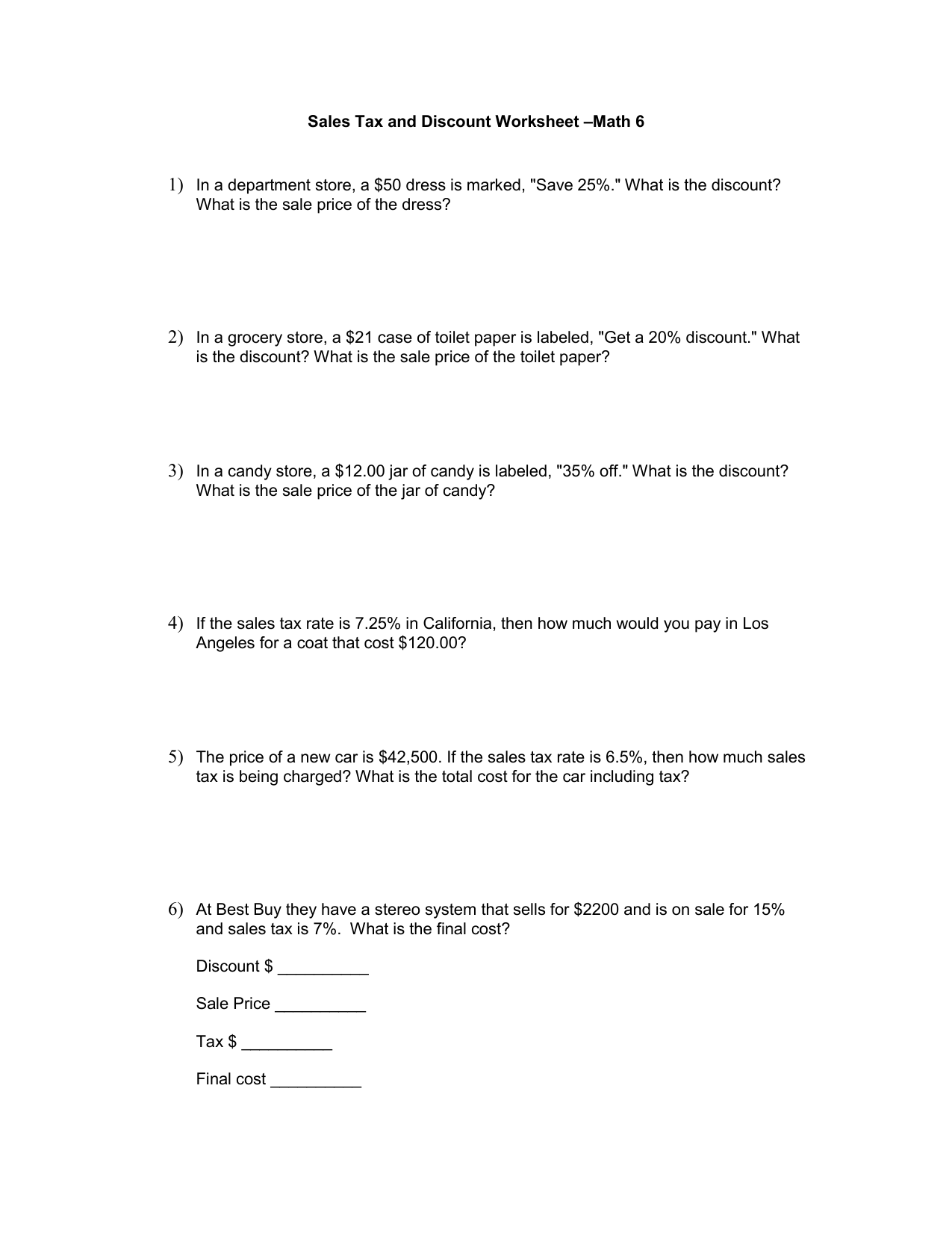

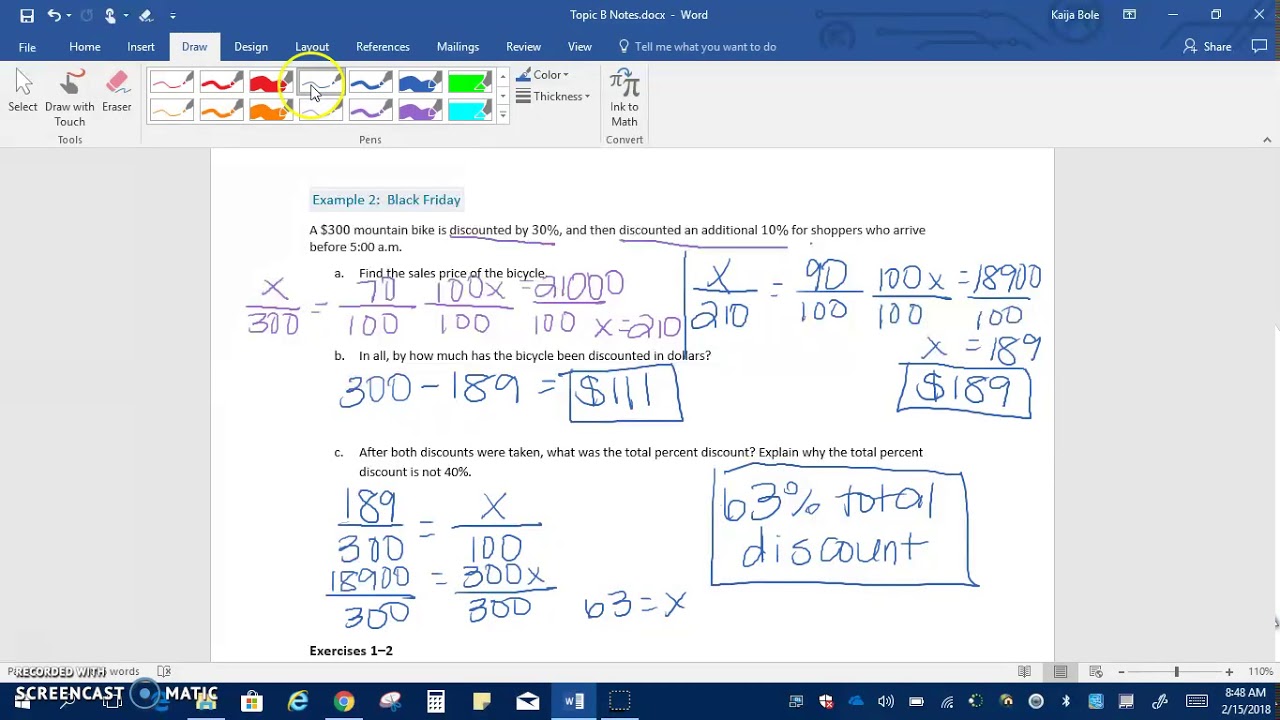

Sales tax and discount worksheet answer key

CengageBrain Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. The Home Office Deduction - TurboTax Tax Tips & Videos 18.07.2022 · Key Takeaways • You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis. a home can include a house, apartment, condominium, mobile home, boat or similar structure. • Generally, your home office must be either the principal location of your business or a place where you regularly meet with … Sales budget | Sales budget example — AccountingTools The basic calculation in the sales budget is to itemize the number of unit sales expected in one row, and then list the average expected unit price in the next row, with the total sales appearing in a third row. The unit price may be adjusted for marketing promotions.

Sales tax and discount worksheet answer key. 7th Grade Review Sheet Tip Tax Answer Key Sales tax and discount worksheet 7th grade answer key 5. The rate is usually given as a percent. The waiterwaitress will compute the amount of the meal including sales tax and tip and give it to the customer. However be sure to refer to the rational numbers definition and chart on page 46 of your math textbook. Graphing cubic functions worksheet pdf answers Speed and Velocity Worksheet Answer Key. 1 day ago · All worksheets are created by experienced and qualified Provided by the Academic Center for Excellence 4 Procedure for Graphing Polynomial Functions c) Work with reduced polynomial If a reduced polynomial is of degree 2, find zeros by factoring or applying the quadratic formula. com Name: ES1 Answer. How do I enter a large number of stock transactions in TurboTax? TurboTax is equipped to handle around 10,000 individual transactions per brokerage account. If you hit the transaction import limit, you can enter a summary for each sales category. Your brokerage statements should include a summary of your transactions, grouped by sales category, for example, Box A short-term covered or Box D long-term covered ... 2021 Instructions for Schedule CA (540) | FTB.ca.gov - California Sales or use tax credit for property used in a former Enterprise Zone (EZ), Local Agency Military Base Recovery Area (LAMBRA), or Targeted Tax Area (TTA). Reduced recovery periods for fruit-bearing grapevines replaced in a California vineyard on or after January 1, 1992, as a result of phylloxera infestation; or on or after January 1, 1997, as a result of Pierce’s disease.

› discountDiscount Worksheets - Math Worksheets 4 Kids Our pdf discount worksheets, awash with exercises involving discount, discount rate, marked price, and selling price, grandly open the discount store for students in grade 6, grade 7, and grade 8. Graduate into prolific discount scholars with our printable tools; do employ the correct formula and validate the answers using the answer key. successessays.comSuccess Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Discount Worksheets - Math Worksheets 4 Kids Our pdf discount worksheets, awash with exercises involving discount, discount rate, marked price, and selling price, grandly open the discount store for students in grade 6, grade 7, and grade 8. Graduate into prolific discount scholars with our printable tools; do employ the correct formula and validate the answers using the answer key. Our free discount and discount … How to Write Off Sales Taxes - TurboTax Tax Tips & Videos Determine the amount of sales tax paid during the year by going through all of your purchases. Step 3: Calculating the deduction Calculate your deduction using the optional sales tax tables. At the end of the instructions to the Schedule A attachment you will find sales tax tables for each state.

Sales & Use Tax - Ohio Department of Taxation The state sales and use tax rate is 5.75 percent. Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below. Key Sales & Use Tax Resources Registration — Ohio law requires any person or business making taxable retail sales to first obtain a license. Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes. Cost Accounting For Dummies Cheat Sheet - dummies Pre-tax dollars needed for purchase = cost of item ÷ (1 - tax rate) Price Variance Price variance = (actual price - budgeted price) × (actual units sold) Efficiency Variance Efficiency variance = (Actual quantity - budgeted quantity) × (standard price or rate) Variable Overhead Variance

6.3: Solve Sales Tax, Commission, and Discount Applications Yes, because 8.5% is close to 10%. 10% of $500 is $50, which is close to $42.42. Write a complete sentence that answers the question. The sales tax rate is 8.5%. Exercise 6.3. 3: Diego bought a new car for $26,525. He was surprised that the dealer then added $2,387.25.

Questions - Answers For Questions! Shontelle received a gift of income-producing property with an adjusted basis of $49,000 to the donor and fair market value of $35,000 on the date of gift.No gift tax was paid by the donor.Shontelle subsequently sold the property for $31,000.What is the recognized gain or loss? A)$0 B)($4,000) C)($10,000) D)($18,000)

Deductions for Sales Tax - TurboTax Tax Tips & Videos Most states charge a sales tax on the purchase of goods sold within their jurisdictions. However, there are several tax-free states in which you can shop that do not impose a sales tax on retail purchases. ... we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited ...

Publication 537 (2021), Installment Sales - IRS tax forms 2017 453A additional tax $121,800 2018 Deferred Tax Liability calculation: 2017 Deferred Obligation: 14,000,000 – 2018 Payment received (5,000,000) 2018 Deferred Obligation: 9,000,000 x Gross Profit Percentage: 96.6670% The amount of gain that has not been recognized: 8,700,030 x Maximum capital gains tax rate: 21% 2018 Deferred Tax Liability ...

turbotax.intuit.com › tax-tips › investments-andCapital Gains and Losses - TurboTax Tax Tips & Videos Jul 12, 2022 · Audit Support Guarantee: If you receive an audit letter based on your 2021 TurboTax return, we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year (2021) and the past two tax years (2020, 2019). We will not ...

Publication 530 (2021), Tax Information for Homeowners You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. For 2021, if you received an Economic Impact Payment (EIP), refer to your Notice 1444-C, Your 2021 Economic Impact Payment.

Math Worksheets for Grades K-8 | Printable Common Core In this section, all of our math worksheets and resources are categorized by grade level in accordance with Common Core math standards. Kindergarten. 1st Grade. 2nd Grade. 3rd Grade. 4th Grade. 5th Grade. 6th Grade. 7th Grade.

Percentages Math Worksheets | Common-Core & Age Based In this section, you can view and download all of our percentages worksheets. These include common-core aligned, themed and age-specific worksheets. Perfect to use in the classroom or homeschooling environment. Selling Price (Local Chamber of Commerce Day Themed) Math Worksheets July 7, 2022 View → Ratio (World Teachers' Day Themed) Math Worksheets

MarketWatch: Stock Market News - Financial News - MarketWatch MarketWatch: Stock Market News - Financial News - MarketWatch

decimals worksheets dynamically created decimal - Santos Olga They are randomly generated, printable from your browser, and include the answer key. There are also opportunities to simulate real world experiences with activities that challenge kids to calculate percentages for sales tax and discounts as well as determine the area. 7th Grade Decimals To Fractions Worksheets Preschool K

School Groups | Newport Aquarium EDUCATOR ANNUAL PASSES. Did you know that Educators can get a discounted Annual Pass with field trip registration for just $19.99? Bring a valid staff ID when your group arrives to purchase. Call 859-815-1478 for more information.

Sales Returns & Allowances: Definition & Examples - Study.com When a customer returns merchandise, the seller must record the receipt of the goods and put them back into inventory if they're still saleable. Let's assume that Lizzie sold $2,000 of lamps to B....

Success Essays - Assisting students with assignments online We Offer the Custom Writing Service with 3 Key Benefits. Assignment Essay Help. Our professional team of writers ensures top-quality custom essay writing services. We strive to ensure that every paper is crafted with getting you the highest grade in mind. Best Customer Support Service. Get 24⁄7 customer support help when you place a homework help service …

The Federal Sales Tax Deduction - The Balance the standard deduction is worth $12,550 for single filers and $25,100 for married joint filers in the 2021 tax year. 2 for 2022, the standard deduction will be $12,950 for single filers and $25,900 for married filers with joint returns. 3 you'll save more money by taking the standard deduction if your total itemized deductions don't surpass these …

Mr. Grunenwald's Website || 7th Grade Math - NYLearns Monday (11/17) - Introduction to Percentages, Homework #'s 1 & 2 on worksheet (Last page of posted notes) NO Weekly Assignment this week.Weekly Assignment 8 will be due Wednesday Nov 26th. If you will not be in school please make sure to hand it in on Tuesday 7R 11-17 Notes.pdf. Tuesday (11/18) - Sales Tax and Discount, Homework - Worksheet Wednesday (11/19) - Mark-up, Discount, Gratuity, Here ...

0 Response to "38 sales tax and discount worksheet answer key"

Post a Comment