45 daycare income and expense worksheet

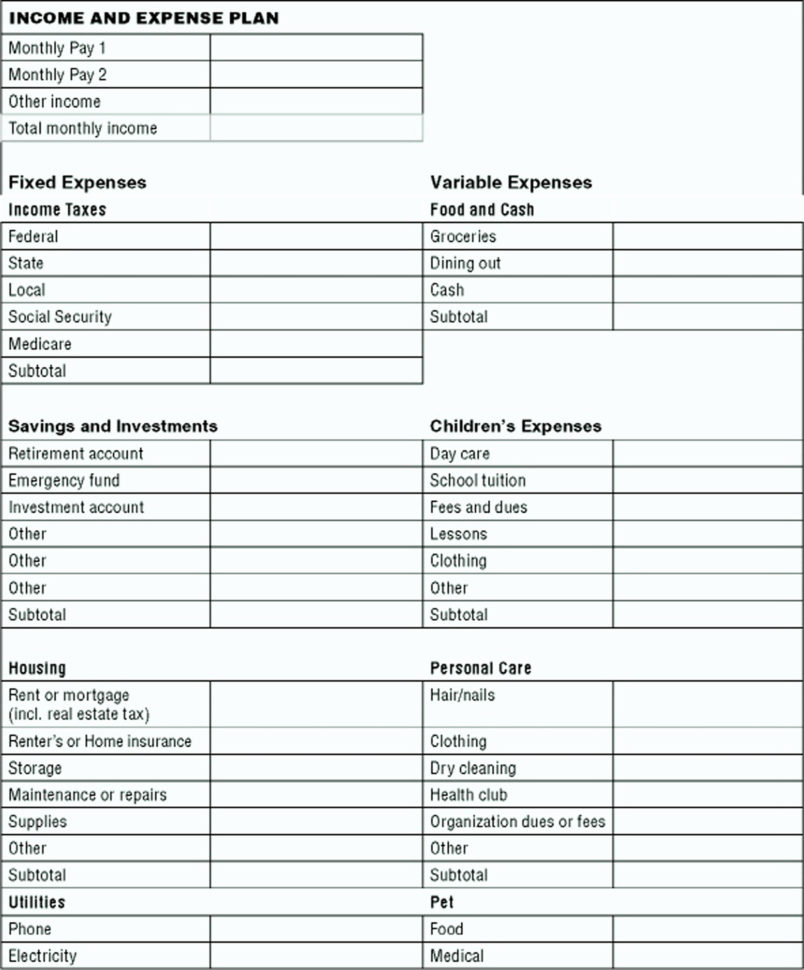

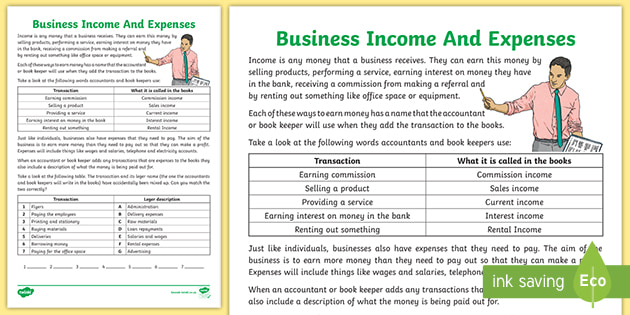

Free Small Business Profit and Loss Templates | Smartsheet This blank profit and loss statement allows you to record quarterly financial data over one year. The template layout is simple and intuitive, including sections for tracking business revenue, expenses, and tax information. Enter your company name, income sources, discounts or other allowances, business expenses, and tax details. nomoredebts.org › monthly-expense-trackerMonthly Expense Tracker, Calculator & Spending Planner ... Open a copy of our Monthly Expense Tracker. The expense categories listed further below and on page 1 of the Expense Tracker will help you decide which expenses to record where. For each week, record dates you are tracking. For example, a 7 day tracking period would be March 30th to April 5th. The next week would start on April 6th.

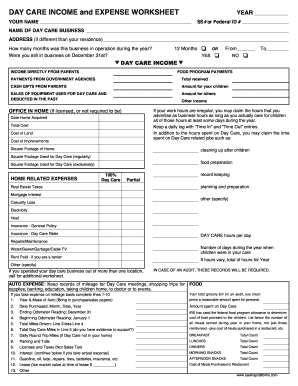

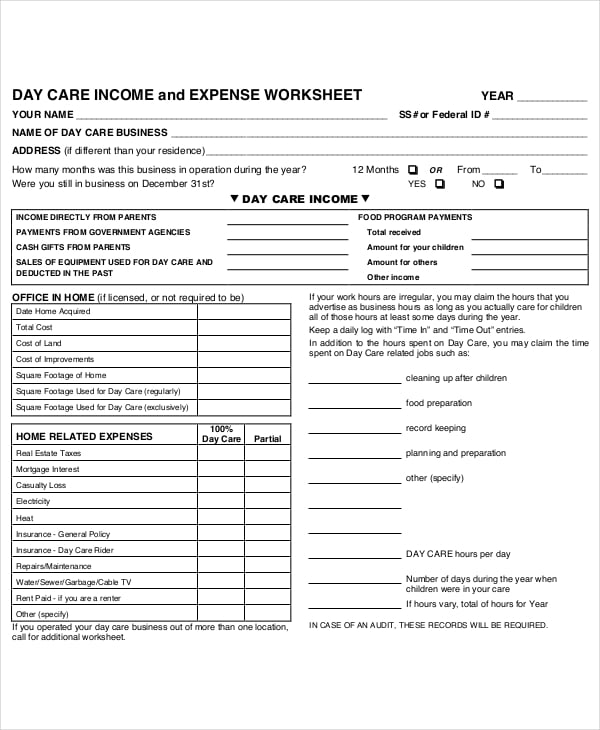

home daycare income and expense worksheet - another-place-another-story Follow these steps to get your Daycare Income And Expense Worksheet edited in no time. EXPENSE FORMS Keep Track. Download our editable Word fill-in daycare income and expense worksheet for your home daycare. The number one question I hear about taxes is how much will I pay. If you do not separate items like. Gross income from day care. If you take expense on mileage basis complete lines 1-10Your total grocery bill in an audit you must- 1.

Daycare income and expense worksheet

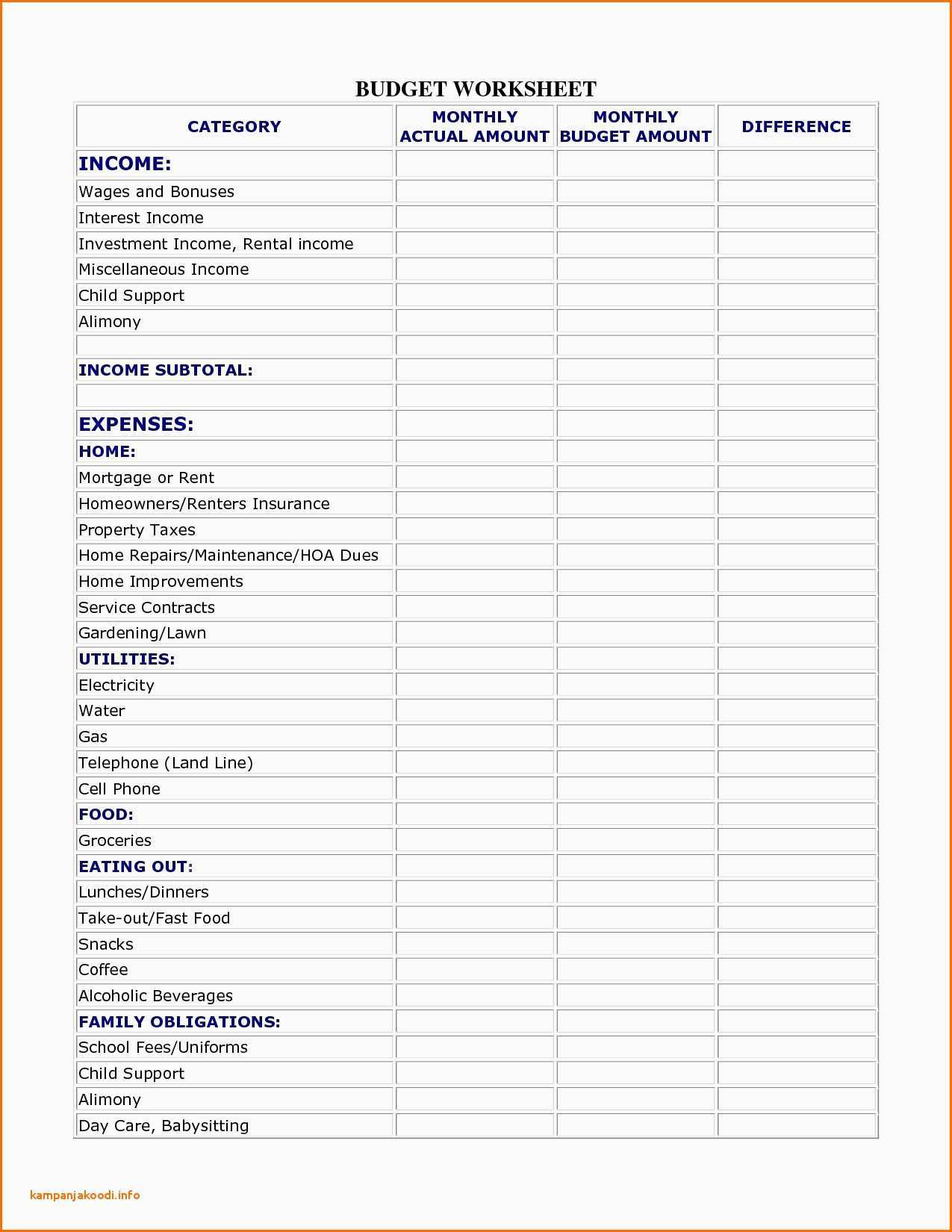

Basic Monthly Budget Worksheets Everyone Should Have - The Balance Download the Expense Worksheet & Calculator Our downloadable Surplus and Shortage Worksheet and Calculator combines the totals from the two worksheets above and calculates your monthly surplus or shortage. You can print this worksheet and fill it out manually, or fill it out digitally where your totals are calculated for you. home daycare income and expense worksheet ... 1711 Woodlawn Ave Wilmington DE 19806 302-322-0452 - - - - 118 Astro Shopping Center Newark DE 19711 - - - -. Download our easy four-page PDF and Word fill-in budget worksheet for your home daycare. You can expect to pay around 20 of your profit in income taxes. Select the document you want to sign and click Upload. Home daycare expense spreadsheet. geuniversalremotevcrcodessale Saint George features 190 low income apartments with rental assistance where households typically pay no more than 30 of their income toward... Latest Posts. authority george housing wallpaper. st george housing authority. ... home daycare income and expense worksheet. About; Contact;

Daycare income and expense worksheet. Income and Expense Tracking Worksheet - Vertex42.com This version was created specifically for printing and completing by hand. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget. Step 3: Continue tracking to help you stick to your budget. Using the Income and Expense Worksheet Maine Child Support Calculator | AllLaw Gross Monthly Income of Custodial Parent: * $ Amount of monthly child support or alimony paid to a spouse from a prior marriage by Custodial Parent: * $ Monthly cost of daycare paid by Custodial Parent: * $ Monthly cost of family group health insurance paid by Custodial Parent: * $ * Fields are required. Calculate To use the child support calculator, select or enter the … Publication 587 (2021), Business Use of Your Home Although you cannot deduct any depreciation or section 179 expense for the portion of your home used for a qualified ... Gross income from her daycare business: $50,000: Expenses not related to the business use of the home : $25,000: Tentative profit: $25,000: Rent: $8,400: Utilities: $850: Painting the basement: $500: Mary enters her tentative profit, $25,000, on line 8. (This figure is … Home Daycare Tax Deductions for Child Care Providers 09/02/2017 · Many of the items below are allowed to be used as an expense only with you T/S% applied. I’ve seen so many new providers think that they can write off 100% of things that you are actually only allowed a percentage of, like utilities or household cleaners to name a few. If any items are used by BOTH your household and your home daycare you can only deduct the …

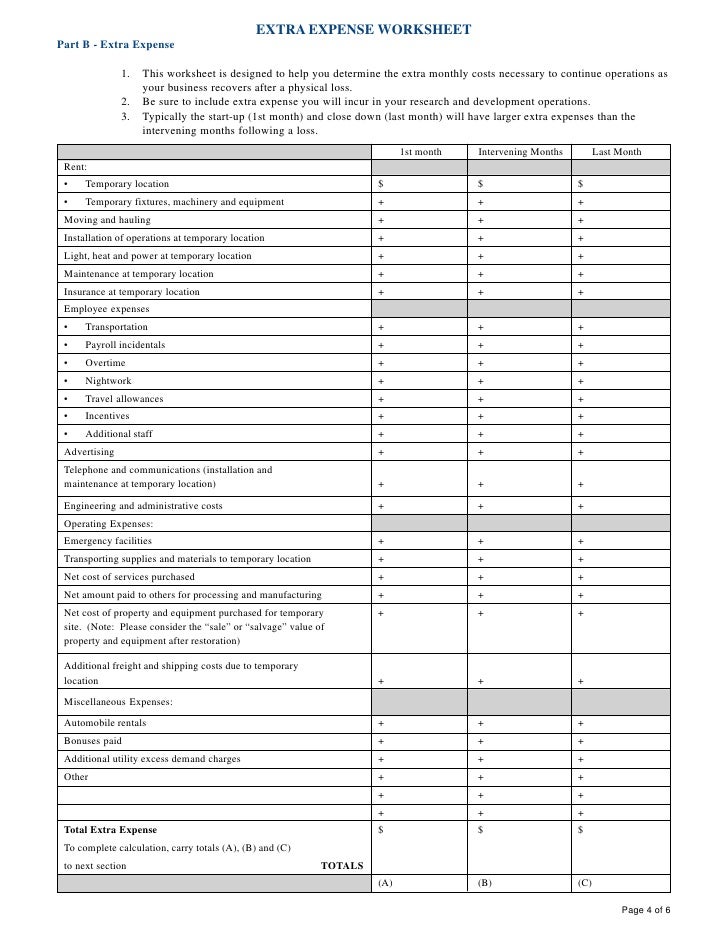

Farm Expenses Worksheet 2022 | CryptoTaxAudit Help Center Business Expenses Worksheet 2022; Business Management Tips 2022; Business Owners - Taking Money Out of a Business 2022; Buy-Sell Agreements 2022; Corporation Meeting Requirements 2022; Day Care Providers Income and Expenses 2022; Employee or Independent Contractor 2022; Excess Business Loss and Net Operating Loss NOL 2022; Expense ... The Best Home Office Deduction Worksheet for Excel [Free Template] The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula Flexible Spending Account (FSA) | Chard Snyder Employees give information about their daycare provider (name, address and tax ID number, or social security number if an individual) on Form 2441 or Schedule 2 of their income tax return. Employees cannot take both the Dependent Care FSA deduction and an income tax return deduction for the same expense. It may be better for some employees to ... Tax Preparation Worksheets - Lake Stevens Tax Service The successful completion of your personal tax return is largely based on having all of the necessary information at hand during your appointment. We have created several worksheets to aid you in the collection and categorization of receipts. Individual Income Tax Worksheet Self-Employed Income & Expense Worksheet Daycare Provider Worksheets

Daycare Budget Template: Tips for Budgeting Child Care 2. Take Advantage of Tax Credits. There are plenty of expenses that are tax-deductible, including daycare costs. The tax credit for dependents can allow you to claim up to 35% of your daycare costs up to a maximum of $3,000 (for one qualifying person) or at $6,000 (for two or more qualifying persons). Dave Ramsey Budget Percentages [2022 Updated Guidelines] - Wealthy Nickel Utilities - 5 to 10%. Housing - 25%. Transportation - 10%. Health - 5 to 10%. Insurance - 10 to 25%. Recreation - 5 to 10%. Personal Spending - 5 to 10%. Miscellaneous - 5 to 10%. Here is a simple budget percentage pie chart you can use as a guideline for your ideal household budget ( Pin it here ): Child Care Services Forms - Child Development (CA Dept of Education) For additional assistance you can either visit the CDSS Child Care Transition web page or call 1-833-559-2420 for more information. Attendance and Fiscal Reporting forms are available through the Child Development Fiscal Services website. Enrollment and Attendance Register CD-9400 (DOC) Requires 11 x 17 paper. swaney-roegner-99 and daycare expense wallpaper. home daycare income and expense worksheet. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Inc… Written By karl-waldhauser-degeyter Saturday, July 30, 2022 Add Comment Edit. bra breast for wallpaper.

texflex.payflex.comHome | TexFlex IRS Resources. Medical and Dental Expenses - IRS Publication 502; Dependent Care Expenses - IRS Form 2441; Dependent Care Expenses - Instructions for IRS Form 2441

{Free} Monthly Expense + Bill Tracker Printable Worksheet- Savor + Savvy An Expense Tracker is meant to log all of the expenses that come through your household each month. It shouldn't include the daily spending, just the expenses to run a household. The Monthly Budget Planner helps you PLAN the months ahead to get a better visual of how you will be achieving your goals. I prefer to use them hand in hand like I mentioned above but you can do one of two things:

home daycare income and expense worksheet - nola-atamian Ensure the details you add to the Daycare Income And Expense Worksheet is updated and accurate. Figure represents the average of costs for annual care of an infant and a 4-year-old. Mortgage Interest 100 Repairs Due to Daycare Home Insurance Other. Dear _____ SS last 4 _____ D ate _____ As a program funded by the Federal.

Solved: Grandparent providing childcare - Intuit To report the income, go to: Go to federal>income and expenses> Self-Employment>Self-employment income and expenses Complete the profile that asks about your business Then there will be a screen where you will enter your self-employment income. At this point, you may wish to make a decision to deduct expenses against your self-employment income.

whereimaginationgrows.com › home-daycare-taxHome Daycare Tax Deductions for Child Care Providers Feb 09, 2017 · T/S% refers to your Time/Space Percentage. It’s a very important number at tax time to home daycare providers. It’s essentially the % of the total cost that you can claim of shared expenses. Every expense shared by your household and the daycare, from electric to toilet paper, uses this percentage to determine the amount a provider can ...

13 Kid's Budget Worksheets (Plus Sample Budget Template for Teenagers) 1. Connections Academy's Kid Budget and Financial Responsibility Worksheet. You can download a free budget worksheet for kids that includes some other pointers to help show them what financial responsibility - even at their age - looks like. Total (weekly) income - Total (weekly) expenses = Weekly Savings.

T778 Child Care Expenses Deduction for 2021 - Canada.ca T778 Child Care Expenses Deduction for 2021 For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in: PDF t778-21e.pdf PDF fillable/saveable t778-fill-21e.pdf For people with visual impairments, the following alternate formats are also available: E-text t778-21e.txt

› publications › p587Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ...

The Child Tax Credit: What's Changing in 2022 In 2021, the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to $3,000. For children under 6, the amount jumped to $3,600. For 2022, that amount reverted to $2,000 per child dependent 16 and younger. Last year the tax credit was also fully refundable, meaning that if the credit amount a ...

Virginia Child Support Calculator | AllLaw How to Get a Child Support Order in Virginia . If a child support order was not part of your divorce or separation agreement or you need help locating your child's father or mother to start receiving child support payments, the Virginia Department of Social Services Division of Child Support Enforcement (DCSE) may be able to assist you in establishing a child support order.

Free Daycare (Child Care) Contract Template - PDF - eForms Calculation - If we use the data above (25 hours/week) and account four (4) weeks in a month we have 100 hours/month. Now we take the average center-based is $1,230/month which equals $12.30/hour and the average center-based childcare is $800/month which equals $8/hour. Daycare Costs vs Nanny Costs Nanny: $19.14 /hour

11 Free Daycare & Childcare Forms | Download PDF | SafetyCulture A toddler daily sheet is used by daycare providers to record food intake, naps, and diaper changes. Use this checklist to track a child's progress and share insights with parents. Download Template Daycare Kitchen Checklist This daycare kitchen checklist is used to evaluate kitchen cleanliness and staff hygiene.

home daycare income and expense worksheet - pgn-gilang To Complete Daycare Income And Expense Worksheet Form Follow the Steps Below. Daycare Business Income And Expense Sheet To. Mortgage Interest 100 Repairs Due to Daycare Home Insurance Other. Day Care Income and Expense Worksheet. Get Started Today with 1 Month Free. Click the Select a File button and select a file to be edited.

How to manage your childcare center budget (with a free excel ... - HiMama HiMama's budget template was designed to help you list and analyze your income and expenses. In the Excel file, you will find three sections: Summary, Income, and Expenses. We have included formulas throughout the template to help make calculations easier, allowing you to play with the numbers to determine a budget that works for your business.

Free Budget Planner Worksheet - NerdWallet Free Budget Planner Worksheet. Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Lauren Schwahn. May 12, 2022. Many or ...

Home | TexFlex What's New. PayFlex will be performing scheduled system maintenance this weekend. The website, PayFlex Mobile ® app and our automated phone system will be unavailable from 11 p.m. CT on Friday, August 12 until 5 a.m. CT on Saturday, August 13. We apologize for any inconvenience this may cause.

Monthly Expense Tracker, Calculator & Spending Planner You should also list any income you may expect to receive during each week. List the dates down the left side and record actual money spent each day. You can then use the blank columns to create your own categories. You may want to track coffees, dining out, or fuel separately. You also need to record weekly savings amounts on pages 14 – 15 of the Expense Tracker. On …

0 Response to "45 daycare income and expense worksheet"

Post a Comment