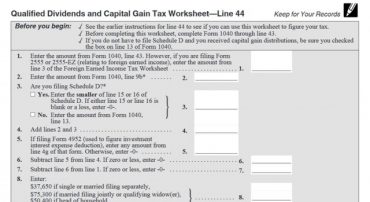

39 qualified dividends and capital gain tax worksheet line 44

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 44 - Tax Guru Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Get the up-to-date 2021 qualified dividends and capital gains worksheet-2022 now Get Form 4.1 out of 5 44 votes 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users Here's how it works 02. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03. Share your form with others

PDF Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Do not : complete lines 21 and 22 below. No. ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ...

Qualified dividends and capital gain tax worksheet line 44

Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon Capital gain tax worksheet—line 44 Irs form 8812 Total ordinary income (line 7 Alternative minimum tax Long term capital gains 2017 Qualified Dividends and capital gain tax worksheet—line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. Publication 17 (2021), Your Federal Income Tax - IRS tax forms The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a ... 2022 Instructions for Schedule D - Capital Gains and Losses Capital Gains and Losses. These instructions explain how to complete Schedule D (Form 1040). Complete Form. 8949 before you complete line 1b, 2, 3, 8b, 9, ...17 pages

Qualified dividends and capital gain tax worksheet line 44. 2022 Instructions for Schedule D (2022) Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset Instructions for Form 1120-PC (2021) | Internal Revenue Service Use Form 1120-W, Estimated Tax for Corporations, as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. ... Dividends (other than capital gain distributions reported on Schedule D (Form 1120) and exempt-interest dividends) that are received from RICs and that are not subject to the 50% deduction. ... Line 9. Tax-exempt ... 2019 Instructions for Schedule D (Rev. January 2020) Jan 21, 2020 — 1040-SR, line 6 (or effectively connected capital gain ... Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the ...17 pages QUAL DIV - 2013 Form 1040—Line 44 Qualified Dividends and Capital Gain ... 2013 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet Tax on all taxable income. Enter the smaller of line 25 or line 26. Also include this amount on Form 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28). Qualified Dividends And Capital Gain Tax Worksheet 2021 The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing. Qualified Dividends and Capital Gain Tax Worksheet Form 1040 Line 44 1 ... Qualified Dividends and Capital Gain Tax Worksheet Form 1040 Line 44 1 Enter the from ACCT 2210 at Southern State Community College. Study Resources. Main Menu; by School; by Literature Title; by Subject; by Study Guides; Textbook Solutions Expert Tutors Earn. Main Menu; Earn Free Access; Upload Documents; Refer Your Friends; Publication 550 (2021), Investment Income and Expenses - IRS tax forms Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D

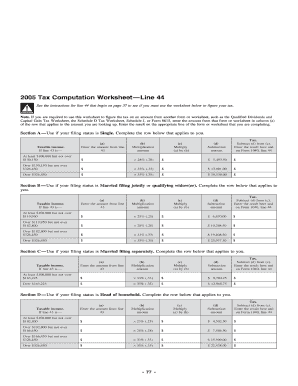

Qualified Dividends and Capital Gain Tax Worksheet 2016.pdf... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 43. How Your Tax Is Calculated: Understanding the Qualified Dividends and ... In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. Qualified Dividends and Capital Gain Tax Worksheet— ... See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. PDF Line 44 the Tax Computation Worksheet on if you are filing Form 2555 or ... subtract Form 1040, line 43, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet). If the result is more than zero, that amount is your capital gain excess. If you do not have a capital gain excess, complete the rest of either of those worksheets according to the worksheet's ...

2021 Instructions for Form 1040-NR - IRS tax forms exceptions noted repeatedly in the line instructions are below. • A nonresident alien filing Form 1040-NR cannot have a Married filing jointly or a Head of household filing status. • Certain tax benefits (such as the child tax credit, the credit for other dependents, and the additional child tax credit; and the premium tax credit for

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

PDF Name of estate or trust Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable ... Subtract line 45 from line 44. If zero or less, enter -0- . . . . . . . . ... or line 5 of the Qualified Dividends Tax Worksheet in the Instructions for Form 1041, whichever applies (as figured for the regular ...

2017 Schedule D (Form 1040) Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Don't : complete lines 21 and 22 below. No. ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ...

Qualified Dividends And Capital Gain Tax Worksheet Line 44 [PDF] - 50 ... We come up with the money for Qualified Dividends And Capital Gain Tax Worksheet Line 44 and numerous book collections from fictions to scientific research in any way. among them is this Qualified Dividends And Capital Gain Tax Worksheet Line 44 that can be your partner. Business Taxpayer Information Publications 2004 Tele-tax United States.

2021 Instructions for Schedule D (Form 1041) Capital gains and qualified divi- dends. For tax year 2021, ... trust after 1976, and a gift tax was paid ... amount from line 44 of the worksheet on.12 pages

Microsoft takes the gloves off as it battles Sony for its Activision ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, ... Republicans favor lowering the capital gain tax rate as an inducement to saving and investment. Also, the lower rate partly ...

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gain Tax Worksheet Qualified Dividends and Capital Gain. Tax ... Enter the amount from Form 1040 or 1040-SR, line 15. ... line 3 of the Foreign Earned Income Tax Worksheet.2 pages

Instructions for Form 8615 (2022) | Internal Revenue Service Net capital gain and qualified dividends on line 8. If neither the child, nor the parent, nor any other child has net capital gain, the net capital gain on line 8 is zero. ... filed by the child, the parent, or any other child. Use the parent's filing status to complete lines 15, 44, and 46. Enter the amount from line 47 of this Schedule D Tax ...

Qualified Dividends And Capital Gain Tax W0rksheet Line 44 Worksheets are Line 44 the tax computation work on if you are filing, Capital gains and losses, Qualified dividends and capital gain tax work line, Form 1040lines 42 and 44 you must complete and attach, Capital gains and losses, 40 of 117, Prepare and e file your federal tax return for, 23 work opa 142.

qualified dividends and capital gain tax worksheet ... - pdfFiller Easily complete a printable IRS Instruction 1040 Line 44 Form 2015 online. Get ready for this year's Tax Season quickly and safely with pdfFiller!

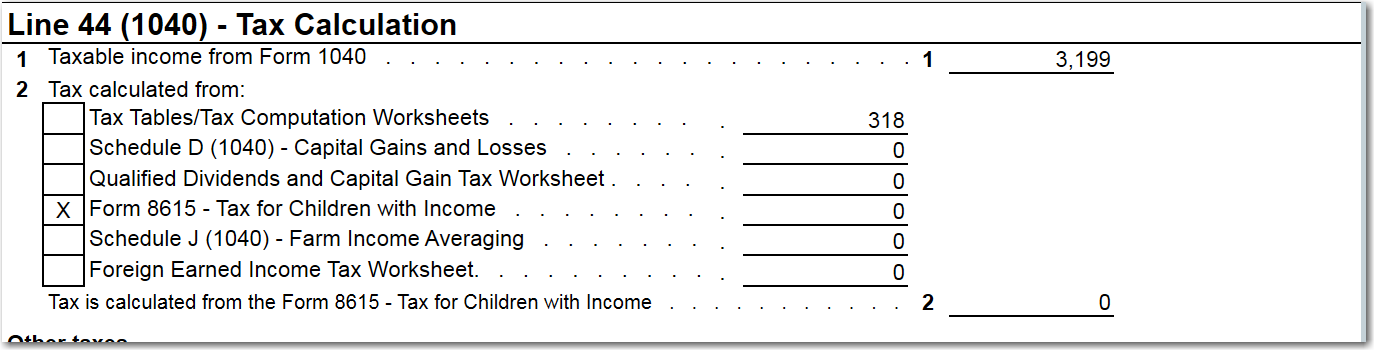

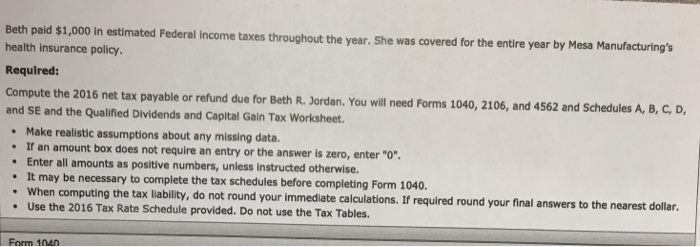

Instructions for Line 44 on Tax Form 1040 | Sapling Line 44 Inclusions The figure entered on line 44 is a total of taxes related to various applicable items. It can cover taxable income, unearned income of a dependent child (e.g., interest and dividends), lump sum distributions and capital gains, and foreign earned income. Line 44 also includes taxes on educational assistance or refunds.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

2021 Instructions for Form 1116 Qualified Dividends and Capital Gains. (Losses), later, before entering an ... line 44. 3. You figured your tax using the. Schedule D Tax Worksheet (in the.24 pages

2022 Instructions for Schedule D Jul 28, 2022 — Capital Gains and Losses. These instructions explain how to complete Schedule D (Form 1040). Complete Form. 8949 before you complete line 1b ...18 pages

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

Qualified dividends and capital gain tax worksheet | Chegg.com Question: Qualified dividends and capital gain tax worksheet line 44 This question hasn't been solved yet Ask an expert Ask an expert Ask an expert done loading

2022 Instructions for Schedule D - Capital Gains and Losses Capital Gains and Losses. These instructions explain how to complete Schedule D (Form 1040). Complete Form. 8949 before you complete line 1b, 2, 3, 8b, 9, ...17 pages

Publication 17 (2021), Your Federal Income Tax - IRS tax forms The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a ...

Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon Capital gain tax worksheet—line 44 Irs form 8812 Total ordinary income (line 7 Alternative minimum tax Long term capital gains 2017 Qualified Dividends and capital gain tax worksheet—line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax.

:max_bytes(150000):strip_icc()/corporatefinance2-1834c5d321214ca2bd4b385eb8bd006f.png)

0 Response to "39 qualified dividends and capital gain tax worksheet line 44"

Post a Comment